Exports and life expectancy: some global trends

Next week, on April 2, US President Donald Trump’s “tariff reciprocity” — tariff equalization with major trade partners which have high tariffs on US exports to their countries — will take effect. The fear is that such a move by Trump will cause a major upheaval in global trade.

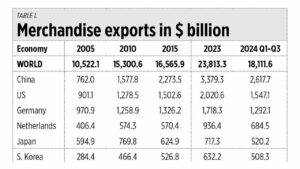

The top three largest merchandise (or goods) exporters in the world are China, the US, and Germany. China and Germany have regular trade surpluses while the US has a perennial trade deficit, an average of around $2.7 billion per day in 2024.

In terms of export market share, China, which joined the World Trade Organization (WTO) only in 2001, has expanded its share from 7.2% of total world exports in 2005 to 14.5% in 2024. The US has a flat share of 8.5% of the total, while Germany and Japan had declining shares of 9.2% and 5.6% in 2005 to 7.1% and 2.9% in 2024, respectively. Many other industrial countries have similar declining shares in total exports (see Table 1).

China overtook the US in 2007 — $1.22 trillion vs $1.15 trillion. One explanation is that this is due to the difference in power generation. From 2006 to 2007, the US added 101 terawatt-hours (TWh) to its grid while China added 416 TWh. China’s momentum continued and by 2011, China overtook the US in power generation, with 4,713 TWh vs 4,363 TWh, respectively. High electricity production means a high capacity to manufacture and mass produce almost anything. I am amazed by the fast economic performance and energy generation of China.

Talking about power, I must correct a mistake in my column last week, “On GDP size, exports, FDI, and electricity generation” (March 18). I wrote, “Recently the Maharlika Investment Corp. (MIC) invested in the NGCP.” It should have been “MIC invested in Synergy Grid & Development Phils., Inc. (SGP).” A Filipino company, SGP owns 60% of the National Grid Corp. of the Philippines (NGCP), while China’s State Grid Corp. is the technical partner, with 40% of NGCP.

TAXESThe call for higher taxes on alcohol, tobacco, vapes, and sugar is alive again as an election campaign issue.

A survey done in 2023 by the Food and Nutrition Research Institute (FNRI) under the Science department about smoking prevalence in the Philippines said that the “percentage of currently smoking adults, 20 years old and above,” showed an initial decline from 23.3% of adult population in 2015 to 18.5% in 2021, then it rose to 23.2% in 2023.

Ironically this coincided with the increase in the tobacco tax, from P50/pack in 2021 to P55/pack in 2022, then to P60/pack in 2023. There was also a huge decline in tobacco tax revenues in this period, from P176.5 billion in 2021 to P160.3 billion in 2022, P134.9 billion in 2023, and P134 billion in 2024.

So the dual goals of imposing a higher tobacco tax — to reduce the incidence of smoking and to raise tobacco tax revenues — were not met, instead the opposite happened. A further increase in the tobacco tax rate will simply make smuggled and illicit tobacco products more attractive and tempting because of their low price in comparison with legal tobacco.

I also checked smoking prevalence and alcohol use in Asia over two decades, 2000 to 2020, and life expectancy until 2022. The data is mixed. Smoking prevalence and alcohol consumption in countries like China, Indonesia, and Singapore are flat yet their life expectancy is still rising. Smoking prevalence in the Philippines has been declining and its alcohol consumption is flat. Other countries have declining tobacco and alcohol use — Japan and South Korea. Others have seen a rise in alcohol use — India, Vietnam, Myanmar, and Cambodia (see Table 2).

There is also a conflict in social and health goals in the Philippines related to sin taxation. Many health activists want people to cut down, if not stop, their consumption of alcohol and tobacco products. But the same health establishments also want more billions of pesos from smokers, vapers, and drinkers, so if there is high consumption of legal products, it makes them happy because they will get more tax money.

Congress and the Department of Finance (DoF) should focus on getting higher revenues without raising the tax rates of many products and services. Recently the DoF issued new privatization guidelines of non-performing public assets.

Finance Secretary Ralph G. Recto emphasized that “Privatization of non-performing assets is among the strategic moves to raise much-needed revenues to fund the growing needs of our people. And by opening the doors for ordinary Filipinos to take part, we are also creating investment opportunities for them while contributing to nation-building.”

Good move, DoF. Cut the huge annual budget deficit and huge outstanding public debt stock by reducing the need for more borrowing.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.