T-bill, bond rates may fall as BSP turns dovish

By Aaron Michael C. Sy, Reporter

THE RATES of Treasury bills (T-bill) and bonds (T-bond) could end mostly lower this week amid dovish signals from the Bangko Sentral ng Pilipinas (BSP).

The rates could follow the mixed week-on-week movements in the secondary market after BSP Governor Eli M. Remolona, Jr. signaled further rate cuts this year after inflation slowed to 1.4% in April, Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp., said in a Viber message.

The Bureau of the Treasury (BTr) will auction off P25 billion in T-bills on Tuesday — P8 billion each in 91- and 182-day debt and P9 billion in 364-day securities.

On Wednesday, the government will sell P40 billion through two reissued T-bonds — P15 billion in seven-year notes with a remaining life of two years and 11 months and P25 billion in 20-year debt with a remaining life of 19 years and 13 days.

Auction dates were moved a day later to give way to the 2025 midterm elections on May 12.

At the secondary market, the 91-day T-bill inched up 0.81 basis point (bp) to close at 5.5227%, based on PHP Bloomberg Valuation Service reference rate data as of May 9 posted on the Philippine Dealing System website.

Meanwhile, the 182- and 364-day deb yields fell 0.05 bp and 0.31 bp to close at 5.6708% and 5.7152%.

The seven-year rate fell 7.77 bps to 5.9751%, while the two-year yield — the tenor closest to the remaining life of the first T-bonds — slipped 1.17 bps to 5.785%. The 20-year yield decreased 5.19 bps to 6.2535%.

Last week, Mr. Remolona, Jr. told Bloomberg the central bank is open to cutting key rates by 75 bps more this year after slower-than-expected April inflation.

The Monetary Board last month resumed its easing cycle after an unexpected pause in February, cutting benchmark rates by 25 bps to bring the policy rate to 5.5%. Its next meeting is on June 19.

Philippine inflation slowed to an over five-year low of 1.4% in April from 1.8% in March and 3.8% a year earlier. For the first four months, it averaged 2%, at the low end of the BSP’s 2-4% annual target.

The three- and 20-year T-bonds could fetch good demand, which rates likely at 5.775% to 5.8% and 6.3% to 6.425%, respectively, a trader said in an e-mailed reply to questions.

“Ultimately, yields were just flat to a basis point lower amidst the P78 billion volume turnover,” the trader said. “We have several US Federal Reserve speakers tonight to usher markets into next week’s shortened trading week due to local elections.”

Last week, the BTr raised P25 billion as planned from T-bills as total bids reached P74.225 billion, almost thrice the amount on offer.

The Treasury borrowed P8 billion via the 91-day T-bills on Monday as tenders for the tenor reached P23.48 billion. The three-month paper was quoted at an average rate of 5.573%, 2.7 bps higher than a week ago. Tenders accepted by the BTr had yields of 5.5% to 5.596%.

The government likewise fully awarded P8 billion of 182-day securities as bids hit P27.835 billion. The average rate of the six-month T-bill was 5.667%, 1.2 bps higher, with accepted rates at 5.644% to 5.678%.

The Treasury raised P9 billion as planned via the 364-day debt as demand reached P22.91 billion. The average rate of the one-year T-bill inched up 0.9 bp to 5.697%, with bids accepted having yields of 5.68% to 5.718%.

The seven-year bonds were last issued on March 25, when the government raised P10 billion from the P30-billion program at an average rate of 5.779%, above the 3.625% coupon.

The 20-year bonds were last offered on Feb. 25, when the government raised P25 billion as planned at an average rate of 6.376%, below the 6.875% coupon.

The Treasury is looking to raise P260 billion from the domestic market this month — P100 billion via T-bills and P160 billion through T-bonds.

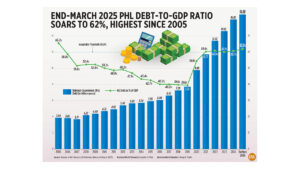

The government borrows from local and foreign sources to help fund its budget deficit, which is capped at P1.54 trillion or 5.3% of gross domestic product this year.