The Laffer Curve of tobacco taxation; the declining unemployment rate

Consider this as Part 3 counting previous articles on the same topic in this column, “The Laffer Curve of Philippine tobacco taxation” (May 22, 2023) and “The Laffer Curve of Philippine tobacco taxation, redux” (June 6, 2024).

There are a few persistent proposals now to further raise the “sin tax” or “health tax,” or what I consider more appropriately called the “double talk tax.” The products in question are alcohol, tobacco, vapes, and sugar sweetened beverages (SSB). The idea is that by raising the tax rates of these “harmful to health” products, consumption of them will decline while government revenues for universal healthcare go up. Nice twin goals.

But these twin goals conflict, not supplement each other. Because while the advocates of this move want more people to avoid these products, they also want more billions of pesos yearly in taxes from consumers of these products. Meaning they are implicitly happy when there are more drinkers, smokers, vapers, and consumers of SSB who send more billions to the government. Hence, I call it “double talk tax.”

To review, the Laffer Curve is an economic concept and theory developed by American economist Arthur Laffer and it shows the changing pattern between tax rates and tax revenue: As tax rates increase, tax revenues also increase — initially. After a certain optimal point, as the tax rate continues to rise, tax revenues begin to decline.

Consider the Philippines’ tobacco taxation. A tax rate of P30/pack in 2017 produced tax revenue of P125.9 billion. At P32.50, then P35 and P40/pack in 2018, 2019, and 2020, revenues increased to P136 billion, P147.6 billion, and P149.7 billion, respectively. In 2021, at P50/pack, revenues peaked at P176.5 billion.

Then things went south. At P55/pack in 2022, revenues declined to P160.3 billion; at P60/pack in 2023, there was a further decline to P134.9 billion; and at P63/pack in 2024, revenues flattened at P134.4 billion (see chart).

The more money that the government wanted to collect, the less revenues it actually collected. That is what the Laffer Curve depicted and showed. This is similar to the “Law of diminishing marginal utility/satisfaction” — as a person consumes more, say in an eat-all-you-can restaurant, their satisfaction declines for each additional plate. Further consumption will lead to harm, like indigestion and an upset stomach.

The main reason for such declining revenues as tax rates increase is that people shift to substitutes, they go from legal tobacco to illicit smuggled tobacco. The higher the tax rate, the higher the price gap between legal and illegal cigarettes which pay zero tax, only bribes to certain government agents that look the other way when the illicit products are sold in the market.

So, given the actual numbers showing declining government revenues from legal tobacco, the appropriate policy is to bring the tax rate down again to that optimal level of P50/pack where it was in 2021, which gave the government a peak revenue of P176 billion. Or at least halt further tax rate increases, keep things flat at P60 to P63/pack for the next few years. Then the Bureau of Internal Revenue and the Department of Finance will be able to collect more tobacco tax revenues.

WHY THE MINIMUM WAGE IS BADAs today is International Labor Day, let us look at the idea of a minimum wage. The biggest harm to labor is not “labor exploitation” via low wages, rather it is not being hired at all and receiving no wages. The real “minimum wage” is zero, not P600/day or so.

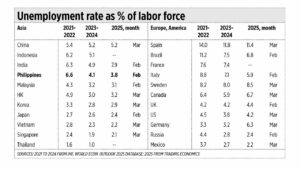

I checked the international unemployment rate numbers. Most Asian countries have unemployment rates of below 5% while many European and North-South American nations have unemployment rates higher than 5%. The Philippines was badly affected by the COVID-19 lockdown of 2020 to mid-2022, so many shops and businesses shut down and the unemployment rate jumped. With higher growth and job creation in 2023 and 2024, the unemployment rate went down to 4.1% and 3.8% in February 2025 (see the table).

I must congratulate the economic team, Secretaries Ralph G. Recto of the Finance department, Amenah F. Pangandaman of Department of Budget and Management, and Arsenio M. Balisacan of the Department of Economy, Planning, and Development or DEPDev (formerly NEDA, the National Economic and Development Authority). They have consistently led our economic policies towards more liberalization and deregulation, not restrictions like during the lockdown. The result is sustaining a high growth level.

As I pointed out in this column last Tuesday, “In average GDP growth over the last three years (2022-2024), of the top 53 economies with a GDP size of at least $500 billion in 2024, the Philippines had the third fastest growth of 6.3%, behind India’s 7.3% and Vietnam’s 6.8%.”

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.