Gov’t debt yields end mostly higher on Fed

YIELDS on government securities (GS) traded in the secondary market ended mostly higher last week amid uncertainty over the pace of the US Federal Reserve’s policy easing cycle.

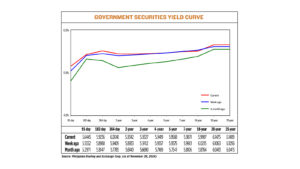

GS yields, which move opposite to prices, went up by an average of 2.97 basis points (bps) last week, based on the data from PHP Bloomberg Valuation Service Reference Rates as of Nov. 29 published on the Philippine Dealing System’s website.

At the short end of the curve, the rates of the 91-, 182-, and 364-day Treasury bills (T-bills) went up by 11.13 bps (to 5.6445%), 2.48 bps (to 5.9236%), and 6.39 bps (to 6.0048%), respectively.

At the belly, yields on the two-, three-, and four-year Treasury bonds (T-bonds) increased by 4.09 bps (to 5.9342%), 2.15 bps (5.9327%), and 0.62 bp (5.9419%), respectively. Meanwhile, the five- and seven-year bonds saw their rates inch down by 0.07 bp (to 5.9568%) and 0.3 bp (5.9871%), respectively.

At the long end of the curve, the rate of the 10-year debt paper declined by 2.28 bps to 5.9987%, while the 20- and 25-year T-bonds saw their yields increase by 4.12 bps (to 6.1475%) and 4.33 bps (6.1489%), respectively.

GS volume traded reached P48.25 billion on Nov. 29, higher than the P23.45 billion recorded a week prior.

“The market was generally sideways with a defensive tone as uncertainties with regards to the Fed rate cut path dampened the mood locally,” Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., said in an e-mail.

“With the resilience of the US economy, rate cuts in the US are slowly being priced out; hence, investors opted to stay on the sidelines given the volatility.”

He noted that yields on the five-, seven-, and 10-year bonds declined slightly as the peso rebounded against the dollar during the week.

“The stability of the local pair prompted some buying,” Mr. Aquino said.

Sandra P. Araullo, chief investment officer at ATRAM Trust Corp., said in a Viber message that the bond market traded within a tight range last week as investors digested US economic data releases.

“The rally in US rates was not enough to spur any strong risk-taking sentiment for Philippine bonds. The volatility of the peso-dollar exchange rate may have contributed to the muted interest for peso government securities as the currency pair traded at intra-year highs,” Ms. Araullo said.

“Demand was concentrated in the belly of the curve… Sparse demand was seen for the rest of the curve as investors continue to bargain hunt,” she added.

Federal Reserve officials appeared divided at their meeting last month over how much farther they may need to cut interest rates, but as a group agreed to avoid giving much guidance from here on about how US monetary policy is likely to evolve, Reuters reported.

There was uncertainty about the direction of the economy, Fed officials noted, according to the minutes of the Nov. 6-7 meeting, uncertainty about just how much the current level of interest rates was doing to restrict the economy — a key issue in deciding how much further rates should fall — and a developing case to step carefully.

“Many participants observed that uncertainties concerning the level of the neutral rate of interest complicated the assessment of the degree of restrictiveness of monetary policy and, in their view, made it appropriate to reduce policy restraint gradually,” said the minutes, which were released on Tuesday.

The neutral interest rate is the level at which economic activity is neither stimulated nor restrained.

The Fed cut its benchmark policy rate by a quarter of a percentage point to the 4.5%-4.75% range at the meeting, a session that followed Republican candidate Donald J. Trump’s victory in the Nov. 5 US presidential election.

Though the implication of the election outcome was not mentioned in the minutes, “many” participants noted the complications of making policy at a time when economic data was volatile due to storms, strikes and other factors, and geopolitical tensions were high.

After the release of the minutes, financial markets added slightly to bets on a rate cut at the Fed’s Dec. 17-18 meeting, and kept intact prior bets on a slower pace of reductions next year, with just one cut priced in by the middle of the year.

Meanwhile, the peso closed at P58.62 versus the dollar on Friday, rising by 5.1 centavos from Thursday’s finish. This was a near three-week high as this was its best close since Nov. 11’s P58.595.

The local unit saw a volatile trading week as it ended at its all-time low of P59 again on Tuesday and then strengthened for three straight sessions as the outlook for US rates weighed on the dollar.

For this week, government debt may continue trading within a tight range, Ms. Araullo said.

“The local market will likely take cues from key data to be released in the US, namely, the global purchasing managers’ index figures and the latest nonfarm payrolls,” Ms. Araullo said.

“On the local side, the CPI (consumer price index) for November will be released. Early indications show that it will print at 2.5%, which is slightly higher from the previous month. We are not expecting that there will be a significant upside surprise to cause another strong sell-off in the local market. We view the current levels now as good opportunities to reposition as we continue to anticipate further rate easing in December and the coming year,” she added.

For his part, Mr. Aquino likewise said Philippine inflation and US jobs data will be the key trading drivers for this week.

“Players will likely remain defensive but still inclined to bargain-hunt given that the BSP (Bangko Sentral ng Pilipinas) is still on an easing cycle… The market may continue to see buyers on any uptick on rates as risk on local inflation remains skewed to the downside,” he said.

“All eyes will be on the US nonfarm payrolls data this Friday, which could provide further clarity on the Fed’s easing path,” Mr. Aquino added.

The BSP on Friday said headline inflation likely settled within the 2.2%-3% range in November, slower than the 4.1% print in the same month a year ago.

However, the upper end of the forecast would be faster than the 2.3% recorded in October.

The Philippine Statistics Authority will release November CPI data on Dec. 5.

BSP Governor Eli M. Remolona, Jr. earlier said that inflationary pressures could cause the central bank to pause its easing cycle, but a slowdown in growth may leave room for another rate cut.

Depending on the data, he said the Monetary Board may cut again or pause at its Dec. 19 meeting.

The BSP has delivered a total of 50 bps worth of rate cuts so far this year after it made 25-bp reductions at its August and October meetings. — Charles Worren E. Laureta with Reuters