Debt yields end higher on Trump tariffs, BSP

YIELDS on government securities (GS) traded in the secondary market went up last week amid increased volatility due to the Trump administration’s shifting tariff policies and the Bangko Sentral ng Pilipinas’ (BSP) policy meeting.

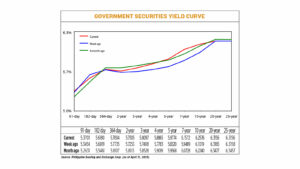

GS yields, which move opposite to prices, rose by an average of 6.17 basis points (bps) week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of April 11 published on the Philippine Dealing System’s website.

Rates at the short end of the curve were mixed, with the 91- and 364-day Treasury bills (T-bills) increasing by 2.47 bps and 0.69 bp to fetch 5.3701%, and 5.7804%, respectively. Meanwhile, the yield on the 182-day T-bill fell by 6.39 bps to 5.6180%.

At the belly, yields went up across all tenors. The two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) saw their rates increase by 2.52 bps (to 5.7505%), 6.89 bps (5.8097%), 10.82 bps (5.8865%), 14.54 bps (5.9774%), and 20.83 bps (6.1572%), respectively.

At the long end, rates were mixed. The 20- and 25-year bonds inched down by 0.09 bp and 0.02 bp to fetch 6.3156% and 6.3156%, respectively. Meanwhile, the yield on the 10-year T-bond surged by 15.57 bps to 6.2576%.

GS volume traded was at P36.07 billion on Friday, lower than the P96.37 billion recorded a week earlier.

Trading last week was volatile due to uncertainties over US President Donald J. Trump’s trade policies, a bond trader said.

“There was a significant rise in investor demand for fixed-income securities as a hedge against the more pronounced movements in the local equity market,” the trader said in an e-mail.

“However, bond movements were still being primarily driven by anticipated inflationary impact of the announced tariffs on imported goods, especially on the longer end of the yield curve. The recently announced 90-day lowering of US tariffs to 10% for applicable Philippine imports have likewise eased significant market concerns over its potential impact to inflation,” the trader added.

ATRAM Trust Corp. Vice-President and Head of Fixed Income Strategies Lodevico M. Ulpo, Jr. said in a Viber message that the yield curve steepened last week, partly driven by the increase in US Treasury rates amid global trade concerns.

“Yields reacted to global and domestic developments with longer-dated bond yields tracking global bond markets. US Treasury yields jumped on concerns about the US economy post Trump’s tariff tantrum. Short end yields edged lower, tracking the BSP’s much anticipated rate cut,” said Nicholas Antonio T. Mapa, chief economist at Metropolitan Bank & Trust Co.

Beijing increased its tariffs on US imports to 125% on Friday, hitting back against Mr. Trump’s decision to raise duties on Chinese goods and increasing the stakes in a trade war that threatens to upend global supply chains, Reuters reported.

The retaliation intensified global economic turmoil unleashed by Mr. Trump’s tariffs. US stocks ended a volatile week higher, but the safe haven of gold hit a record high during the session and benchmark US 10-year government bond yields posted their biggest weekly increase since 2001 alongside a slump in the dollar, signaling a lack of confidence in America Inc.

The $29-trillion Treasury market saw an acute sell-off following Mr. Trump’s initial announcement about what he calls reciprocal tariffs. That turbulence was seen as part of what drove Mr. Trump to announce a 90-day pause for countries other than China on Wednesday.

The White House has said since then that more than 75 countries have sought trade negotiations with the United States and that future deals would bring certainty.

The tit-for-tat tariff increases by the US and China stand to make goods trade between the world’s two largest economies impossible, analysts say. That commerce was worth more than $650 billion in 2024.

Benchmark 10-year US Treasury yields, which move opposite to prices, registered their biggest weekly rise in more than two decades, with trading volumes well above average, amid fears that China may be offloading a large portion of its US bond holdings.

The market’s anticipation of a jumbo issuance of new 10-year benchmark T-bonds also drove yields higher, Mr. Ulpo said, overshadowing the BSP’s widely expected rate cut on Thursday.

“While the BSP’s decision was aligned with easing inflation and signaled a dovish stance, its market impact was muted amid heightened supply concerns and shifting risk sentiment. The upcoming bond issuance created a defensive tone in the belly to the long end of the curve as investors positioned ahead of expected duration supply. With global factors still dominant, market expectations have tilted toward higher long-end yields despite the easing cycle,” he said.

“Despite the rate cut, yield movements were more reactive to global rate volatility and looming supply risks, dampening the downward pressure on yields that typically follows a policy easing,” Mr. Ulpo added.

The Bureau of the Treasury (BTr) is looking to raise at least P30 billion through 10-year fixed-rate Treasury notes that will start this week. National Treasurer Sharon P. Almanza said the offering will establish a new 10-year benchmark bond.

The BTr will hold the price-setting for the bonds on Tuesday. The offer is set to run until April 24, unless closed earlier, while the issue date is scheduled for April 28.

Meanwhile, the Monetary Board on Thursday cut benchmark interest rates by 25 bps to bring the policy rate to 5.5%, as expected by all 17 analysts in a BusinessWorld poll.

BSP Governor Eli M. Remolona, Jr. said expectations of easing inflation support the shift to a more accommodative monetary policy stance.

He added that the Monetary Board is considering further rate cuts this year but maintained that these will be delivered in “baby steps” of 25 bps at a time.

“For now, what we’re looking at is a few more cuts, but we have more meetings than the number of cuts we are thinking about,” Mr. Remolona said.

The Monetary Board has four meetings left this year, which are scheduled for June 19, Aug. 28, Oct. 9, and Dec. 11.

For this week, the market’s focus will be on the Treasury’s bond offer, Mr. Ulpo said.

“All eyes will be on the expected issuance of a jumbo 10-year bond, which is likely to test market appetite for duration and drive positioning across the curve. Preliminary indications suggest the bond may price with a coupon in the 6.25%–6.5% range, reinforcing expectations of continued steepening unless strong demand emerges,” he said.

“At the same time, external risks — particularly upcoming US inflation data and any Federal Reserve commentary — remain critical drivers for sentiment and could exacerbate volatility in long-end yields. Market participants should remain cautious, as supply pressures and global macro factors continue to dominate short-term rate direction,” Mr. Ulpo added.

The trader said that the market will continue to monitor the US government’s trade policy announcements. “Moreover, they will also consider major economic releases on Chinese GDP (gross domestic product) and US retail sales, which might provide an initial assessment of the potential impact of a protracted trade war on broader global economic prospects.” — Abigail Marie P. Yraola with Reuters