ADB raises PHL economic outlook for this year, 2022

Shoppers look for bargains at a market in Taytay, Rizal amid the holiday season. — PHILIPPINE STAR/ MICHAEL VARCAS

THE ASIAN Development Bank (ADB) raised its Philippine growth forecast for this year and 2022, amid a heightened coronavirus vaccination drive and a plunge in new cases.

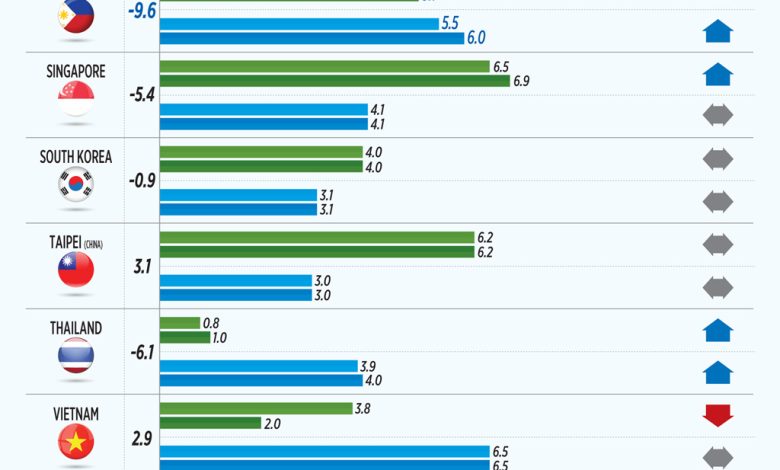

In the supplement to the Asian Development Outlook 2021, the multilateral lender said it now expects the Philippines’ gross domestic product (GDP) to grow by 5.1% this year, from 4.5% given in September. It exceeds the government’s downgraded 4-5% target this year.

For 2022, GDP is expected to rise by 6%, from the previous projection of 5.5%. This is below the government’s 7-9% goal.

“The Philippine economy has shown impressive resilience,” ADB Philippines Country Director Kelly Bird said in a statement on Tuesday.

“Growth momentum has clearly picked up on the back of the government’s vigorous drive to vaccinate Filipinos against the COVID-19 virus. Public spending on infrastructure and continued vaccination of the population will help the country further accelerate its recovery in 2022.”

A 5.1% GDP growth this year would reverse the record 9.6% contraction in 2020, but is still lower than the pre-pandemic 6.1% expansion in 2019.

The multilateral bank said the country’s economic performance in the third quarter was a surprise as it expanded by 7.1% year on year.

Third-quarter growth was lower than 12% in the preceding quarter after lockdowns were reimposed to contain a Delta-driven surge in COVID-19 cases.

“Vaccination has allowed the economy to slowly reopen, boosting consumer and business confidence,” ADB said.

The government has accelerated its vaccine rollout and allowed people to move more freely. Daily COVID-19 infections have also dropped from the peak in September.

About 36.59% of Filipinos have been fully vaccinated against COVID-19, the Johns Hopkins University tracker showed.

Meanwhile, the ADB raised the inflation outlook for the Philippines to 4.4% for 2021 and 3.7% for next year due to soaring oil prices. These are higher than the September forecast of 4.1% and 3.5% for 2021 and 2022, respectively.

Inflation in November eased to a four-month low of 4.2%, but remained higher than the central bank’s 3.3%-4.1% forecast for the month.

The ADB’s projection is higher than the central bank’s 2-4% target for the year.

THREAT FROM OMICRON

The ADB reduced its growth forecast for developing Asia to 7% (from 7.1%) this year and to 5.3% (from 5.4%) in 2022, amid uncertainty brought by the emergence of the Omicron variant.

“The main risk to the outlook remains a resurgence in COVID-19 cases. Recent developments in Europe show that extensive virus outbreaks can occur even in highly vaccinated countries and force governments to retighten mobility restrictions. The emergence of the highly mutated Omicron variant brings additional uncertainty,” the ADB said.

“As it appears to be significantly more transmissible than earlier variants, its economic impact could be substantial.”

In developing Asia, the bank noted new COVID-19 cases daily averaged 50,000 as of Nov. 30, 71% lower than the peak in August. Globally, new cases are on the rise, fueled by the new wave of infections in Europe.

For Southeast Asia, the ADB trimmed its outlook to 3% from 3.1% this year, but hiked its projection for next year to 5.1% from 5%.

“Subregional growth slowed modestly in Q3 2021 as mobility restrictions tightened in the quarter to curb the spread of the highly transmissible Delta coronavirus variant,” it said.

Moody’s Analytics said the global outlook is now “less exuberant” as the Omicron variant increases uncertainty in the near term, although the recovery momentum was unlikely to be derailed.

“The Omicron variant has driven (business) sentiment lower, as have supply-chain disruptions eating into inventories and hurting capacity to meet increased demand. While the economic recovery has yielded improved sales and employment intentions, caution has increased,” Moody’s Analytics Senior APAC Economist Katina Ell said in an analysis.

“Expectations into next year are mixed as uncertainty remains high.” — Jenina P. Ibanez