Debt yields inch lower as focus turns to data

YIELDS on government securities (GS) were mixed last week as focus turned to local economic data, with the market continuing to monitor global trade developments amid ongoing tariff negotiations with the United States.

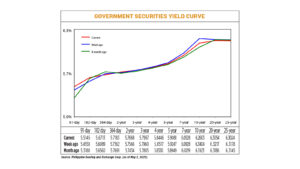

GS yields, which move opposite to prices, inched down by an average of 0.54 basis point (bp) week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of May 2 published on the Philippine Dealing System’s website.

At the short end of the curve, the 91- and 182-day Treasury bills (T-bills) rose by 5.88 bps and 6.24 bps to yield 5.5146% and 5.6713%, respectively. Meanwhile, the rate of the 364-day tenor declined by 1.79 bps to 5.7183%.

At the belly, rates of the two- and three-year Treasury bonds (T-bonds) went up by 1.22 bps (to 5.7668%) and 0.07 bp (5.7967%), respectively. Meanwhile, yields on the four-, five-, and seven-year tenors declined by 0.71 bp (to 5.8446%), 1.66 bps (5.9081%), and 4 bps (6.0528%), respectively.

At the long end, yields went down across all tenors. Rates of the 10-, 20-, and 25-year bonds dropped by 8.01 bps (to 6.2603%), 1.63 bps (6.3054%), and 1.54 bps (6.3024%), respectively.

GS volume traded amounted to P29.46 billion on Friday, lower than the P35.62 billion traded a week earlier.

“We continued to see rates stabilize after that volatile start to April with the ‘Liberation Day’ tariff announcements,” a bond trader said in a Viber message.

ATRAM Trust Corp. Chief Investment Officer Alessandra P. Araullo said that while the market continued to monitor the ongoing trade policy developments and their potential impact the global economy, expectations of easing inflation at home supported bond yields.

“Local drivers were more influential than external factors. Despite the external pressures, the local bond market rallied, with the new 10-year bonds averaging lower by 8-9 basis points since their launch on Monday. The local bond market remained well-supported amid expectations of further rate cuts from both the Federal Reserve and BSP (Bangko Sentral ng Pilipinas). Risk appetite returned post the 10-year auction, allowing the curve to normalize. Overall, the local bond market showed resilience and positive performance, driven by both local and external factors,” Ms. Araullo said in a Viber message.

“The inflation print for April is expected to match the previous month’s print and remain below the BSP target range. This moderation in inflation supports a positive tone for local bonds and reinforces expectations of a more accommodative monetary policy… Overall, the sustained inflation rates and supportive monetary policy created a favorable environment for the local bond market.”

Philippine headline inflation likely remained below 2% for a second straight month in April amid lower food prices, analysts said.

A BusinessWorld poll of 14 analysts yielded a median estimate of 1.8% for the April consumer price index (CPI). This is within the BSP’s 1.3% to 2.1% forecast for the month.

If realized, April inflation would be steady from the March print and be sharply slower than the 3.8% clip logged in the same month in 2024. This would also mark the ninth straight month that inflation settled within the BSP’s 2-4% target range.

The Philippine Statistics Authority will release April inflation data on May 6 (Tuesday).

The Monetary Board last month cut benchmark borrowing costs by 25 bps to bring the policy rate to 5.5%, putting its easing cycle back on track after an unexpected pause in February.

The central bank has now slashed benchmark rates by a cumulative 100 bps since it kicked off its easing cycle in August last year.

BSP Governor Eli M. Remolona, Jr. has said that they are considering further reductions this year in “baby steps” or increments of 25 bps. The Monetary Board’s next policy review is scheduled for June 19

Meanwhile, the government raised a total of P300 billion from its offering of new 10-year fixed-rate Treasury notes, 10 times the initial P30-billion program. The issuance was listed on the Philippine Dealing & Exchange Corp.’s fixed-income board on April 28.

The Bureau of the Treasury (BTr) borrowed an initial P135 billion from the benchmark papers at the rate-setting auction on April 15 and held a public offer that ended on April 23.

The notes fetched a coupon rate of 6.375%. Accepted bid yields ranged from 6% to 6.4%, resulting in an average rate of 6.286%.

For this week, the release of April inflation data will take center stage, both analysts said.

“The local bond market is expected to trade with a downward bias, supported by the benign inflation outlook and growing policy support. The local bond market is likely to continue its positive performance, driven by the moderation in inflation and expectations of further rate cuts,” Ms. Araullo said.

“Investors need to remain vigilant against external shocks, as these could impact the local market despite the supportive local factors.”

The trader added that the market could stay range-bound and react to the US jobs data released on Friday as well as the BTr’s auction of reissued 10-year bonds on Tuesday.

US job growth slowed marginally in April and employers continued to hoard workers, but the outlook for the labor market is increasingly darkening as President Donald J. Trump’s protectionist trade policy heightens economic uncertainty, Reuters reported.

Nonfarm payrolls increased by 177,000 jobs last month after rising by a downwardly revised 185,000 in March, the Labor department’s Bureau of Labor Statistics said. Economists polled by Reuters had forecast 130,000 jobs added after a previously reported 228,000 advance in March.

The survey of establishments also showed February’s payrolls count was revised down by 15,000 jobs to 102,000. — Pierce Oel A. Montalvo with Reuters