Gov’t debt yields rise amid US policy risks

YIELDS on government securities rose across all tenors last week as Philippine markets worried about US fiscal policies under President-elect Donald J. Trump.

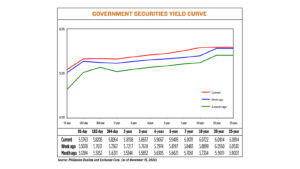

Yields, which move opposite prices, increased by an average of 9.37 basis points (bps) week on week, according to PHP Bloomberg Valuation Service Reference Rates data posted on the Philippine Dealing System website as of Nov. 15.

Ninety-one, 182- and 364-day Treasury bill (T-bill) rates all increased week on week, as well as two-, three-, four, five- and seven-year Treasury bonds (T-bonds). Ten, 20- and 25-year debt likewise increased.

Volume fell to P16.13 billion on Friday from P45.8 billion a week earlier.

“This week’s trading was primarily influenced by how Trump’s planned policies will affect the rest of the world,” Noel S. Reyes, chief investment officer for Trust and Asset Management Group at Security Bank Corp., said in a Viber message.

During the campaign, Mr. Trump vowed to impose a 60% tariff on Chinese imports and 20% for the rest of the world.

The US was the Philippines’ top export market in September, with shipments worth $1.08 billion, or 17.3% of the Southeast Asian nation’s exports.

“Regarded as expansionary and purely America-focused, the immediate effect of his tax cuts, tariff implementation, reshoring of businesses back home and deportation of illegal immigrants are seen to be inflationary, slowing down the Fed’s rate-cutting bias, hence the statement of Powell,” Mr. Reyes said.

The selling momentum was apparent for most of the week given the recent strength of the US dollar and so-called Trump trades regaining lost ground, Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp.

Hedge funds piled into bets on financial stocks, Tesla shares and a prison operator in the third quarter ahead of a rally that followed Mr. Trump’s victory, Reuters reported, citing filings. Many of the bets have become known as Trump trades, corners of the market that at times were swayed by the Republican candidate’s fortunes before the election and notched gains after his victory.

On Tuesday, the Philippine peso sank to a four-month low against the dollar, losing 23.6 centavos to P58.831 amid market concerns that Mr. Trump’s proposed tariff increases could trigger inflationary pressures in the US.

Bond yields and the dollar have surged on growth prospects and concerns that Mr. Trump’s policies might rekindle inflation after a long battle against price pressures after the pandemic. The dollar index, which tracks the US currency against peers including the euro and Japan’s yen, was 0.12% lower on Friday to 106.75. The greenback had risen for five straight sessions and was poised for its biggest weekly percentage gain since early October, according to Reuters.

“Players continued to be averse to the local bond market as uncertainties mount on President-elect Trump’s economic policies,” Ms. Araullo said.

“The selling pressure for the week has caused yields to increase by 5-20 bps. With the yields in the five-year, 10-year and 20-year (bonds) increasing by 15 bps, 17 bps and 5 bps respectively.”

Mr. Reyes said yields have moved up by as much as 80 bps for 10-year bonds, while yields on its local counterpart have climbed back above 6%. “Support at 6% succumbed to externally driven pressure as execution of Trump’s planned policies are being awaited and still provides uncertainty.”

Ms. Araullo said local markets would likely monitor US Treasury movements and await specific details of Mr. Trump’s economic agenda in the coming week. “Given the lack of any compelling catalyst, we expect that yields to trade sideways, with an upward bias for next week.” — Pierce Oel A. Montalvo