Manufacturing grows at its fastest pace in 7 months

By Ana Olivia A. Tirona, Researcher

FACTORY OUTPUT in March grew at its fastest pace in seven months as manufacturers propped up inventories after restrictions eased.

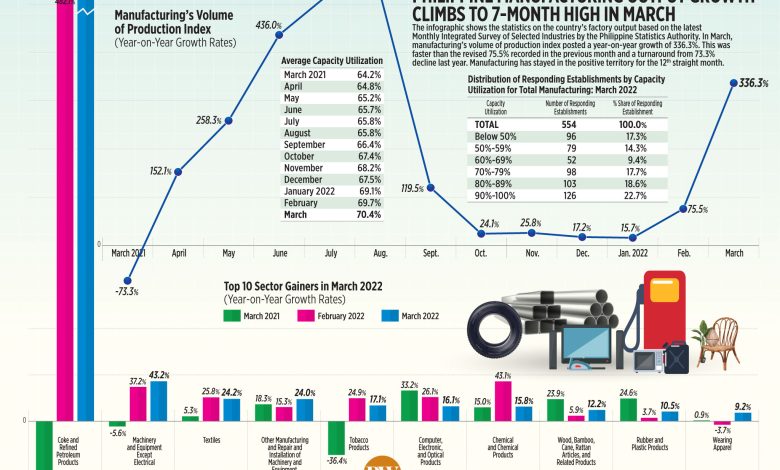

Preliminary data from the Philippine Statistics Authority’s Monthly Integrated Survey of Selected Industries showed manufacturing, as measured by the volume of production index (VoPI), surged more than four times or 336.3% year on year in March.

This was faster than February’s revised 75.5% growth and a turnaround from the 73.3% contraction recorded in March 2021.

March marked the 12th straight month that the manufacturing output was in positive territory. March’s print was also the highest year-on-year growth in seven months or since the 521% surge in August last year.

Manufacturing growth averaged 80.9% in the first quarter.

Philippine Chamber of Commerce and Industry President George T. Barcelon said in a Viber message the factory output growth in March was mostly driven by the need to build up inventory.

Security Bank Corp. Chief Economist Robert Dan J. Roces said the manufacturing’s rise was further fueled by the looser lockdown in March.

“We can attribute this surge to robust output and new orders growth, as validated by the PMI (purchasing managers’ index) reading as well,” Mr. Roces said in a separate Viber message.

“Easing mobility had a profound effect on output, which both improved the consumption footprint and ability to move raw materials for production purposes,” he said.

The government placed Metro Manila and most parts of the country under the most lenient alert level in March, allowing businesses to become fully operational.

S&P Global Philippines Manufacturing PMI jumped to a three-year high of 53.2 in March, signaling improvement in operating conditions.

Fifteen of 22 industry divisions posted VoPI growth in March, led by manufacture of coke and refined petroleum products, which grew almost 23 times (2,175.6%) annually — faster than the revised 482.1% growth in February.

Other industry segments that showed growth included machinery and equipment except electrical (43.2% in March from 37.2% in February); textiles (24.2% from 25.8%); other manufacturing and repair and installation of machinery and equipment (24% from 15.3%); and tobacco products (17.1% from 24.9%).

Meanwhile, declines were recorded for the manufacture of electrical equipment (-36.5% in March from -27.4% in February); printing and reproduction of recorded media (-10.9% from -10.7%); leather and related products, including footwear (-5.9% from 31.4%); other non-metallic mineral products (-5.4% from 22.6%); transport equipment (-4.6% from 6.2%); basic pharmaceutical products and pharmaceutical preparations (-0.6% from 7.2%); and food products (-0.1% from 20.3%).

The capacity utilization — the extent to which industry resources are used in producing goods — averaged 70.4% in March, faster than the revised 69.7% the previous month.

Of the 22 sectors, 21 reached an average capacity utilization rate of at least 50%.

Mr. Barcelon said he expects factory output numbers to “still be okay” until the first half of 2022 as inventory remains sufficient.

“There will be more supply chain disruption in the third quarter and manufacturing will go down a bit,” Mr. Barcelon said.

Mr. Roces said manufacturing output likely further improved in April, but risks from high inflation remain.

“[I]inflation, supply chain difficulties emanating from China, and commodity price jumps due to the Russia-Ukraine conflict may dampen and remain downside risks in the months ahead,” Mr. Roces said.

Inflation soared to an over three-year high of 4.9% year on year in April — breaching the central bank’s target and beating market expectations — as food and energy prices continued to rise amid the ongoing war between Russia and Ukraine.