Gov’t debt yields drop

YIELDS on government securities traded in the secondary market fell last week after slower-than-expected economic growth in the first quarter and easing April inflation.

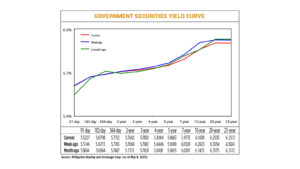

Bond yields, which move opposite prices, fell 3.41 basis points (bps) on average from a week earlier, based on PHP Bloomberg Valuation Service reference rates as of May 9 posted on the Philippine Dealing System website.

Last week, bond rates mostly fell across all tenors, while the traded volume of government rose to P81.85 billion from P29.46 billion a week earlier.

Easing inflation and slowing economic growth “fueled expectations of a potential Bangko Sentral ng Pilipinas rate cut in June,” a bond trader said in an e-mailed reply to questions.

BSP Governor Eli M. Remolona, Jr. as signaled 75 bps more in policy rate cuts this year, “which was more aggressive than market consensus of only delivering 50 bps more after the first reduction in key rates in April,” the trader said.

Noel S. Reyes, chief investment officer for Trust and Asset Management Group at Security Bank Corp., attributed the decline in debt yields and bond market rally to “softer-than-expected” GDP expansion and benign inflation.

“[These] were enough catalysts to spur buying in the bond market,” he said in an e-mail.

The Philippine economy grew 5.4% last quarter from 5.9% a year earlier, according to the Philippine Statistics Authority.

The expansion was driven by government spending that climbed 18.7%, and private consumption that rose 5.3%. Inflation in April slowed to 1.4%, the lowest in more than five years.

The bond trader expects the market to watch developments US-China trade talks in Switzerland.

“They will also wait for the reports on US consumer and producer inflation for April, which might indicate any realized inflationary impact from the partial imposition of tariffs since ‘Liberation Day,’” the trader added.

Mr. Reyes expects the trade talks to lead to volatile markets.

“What is certain is that there will be a tariff imposition at least at the blanket floor of 10%, which would still lead to higher prices, dampen demand and lower global GDP growth,” he said. “This should result in central bank cuts and lower bond yields.” — Abigail Marie P. Yraola