2021 budget deficit falls below ceiling

By Jenina P. Ibañez, Senior Reporter

THE GOVERNMENT fell short of its budget deficit ceiling in 2021, as it generated better-than-expected revenues but missed its spending target, data from the Bureau of the Treasury (BTr) showed.

This brought the full-year deficit to P1.7 trillion, up by 21.87% from the previous year but missing the P1.9-trillion ceiling by 10%.

The 2021 deficit is equal to 8.61% of gross domestic product (GDP), lower than the programmed 9.3% but higher than 7.65% in 2020.

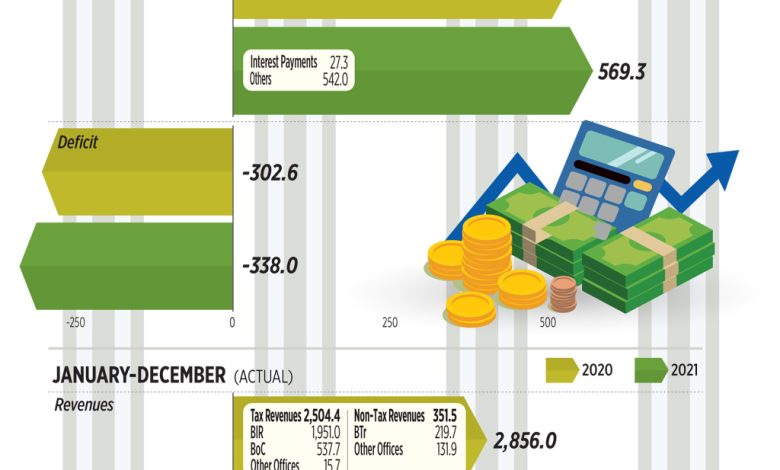

In December alone, the fiscal gap ballooned to a record P338 billion, up by 11.7% from last year’s P302.6 billion as revenues contracted by 3%.

Government spending rose by 5.21% year on year to P569.3 billion in December.

Primary payments — or total expenditures minus interest payments — grew by 5.08% to P542 billion. Interest payments increased by 7.87% to P27.3 billion during the month.

Revenues in December reached P231.3 billion, down by 3.03% from a year earlier.

Accounting for over 96.6% of the total, tax revenues rose by 6.73% to P223.4 billion.

Tax collections from the Bureau of Internal Revenue (BIR) slipped by 0.63% to P162.3 billion, while revenues generated by the Bureau of Customs (BoC) reached P60.3 billion, or 32.9% higher than last year. Other tax collecting offices posted P800 million in revenue, up by 28.53% from a year earlier.

Nontax revenues from the Bureau of the Treasury reached P4.7 billion, down by 43.41%

The government runs on a budget deficit when it spends more than it makes to fund programs that support economic growth. It borrows from foreign and local sources to plug the gap.

FULL-YEAR DEFICITBreaking down the P1.7-trillion full-year deficit, total spending reached P4.68 trillion, up by 10.6% compared with the previous year’s P4.23 trillion.

Spending grew due to “infrastructure and other capital expenditures, continued spending for various recovery measures including vaccine procurement and equity infusion in support of government financial institutions lending assistance programs, as well as higher internal revenue allotment shares of local government units,” the BTr said.

However, this was lower by 1.3% than the P4.74-trillion spending program.

Meanwhile, revenue collection last year hit P3 trillion, or 5.24% higher than the previous year and better than the P2.9-trillion program.

Tax collections, which represent 91% of the total, jumped by 9.4% to P2.74 trillion.

The BIR collected P2.08 trillion, up by 6.51% year on year, while Customs collections increased by 19.69% to P643.6 billion.

BTr said its income contracted by 43% to P125.3 billion “mainly due to lower dividends on National Government shares of stocks, interest on advances from GOCCs (government-owned and -controlled corporations), and other government service income.”

Nontax revenues from the Treasury plummeted by 42.95% to P125.3 billion.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the government should raise its revenue collections after seeing a modest year-on- year decline in 2021.

“There is a need to further increase tax revenue collections, in view of the further reopening of the economy towards greater normalcy,” he said via Viber.

UnionBank of the Philippines Chief Economist Ruben Carlo O. Asuncion said in a Viber message fiscal consolidation should be the priority of the next administration.

“Successful implementation of all the presidential candidates’ promises so far would definitely have budget implications moving forward,” he said.

The record-high deficit was expected given that pandemic-related complications had caused soft revenue streams, ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said.

“Government officials were actually holding back on spending to avert a substantial hit on the debt-to-GDP ratio which settled at a precarious level of 60.5% of GDP,” he said via Viber.

“The challenge for the incoming administration would be to find a way to improve our fiscal position in the near term while still ensuring that fiscal authorities provided enough support for the recovery.”