Mochi eyes small firms outside Metro Manila

By Beatriz Marie D. Cruz, Reporter

MOCHI SOLUTIONS, a local billing and collection platform, is looking to quintuple its users this year as it focuses on underserved companies, according to its chief executive officer (CEO).

“So far, we have over a hundred live users, mostly in service sectors like travel, training and education, marketing and creatives,” Yroen Guaya Melgar, co-founder and CEO at Mochi Solutions, told BusinessWorld. “We’ve found that these businesses are often underserved, since most electronic commerce solutions are built for selling goods.”

“This year, we’re hoping to grow five times to 500 live users, focusing on underserved businesses outside Metro Manila,” she said in an e-mailed reply to questions.

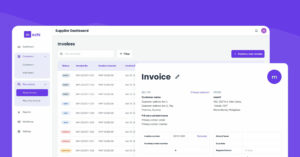

Established in 2023, Mochi caters mainly to micro, small and medium enterprises (MSMEs). It offers invoices, payment links, payment reminders, workflow automation, customer engagement and billing and collection reports.

Users can access as many as five user accounts and unlimited invoices under a 60-day free trial. Its standard plan, which costs P1,899 a month, offers as many as 300 invoices a month.

To expand its reach, Mochi is focused on building partnerships with platforms and service providers that complement its billing and collection services.

“Gone are the days of building on your own,” Ms. Melgar said. “Now, we have to strengthen our ability to connect and be more interoperable.”

The platform is also eyeing partnerships with banks and other financial service providers since many of its users need access to capital and other financial services, she pointed out.

About 99% of business establishments in the Philippines are MSMEs, contributing 40% to economic output. But many smaller firms, especially in the countryside, are hampered by limited capital and access to digital platforms.

Majority of Mochi’s users use social media to interact with customers and manage orders. Hence, being tech-savvy is not the issue.

Smaller firms struggle with complicated onboarding and high transaction fees, particularly in payment platforms, Ms. Melgar said. “Based on our own experience, more than 50% of users drop off during onboarding with payment gateways because they can’t complete the requirements.”

The Philippines generally has higher payment fees, especially for cards, compared with Indonesia, Malaysia and Vietnam. This is a disadvantage for businesses operating on thin margins and customers doing larger transactions, she added.

Mochi’s recent partnership with financial technology firm PayMongo, Inc. is expected to help streamline businesses’ financial operations.

“So far, we’ve focused on payments, but MSMEs also need other types of support such as access to capital, the ability to accept foreign payments and tools for handling multicurrency transactions,” Ms. Melgar said.

“The good news is that PayMongo is already developing or piloting solutions in these areas, and we’re excited to explore how Mochi can be part of that.”

The platform is looking to raise a seed fund by the end of the year and is in talks with local and regional investors, she said.

“We’re also strengthening our integration with platforms that support the full business workflow, like enterprise resource planning, so billing and payments are connected to how people actually run their operations,” Ms. Melgar said.

Mochi is also working with local governments and business groups to help promote digital tools.

“For us, billing and payments are just the starting point,” she said. “Our goal is to make sure small businesses have access to a full ecosystem of digital tools that support how they work and grow.”