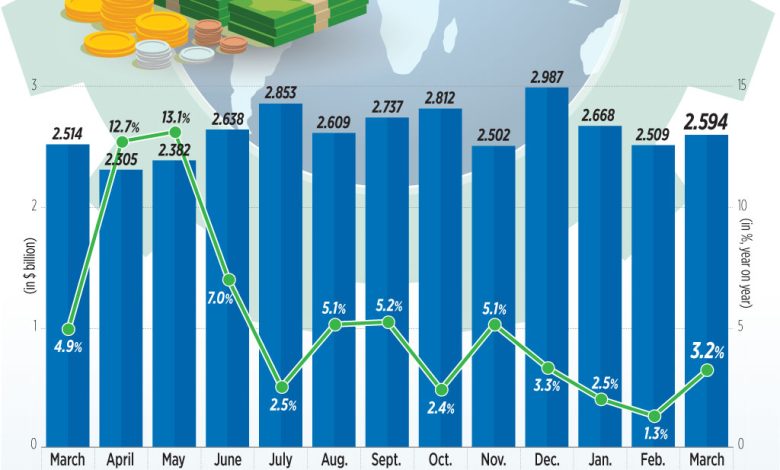

Remittances jump 3.2% in March

By Keisha B. Ta-asan

MONEY SENT HOME by overseas Filipinos rose by 3.2% in March, reflecting improved economic conditions in many host countries as pandemic restrictions eased.

Data released by the Bangko Sentral ng Pilipinas (BSP) on Monday showed cash remittances sent through banks stood at $2.59 billion in March, up from $2.51 billion in the same month in 2021.

This is the biggest monthly inflow recorded since the $2.66-billion remittances seen in January.

The March remittance growth is also the fastest in three months or since the 3.3% rise in December 2021.

“The expansion in cash remittances was due to the growth in receipts from land-based and sea-based workers,” BSP said in a statement.

In March, remittances sent by land-based workers jumped by 3.7% to $2.02 billion from last year’s $1.94 billion, while those sent by sea-based workers increased by 1.3% to $573 million from $566 million a year ago.

“Cash remittance growth was sustained as deployment, both official and unofficial continued. Meanwhile, better economic prospects in host countries also helped OFs (overseas Filipinos) send home more of their income back home to beneficiaries,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail.

Rizal Commercial Banking Corp. (RCBC) Chief Economist Michael L. Ricafort said in a note that global economic recovery prospects have been improving as many countries reopened their economies, boosting jobs outlook for some overseas Filipino workers (OFWs).

However, UnionBank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said the weakness of the peso against the US dollar may have affected the remittances sent by OFWs in March.

“OFWs are usually encouraged to see an exchange rate more favorable to them. If the peso is weaker (nominally a higher value), then they are attracted to have their hard-earned money sent home and eventually exchanged,” Mr. Asuncion said in an e-mail.

Mr. Asuncion said some OFWs may have also sent more money to help their families with household and school expenses amid rising prices.

Inflation quickened to 4% in March, amid a spike in oil and food prices.

For the first three months of the year, cash remittances rose by 2.4% to $7.77 billion, from $7.59 billion in the comparable period last year. This was mainly due to higher inflows from the United States, Japan, Singapore, Taiwan, and Saudi Arabia.

By country, the United States, Singapore, Saudi Arabia, Japan, the United Kingdom, the United Arab Emirates, Canada, Taiwan, Qatar, and Malaysia accounted for 79.1% of total cash remittances in the first quarter.

Meanwhile, personal remittances, which include inflows in kind, increased by 3.1% to $2.88 billion from the $2.80 billion posted in March 2021.

This brought personal remittances 2.3% higher to $8.64 billion in the first quarter, from the $8.45 billion recorded in the comparable period in 2021.

“Remittances will likely prove to be steady this year as deployment continues but we are unlikely to see growth accelerate from hereon given global headwinds and with no particular changes to deployment of overseas Filipinos,” Mr. Mapa said.

Mr. Asuncion said their forecast for April remittance annual growth has been penciled in at 11.1%.

“If factors cited (weak peso and rising inflation) continue, we may see April actual growth outperform,” he added.

The BSP expects remittances to grow by 4% this year.