PHL recovery hopes to support financial markets

ANALYSTS expect the country’s financial markets to recover along with the economy next year, but cautioned risks remain with the threat of the coronavirus disease 2019 (COVID-19), as shown by the mixed performance in the third quarter.

“In [the third quarter], financial markets showed mixed trends with investor sentiment influenced by various developments both domestically and externally,” the Bangko Sentral ng Pilipinas (BSP) told BusinessWorld in an e-mail.

The BSP said domestic financial markets were weighed by developments at home and abroad such as the renewed lockdowns to curb the spread of the more-infectious Delta variant and news on the US Federal Reserve’s plans to wind down its massive bond-buying program.

To recall, the government in August cut its economic growth target to 4-5% from 6-7% previously to reflect the effect of stricter mobility restrictions declared to curb the Delta-driven surge in COVID-19 cases in Metro Manila.

Furthermore, the account of the July 27-28 meeting showed Fed officials largely expecting to reduce the US central bank’s emergency monthly purchases of $120 billion of Treasury bonds and mortgage-backed securities.

The BSP also noted the forecast and outlook downgrades by the International Monetary Fund, the World Bank, ASEAN+3 Macroeconomic Research Office (AMRO), Oxford Economics, S&P Global Ratings, Moody’s Investors Service and Fitch Rating as among key factors in driving investor sentiment during the quarter.

On the other hand, the central bank also noted favorable macroeconomic data that lifted sentiment such as the faster-than-expected gross domestic product (GDP) growth in the second quarter and the sustained recovery in other metrics such as factory activity, corporate earnings, remittances from overseas Filipinos, foreign direct investments, unemployment, and domestic inflation.

These mixed developments reflect the results in the country’s financial markets.

In the third quarter, the Philippine Stock Exchange index (PSEi) averaged 6,751.98, up by 2.76% from the 6,570.78 in the second quarter, data from the local bourse showed. On an end-period basis, the PSEi was 0.74% higher in the third quarter at 6,952.88 versus the preceding quarter.

Meanwhile, BSP data showed the peso averaging P50.11 against the dollar in the July-September period, depreciating 4.01% from the previous three-month period’s average of P48.17:$1.

Demand for government bonds remained strong during the period. Treasury bill (T-bill) auctions conducted in the third quarter saw total subscription for the quarter amounting to around P701.68 billion, which is around 3.6 times the P197-billion aggregate offered amount. This oversubscription amount of P504.68 billion, however, was lower than the P705.52 billion in the previous quarter.

Demand for Treasury bonds (T-bonds) were likewise robust with a total subscription amount of P868.26 billion, almost twice more than the offered amount of P455 billion.

In the secondary bond market, domestic yields as of end-September were higher by a range of 5.89 basis points (bps) for the 364-day T-bonds to 58.13 bps for the 10-year bonds compared with end-June levels. On the other hand, rates for the 91- and 182-day T-bills were lower by 4.51 bps and 1.67 bps, respectively.

On average, yields were higher by 23.21 bps on a quarter-on-quarter basis, according to the PHP Bloomberg Valuation Service Rates published on the Philippine Dealing System’s website.

WHAT INDICATORS TO WATCH OUT FOR

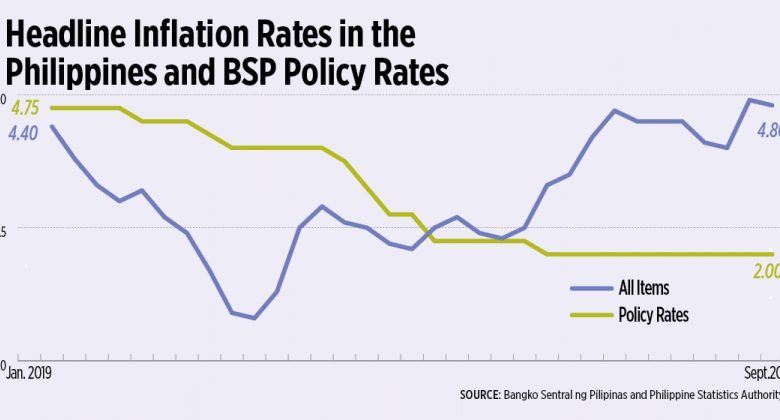

“Financial market participants are anticipated to closely monitor developments in the country’s GDP, corporate earnings, inflation, remittances, and trade balance, to name a few,” the BSP said.

The central bank added that market players are also expected “to be mindful of the downside risks” to economic growth such as the potential spike of new COVID-19 cases that could trigger a reimposition of lockdown restrictions.

“External developments such as global inflation concerns following the movement in global oil and commodity prices, as well as potential changes in the monetary policy stance of major central banks will likewise be in the radar of investors,” the BSP added.

UnionBank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion cites the Purchasing Managers’ Index (PMI) as “an insightful indicator” in gauging how businesses will perform in the future, as well as looking at trends in the manufacturing and service sectors.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said market players should keep an eye on developments in China.

“Inflation is heating up in large part due to the multispeed recovery with the US the main driving force behind this acceleration. However, China has limped along after a strong start to the year and a possible slowdown of the world’s second largest economy may be the issue that throws a monkey wrench into next year’s recovery narrative,” Mr. Mapa said.

“Included also on this list should be the normalization of monetary policy by the Fed and others, but I believe China’s growth fortunes plays a major part in this space as well,” he added.

Analysts also cited pandemic-related developments to continue influencing markets, albeit at a lesser degree compared with the previous quarters.

“[B]usinesses that were previously restricted are now allowed to operate again and with higher capacity…,” said Rizal Commercial Banking Corp. (RCBC) Chief Economist Michael L. Ricafort.

For Asian Institute of Management (AIM) economist John Paolo R. Rivera, the impact of the pandemic “has been slowly integrated into the system” as people learn to coexist with the virus.

“Investor confidence is not dependent on whether the current situation can be improved further to avoid any return to strict restrictions,” he said.

ECONOMIC RECOVERY PROSPECTS

Barring a resurgence of COVID-19 cases, the economy is expected to have performed better in the last three months of 2021, analysts said.

“There are signs of a continued recovery in [the fourth quarter 2021] as mobility data are already reflecting a strong rebound in domestic activity; data for retail and recreation, grocery and pharmacy mobility signaling the highest level of activity since the onset of the pandemic. These should be positive for market sentiment as well,” said Security Bank Corp. Chief Economist Robert Dan J. Roces.

The BSP expects the economy to settle within the revised 4-5% growth target this year.

“With the acceleration in vaccine deployment and the recalibration of quarantine protocols, the government is optimistic that the country will be able to recover further in 2022 with a growth of 7.0-9.0%, and over the medium term with growth rates of 6.0-7.0% in 2023 and 2024,” the BSP said.

“After five consecutive quarters of contraction, the positive performance in [the second and third quarter]… suggests that the economy could be on its way to recovery,” the central bank added.

The country’s GDP expanded by an annual 12% and 7.1% in the second and third quarter, respectively, following a 3.9% decline in the first three months of the year. This brought year-to-date growth at 4.9%.

The economy would have to grow by 1.7% in the fourth quarter to meet the lower end of the government’s 4-5% target band, while it would need to expand by 5.3% to reach the higher end of the goal.

“The Philippine economy is in a better position in 2021 compared to 2020 due to the effects of vaccination. It could have been better if vaccination had been much faster but nonetheless, the vaccination process has saved a lot of lives and jobs. Hopefully, this would continue as we achieve herd immunity and co-exist with the virus until its eventual eradication,” AIM’s Mr. Rivera said.

ING Bank’s Mr. Mapa was less upbeat, citing the recovery is the result of base effects after GDP plunged to 2017 levels.

“Relatively outsized [year-on-year] growth prints were to be expected and scarring effects from the protracted recession will begin to show in the coming quarters,” he said.

With these in mind, below are the BSP’s and analysts’ outlook for each of the key markets. — Bernadette Therese M. Gadon

*****

EQUITIES MARKET

BSP: “In the near term, the local bourse may be expected to further rally and trade over the 7,400 and 7,500 levels amid the continued improvement in the pace of the country’s vaccine rollout, decline in COVID-19 infections, and the continued reopening of the Philippine economy. Moreover, the sustained government spending on infrastructure and the implementation of the third stimulus package under the “Bayanihan to Arise as One Act,” complemented by decisive monetary policy support by the BSP, could further boost investors’ buying momentum.”

Mr. Mapa: “A disappointing GDP performance in the coming quarters will sober market expectations after base effects wear off, capping equity market rallies.”

Mr. Roces: “Better, with improved business optimism and investor sentiment.”

Mr. Asuncion: “As lockdowns continue to ease down during the fourth quarter, consumer spending is expected to increase and strengthen manufacturing supply and demand. The forecasted value of PMI is expected to be at a number above the expansion 50.0 plus range.”

Mr. Ricafort: “The PSEi could still gain towards well into the pre-pandemic levels, should there a breach above 7,500 and eventually 8,000 levels, partly supported by liquidity-driven gains amid greater normalization of the economy (though may be in a gradually manner) amid increased vaccinations and further significant reduction in new COVID-19 cases.

“Further measures to re-open the economy would increase capacity for many businesses, especially the previously restricted ones, thereby leading to higher sales, earnings, employment, more business activities, and higher investment valuations for many positively affected listed companies.

“New record high US stock markets amid liquidity-driven gains and improved US/global economic recovery would help support global market risk appetite/risk-on mode.”

Mr. Rivera: “It is hard to say, but assuming the situation continues to improve faster than the Philippines’ counterparts, we would be in a relatively better position to attract investors to put in their money. This would also have repercussions on our PHP (Philippine Peso) being stronger than other currencies. Financial markets behave depending on the state of economic and public health.”

FIXED-INCOME MARKET

BSP: “The domestic bond market is expected to remain liquid amid the BSP’s continued liquidity support to ensure the proper functioning of financial markets. In the corporate bond market, firms are expected to continue to tap the bond market as alternative source to finance existing debt, business operations, and investments, as the economy enters the recovery phase.

“Meanwhile, the BSP expects some narrowing trend in debt spreads due to improved investor sentiment as business activities start to reopen. However, negative developments such as the possible resurgence of COVID-19 cases could pose significant downside risk to growth and affect debt spreads. Eventual monetary policy normalization in the US could also exert upward pressure on both sovereign and corporate debt yields.”

Mr. Mapa: “[R]ates are moving higher and much higher as BSP will likely need to adjust rates against a backdrop of elevated inflation. A ratings downgrade may also force the bond space into some correction.”

Mr. Roces: “In the short-to-medium term, we see yields trading on an upward trajectory given upward risks from local inflation; upward risks remain as well with rising global inflation and with expectations of a Fed rate hike next year. But with the view of lower local inflation expected next year, end-2022 GS10 yield may be lower than end-2021.”

Mr. Asuncion: “Supply constraints coupled with wage increases is expected to increase inflation as demand picks up near the holiday season. Alongside inflationary pressures, Fed bond purchases have begun tapering on November. Despite this, the national treasury holds an optimistic view that government bonds would remain attractive amidst the speculations for inflation. This was manifested by the debt paper rates increasing, both local and international, given that inflation rates remain elevated. Moreover, the GDP data for the fourth quarter [is] expected to be at 5.5%, however, this will change because of the better-than-expected outlook.”

Mr. Ricafort: “Any increase in Fed rates in the latter part of 2022, by about 0.25% and by another 0.25% in 2023, consistent with the hawkish Fed signals since June 16, 2021, could lead to higher key policy rates for some countries around the world, from unusually low levels, including the Philippines, especially if the economy recovers further with increased vaccinations versus COVID-19.”

Mr. Rivera: “It is hard to say but assuming the situation continues to improve faster than the Philippines’ counterparts, we would be in a relatively better position to attract investors to put in their money. This would also have repercussions on our PHP being stronger than other currencies. Financial markets behave depending on the state of economic and public health.”

FOREIGN EXCHANGE (FX) MARKET

BSP: “Consistent with the country’s floating exchange rate arrangement, the peso will remain market-driven and would continue to reflect emerging demand and supply conditions in the FX market. Over the near term, the peso will continue to be supported by structural FX flows through recovery in exports, remittances, and business process outsourcing (BPO) receipts. FX inflows related to FDIs are seen to continue to grow as the global economy recovers and National Government (NG) infrastructure spending continues. The latest outlook on the external sector for 2021-2022 likewise suggests improvements in these sources of FX amid expected recovery in major trading partners as well as the gradual reopening of the domestic economy as the share of vaccinated population in most economies continue to increase. The ample international reserves could also buttress the Philippine peso.

“Nonetheless, (i) uncertainties over the potential resurgence of COVID-19 cases amid new virus variants, which could negatively impact on the deployment of [remittances] and tourist arrivals as well as dampen investor sentiment, among others; (ii) the rise in global yields (in particular, US interest rates) which could result in investors’ portfolio reallocation; and (iii) the possible continued rise in deglobalization (or protectionism) which could weaken the demand for exports and foreign investments, could pose risks to the peso. At the same time, weak market sentiment may persist if the availability and deployment of safe and effective vaccine in the Philippines is delayed.

“Given these risks, the BSP will rely on measures that will cushion the impact of possible sharp currency movements such as maintaining a healthy level of FX reserves as a buffer alongside reviewing and adjusting existing macro-prudential measures.”

Mr. Mapa: “A strong USD (US Dollar) environment should translate to a gradual depreciation trend for the PHP.”

Mr. Roces: “PHP to depreciate with wider trade deficit and stronger USD as the US economy continues to rebound.”

Mr. Asuncion: “The peso-dollar exchange rate has demonstrated strong depreciation beginning Q2 2021. The peso has remained sensitive to COVID-19 outbreaks given the poor vaccination rates and difficulty in managing the effect of the pandemic. As remittances has experienced sustained growth over the months and the expected headline inflation to come, the PHP is expected to continue to depreciate for 2022.”

Mr. Ricafort: “The seasonal increase in remittances and conversion to pesos in the fourth quarter, culminating in the Christmas holiday season, would help provide some support on the local currency vs. the US dollar.

“Continued growth in remittances, BPO revenues, foreign investments, as well as some possible pick up in BPO revenues and tourism receipts eventually would help finance the country’s trade deficit, in view of the expected pickup in economic activities including importation as the economy re-opens further.

“The country’s gross international reserves, near record highs recently and equivalent to more than 10 months of imports, or way above the minimum acceptable standard of three to four months, would continue to provide structural buffer for the peso exchange rate, especially greater protection versus any speculative attacks, going forward.”

Mr. Rivera: “It is hard to say but assuming the situation continues to improve faster than the Philippines’ counterparts, we would be in a relatively better position to attract investors to put in their money. This would also have repercussions on our PHP being stronger than other currencies. Financial markets behave depending on the state of economic and public health.”