ASEAN+3 to ramp up regional financial cooperation to cushion global trade shocks

MILAN, Italy — Finance ministers and central bank governors from ASEAN+3 economies have pledged to further regional financial cooperation to withstand rising trade uncertainty, with the Philippines also seeking to ramp up trade with its neighbors.

In a joint statement, ASEAN+3 finance ministers and central bank governors noted “escalating trade protectionism,” which could lead to “economic fragmentation, affecting trade, investment, and capital flows across the region.”

“We call for enhanced regional unity and cooperation as we endeavor to weather the heightened uncertainty,” they added.

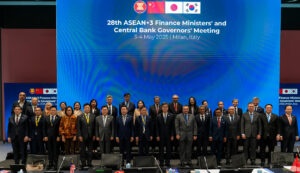

The 28th ASEAN+3 Finance Ministers’ and Central Bank Governors’ Meeting was held on Sunday over the ADB Annual Meeting in Milan, Italy.

The regional group is composed of the 10 Association of Southeast Asian Nations (ASEAN) member states plus China, Japan and South Korea.

“Today’s meeting reaffirmed our shared vision for a more resilient, inclusive and forward-looking ASEAN+3 vision,” Malaysian Minister of Finance II Amir Hamzah Azizan said at a press conference after the meeting on Sunday.

For its part, the Philippines said it would uphold the latest commitment to boost trade collaboration with the region, Finance Secretary Ralph G. Recto said.

“We should trade more with ASEAN as well,” Mr. Recto told BusinessWorld in a text message.

Asia was among the regions most significantly hit by the US’ sweeping reciprocal tariffs, including Vietnam (46%), Thailand (36%), Indonesia (32%) and Malaysia (24%).

The Philippines was slapped with a 17% rate, second lowest in the region.

“Our current policy priority is to reinforce long-term resilience while maintaining flexibility to address near-term challenges, including rising protectionism and volatile global financial conditions,” according to the Asian finance chiefs.

They also cited tighter global financial conditions, slowing growth and weakened investment flows.

“We urge international organizations to uphold multilateralism and promote free trade, analyze and monitor the potential impact of trade tensions on the global economy, and support their members in providing policy advice to manage the negative shocks that may arise.”

They will also push for further intra-regional trade and investment to mitigate external shocks and continue to support sustainable economic development.

“Given our financial market interlinkages, we are closely monitoring regional financial market conditions,” they said.

“We also reaffirm our resolve and commitment to ensure our financial systems and markets remain resilient despite the uncertainty, while maintaining open communication among members in light of the rapidly evolving developments.”

The ASEAN+3 officials also called for the need to rebuild fiscal policy buffers, provide well-targeted support to sustain growth and implement structural reforms.

“We will also carefully recalibrate monetary policy based on domestic conditions. We will maintain exchange rate flexibility as a buffer against external shocks.”

“Importantly, our export markets and sources of growth have become increasingly diversified over the years, with domestic demand and intraregional trade now serving as key drivers of growth,” it added.

Meanwhile, the ASEAN+3 officials cited several initiatives to enhance financial frameworks within the region.

“Recognizing the pivotal role of the ASEAN+3 Finance Process in supporting regional economies to navigate this uncertain environment, we agreed to further strengthen regional financial cooperation.”

They cited the recently approved amendments to the Chiang Mai Initiative Multilateralization (CMIM).

“We reaffirm our commitment to strengthening the CMIM as an effective regional financial safety net, a vital component of the global financial safety net,” they said.

“In this regard, we approve the amended CMIM Agreement and are committed to the swift completion of domestic procedures and the signing for its entry into force.”

Under the amendments, the rapid financing facility is introduced with the incorporation of eligible freely usable currencies (FUCs) as its currencies of choice under the CMIM.

“We believe that this new CMIM facility will enhance regional resilience by offering members timely access to emergency financing during urgent balance of payments needs, in response to sudden exogenous shocks such as pandemics and natural disasters.”

Launched in 2010, the CMIM is a multilateral arrangement among ASEAN+3 and the Hong Kong Monetary Authority. The facility’s size was later doubled to $240 billion in 2012.

“The narrowing down of (paid-in) capital models and the optimization of the new repurposing facility signaled the region’s commitment to continue adapting the CMIM amid a more volatile and unpredictable external environment,” Malaysian central bank Governor Shaik Abdul Rasheed Abdul Ghaffour said during the press conference.

Mr. Ghaffour also noted that the region agreed on the principles on how open costs in local currencies will be determined under the CMIM.

“And once finalized, CMIM will be able to fully realize the intended benefits of incorporating local currency lending. What this means is that it gives members access to different currencies and added flexibility when facing short-term liquidity difficulties,” he added.

Apart from the CMIM, other measures that the region will continue to undertake include the ASEAN+3 Fiscal Policy Exchange Initiative, Asian Bond Markets Initiative (ABMI), Disaster Risk Financing Initiative (DRFI), and ASEAN+3 Future Initiatives.

Priorities introduced this year also include “promoting fiscal exchange, updating the strategic directions, and exploring policy adjustment instrument (PAI).”

REGIONAL OUTLOOKMeanwhile, the finance ministers and central bank chiefs expect gross domestic product (GDP) growth in the region to remain strong despite shocks.

“Underpinned by solid macroeconomic fundamentals, the region is expected to remain resilient at around 4% of GDP growth in 2025, amid ongoing external headwinds, including geopolitical and trade tensions,” they said.

In its latest regional economic outlook update, the ASEAN+3 Macroeconomic Research Office (AMRO) said it expects the region to grow by 4.2% this year and 4.1% in 2026.

AMRO projects the Philippine economy to grow by 6.3% this year, the second-fastest forecast among ASEAN, after Vietnam (6.5%.)

“Over the medium term, ASEAN+3 is expected to remain a key driver of the global economy, contributing to more than 40% of global growth.”

“Meanwhile, inflation is expected to remain low at below 2% in 2025. The region’s outlook is, however, subject to heightened uncertainties,” the think tank said. — Luisa Maria Jacinta C. Jocson