The law of unintended consequences in the US-Russia economic war

While the shooting war is limited to Russia and Ukraine, the US-led economic war against Russia is unlimited in its impact on the global economy, especially in energy products, crops, and mining products.

Take the TTF/EU gas. It was only €15.9 per megawatt-hour (MWH) on March 4, 2021, it went up to €204/MWH on March 4, 2022, for a year-on-year (YoY) 1,152% increase. The same for UK gas — only £39.8/MWH in March 4, 2021, it went up to £486/MWH a year later for a YoY 1,100% increase. This is mainly because many European countries — especially Germany, Italy, Finland, Poland, Netherlands, Moldova, etc. — are highly dependent on Russian gas.

The UK is not too dependent on Russia gas but since many Europeans shifted to buy more gas from Qatar, Norway, Algeria, US LNG, etc., the prices of these countries’ products also rose. So, while the target of economic and financial sanctions by the US and allies is Russia, there is collateral damage to US allies like Germany and the UK. The law of unintended consequences.

And then there is coal. The benchmark Newcastle (Australia) coal was only $87.5/ton in March 4, 2021, it went up to $419/ton a year after, for a YoY 377% increase.

Then there is a food product — wheat. High wheat prices mean high food prices for many countries in the world. And aluminum, nickel, tin, and a few other mining or metal products. These are used in various gadgets, automotive products, even renewable products like solar-wind. High metal prices mean high prices for electronics, autos, RE infrastructure. Prices in Feb. 24, the first day of Russia invasion of Ukraine, are included here in Table 1.

The dependence of many European countries on Russia gas has been mentioned above. If Russia is not paid or paid very late due to the removal of its many banks from the international SWIFT bank messaging system, then Russia will reduce its gas-oil exports to Europe. Supply goes down, prices go up.

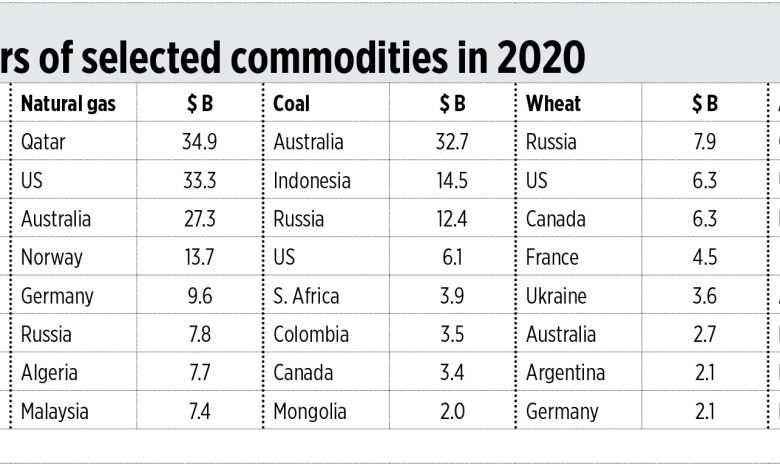

In 2020, Russia was the world’s second largest crude oil exporter next to Saudi Arabia. Russia was the world’s sixth largest natural gas exporter, the third largest coal exporter, the number one wheat exporter, and the third largest aluminum exporter (Table 2). Russia is not a major exporter of nickel and tin but it is a major producer.

The Philippines gets the bulk of its coal from Indonesia, not Australia, but Indonesia prices follow the Newcastle prices with a lag of a few days or weeks. And coal provided 57% of total power generation in the Philippines in 2020 and 2021.

With all these unintended consequences of the US-led economic war against Russia, smaller economies like the Philippines have to prepare more economically because things will worsen before they get better. How should we prepare, especially in cushioning the impact of high inflation and its effect on household consumption?

One, Congress should consider amending the (1.) TRAIN law of 2017 (RA 10963) to suspend the excise tax on energy products: P10/liter for gasoline, P6/liter for diesel, P3/kilo for LPG, P150/ton for coal, and so on, and (2.) the General Appropriations Act (GAA) 2022 and cut some spending commensurate with the tax cut. If the tax cut cannot be done, they should still amend the GAA law and realign some budget items for selective subsidies to certain sectors, especially in transportation and energy.

This will not be easy because it is officially the election campaign period already but Senators and Congressmen/women running for re-election can earn political points if they go back to their respective chambers and quickly make this legislation within a few days.

Two, government should never entertain the idea of price controls for oil and electricity prices. Consumers understand that these energy price hikes are beyond our control, not the fault of the gasoline stations or the gas and coal power plants. Malampaya gas prices are pegged on Dubai crude prices and since Dubai crude has also reached $100+ a barrel, then generation prices from the four gas plants in Batangas will also rise.

Good thing for us, the current Department of Energy (DoE) leadership fully understands the dynamics of business and has zero appetite for any energy price controls on companies which will require government financial remedies which will come from taxes.

Three, energy conservation. We may have to voluntarily limit our mobility to reduce our gasoline/diesel consumption and save money. As electricity prices will soon rise, we have to conserve our electricity usage too, and use more energy-efficient lights, appliances, and gadgets.

Four, at the international foreign diplomacy level, the Philippines and many other countries now affected by the economic war should encourage (a.) the US and other big NATO member countries to make a categorical and explicit statement that Ukraine should not be invited, should not be accepted, as NATO member, and (b.) Russia should immediately pull out of Ukraine when this statement is made. The war must end soon.

Recall that NATO expansion to include Ukraine — proposed by the US in 2008 or 14 years ago — is an important source of the conflict. Ukraine is the second biggest country in Europe in land area after Russia. Missiles on the Ukraine border can reach Moscow in just three minutes or so, so it was a “red line” for Russia. The Russian invasion is wrong. The planned NATO expansion to Ukraine is equally wrong. Both should not have happened or been entertained in the first place.

Five, consider long-term projects to further explore and develop our oil-gas potentials in Philippine territories now. And nuclear power development, at least for small modular reactors (SMRs).

Six, increase agricultural productivity. Rice and corn are close substitutes for wheat, and slowly rice and corn prices are rising in the international market. Our cheap rice imports from Vietnam and Thailand will soon be diverted to other countries at higher prices. So, we have to raise domestic output of rice and corn here.

Finally, recognize that fossil fuels for baseload, 24/7 electricity needs can never be substituted by intermittent, unstable, unreliable, non-dispatchable solar-wind. Insisting on the latter will mean declaring an economic war on ourselves. Leave the solar-wind to contestable customers who want it, and corporations that want to look good on ESG publicity.

Bienvenido S. Oplas, Jr. is the president of Minimal Government Thinkers.