Gov’t debt yields decline on steady Jan. inflation

YIELDS on government securities (GS) traded on the secondary market mostly declined last week following the release of data showing that Philippine headline inflation was broadly steady last month.

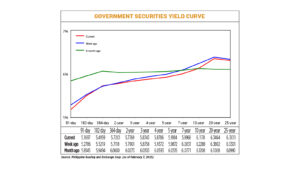

GS yields, which move opposite to prices, went down by 5.17 basis points (bps) last week, based on data from PHP Bloomberg Valuation Service Reference Rates as of Feb. 7 published on the Philippine Dealing System’s website.

Rates of all benchmark tenors ended lower week on week except for the 364-day Treasury bill (T-bill), which inched up by 0.83 bp to yield 5.7201%.

At the short end, yields on the 91- and 182-day T-bills went down by 10.89 bps (to 5.1697%) and 2.60 bps (5.4959%), respectively.

At the belly, rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) decreased by 1.32 bps (to 5.7769%), 4.15 bps (5.8343%), 5.86 bps (5.8786%), 6.88 bps (5.9184%), and 8.63 bps (5.9968%), respectively.

Lastly, at the long end of the curve, yields on the 10-, 20-, and 25-year debt papers declined by 11.10 bps (to 6.1178%), 3.38 bps (6.3464%), and 2.9 bps (6.3011%), respectively.

GS volume traded reached P38.39 billion on Friday, higher than the P30.65 billion recorded a week prior.

Traders said government debt yields went down following the release of the January inflation report.

“With Philippine inflation remaining steady in January, bond yields fell across the board as the release both eased domestic inflationary concerns and bolstered expectations for a BSP (Bangko Sentral ng Pilipinas) policy rate cut [this] week,” the first bond trader said in a Viber message.

“The bond market got a boost from the relatively steady CPI (consumer price index) print… The Philippine CPI data gives space for BSP to cut rates on Thursday,” the second bond trader likewise said in a Viber message.

Philippine headline inflation remained steady in January as lower utility costs offset a spike in food prices, preliminary data from the Philippine Statistics Authority (PSA) showed.

The CPI rose 2.9% year on year in January, the same as December. It also settled within the 2.5%-3.3% forecast of the Bangko Sentral ng Pilipinas (BSP).

However, the January print was slightly higher than the 2.8% median estimate in a BusinessWorld poll of 16 analysts.

The BSP said following the data release that it will continue to monitor risks to the inflation outlook and maintain a “measured approach” to policy easing.

BSP Governor Eli M. Remolona, Jr. earlier said that a rate cut is “on the table” at the Monetary Board’s Feb. 13 policy meeting, adding that they may slash benchmark interest rates by a cumulative 50 bps this year in a gradual manner as “policy insurance” against risks.

The Philippine central bank has cut borrowing costs by 75 bps since kicking off its easing cycle in August last year, bringing the policy rate to 5.75%.

“In addition to the weaker-than-feared Philippine inflation in January, the easing US dollar has also supported lower BVAL and US Treasury yields,” the first bond trader said.

The second bond trader added that US President Donald J. Trump’s decision to pause its planned tariffs on Canada and Mexico contributed to the week-on-week decline in GS yields.

Mr. Trump earlier announced tariffs of 25% on Canada and Mexico but delayed them after a negative reaction from investors, Reuters reported. The two largest US trading partners agreed to increase enforcement efforts at the border, a top Trump priority.

On Friday, Mr. Trump said he plans to announce reciprocal tariffs on many countries by Monday or Tuesday this week, a major escalation of his offensive to tear up and reshape global trade relationships in the US’ favor.

Mr. Trump did not identify which countries would be hit but suggested it would be a broad effort that could also help solve US budget problems.

The move would fulfill Mr. Trump’s campaign promise to impose tariffs on American imports equal to rates that trading partners impose on American exports.

The US trade-weighted average tariff rate is about 2.2%, according to World Trade Organization data, compared to 12% for India, 6.7% for Brazil, 5.1% for Vietnam and 2.7% for European Union countries.

For this week, GS yields may continue to go down on expectations of “potentially softer US consumer inflation reports and potentially dovish remarks from the BSP policy meeting,” the first trader said.

US CPI data will be released on Feb. 12 (Wednesday).

The second bond trader added that US jobs data released last week, developments in the Trump administration’s tariff policies, and results of the Bureau of the Treasury’s (BTr) T-bill and T-bond auctions could affect local bond yield movements.

The BTr will offer P22 billion in T-bills on Monday. On Tuesday, it will auction off P30 billion in reissued 10-year bonds with a remaining life of seven years and seven months. — Kenneth H. Hernandez with Reuters