The truth behind Metro Manila’s condo crisis

METRO MANILA’S CONDOMINIUM OVERSUPPLY IS STRICTLY LOCALIZED, NOT MARKET-WIDEContrary to common narratives, Metro Manila is not experiencing a widespread condominium oversupply. This perceived glut is primarily concentrated in specific areas — most notably in select barangays of Pasay, Parañaque and Muntinlupa — likely driven by the exodus of Philippine Offshore Gaming Operators (POGO), which significantly increased condo vacancies in those neighborhoods. The situation was further compounded by pandemic-era migration, as many residents returned to their hometown provinces. The rise of virtual assistant work — now employing about a million Filipinos — has further enabled many to remain based outside Metro Manila. Outside these areas, particularly around major business districts, universities and upscale communities, absorption and occupancy remain stable. Understanding this distinction is crucial for accurately assessing risks and opportunities within the condominium market.

THREE DISTINCT MOTIVES DRIVE THE CONDOMINIUM MARKETTo better comprehend the condominium market dynamics, it’s essential to recognize the distinct buyer segments driving demand. The first segment includes end-users — students seeking proximity to educational institutions, corporate professionals looking for suitable accommodation close to employment hubs and expatriates requiring centrally located residences. The second segment consists of investors who acquire units primarily to generate rental income, typically favoring mid-to-lower-tier properties with consistent demand. Lastly, the luxury market appeals to high-net-worth individuals prioritizing capital appreciation, long-term wealth preservation and the supplementary benefits of rental returns by leasing to expats. Clearly identifying these segments provides context for the ongoing challenges in affordability and market attractiveness.

CONDOMINIUM VALUES HAVE APPRECIATED NEARLY 300%, OUTPACING FAMILY INCOME GROWTHThe affordability issue becomes clearer when examining condominium value appreciation versus family income growth. Between 2015 and 2024, condo prices surged 303% in mid-to-low segments and 296% in luxury segments. In stark contrast, average family incomes in Metro Manila increased by only about 21% during the same period. This disparity significantly heightens affordability barriers, preventing many prospective buyers from entering the market and exacerbating the challenge of homeownership for average families.

RENTAL YIELDS ADJUST TO 2–4%, REFLECTING NORMAL GLOBAL STANDARDSAlongside rising prices, rental yields in Metro Manila condominiums have also adjusted downward, from a high of 5–10% in 2015 to about 2–4% today. While this decline may seem alarming, it aligns with global real estate norms, where mature markets typically yield 2–4%. This adjustment represents a normalization rather than a crisis, signaling a maturing real estate environment. Consequently, investors should recalibrate expectations and adopt strategies suited to this yield context.

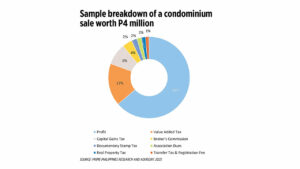

HIGH TRANSACTION COSTS ARE ERODING CONDO RESALE PROFITS, REDUCING NET GAINS TO AROUND 64%However, even with normalized rental yields, another critical issue affects condominium owners — excessive transaction costs. A significant portion of profits from resale transactions involving ordinary assets, such as previously rented condominiums, is eroded by value-added tax (VAT) and other transaction costs that are calculated based on inflated zonal valuations. These zonal valuations, which are 20–30% higher than actual market prices, disproportionately increase sellers’ costs, leaving them with only about 64% of their potential resale revenue. Such substantial erosion of profit discourages secondary market participation and restricts overall market liquidity.

RECENTLY ADJUSTED ZONAL VALUES INFLATE COSTS, REDUCING SELLER PROFITSThis issue is further intensified by historical policy shifts. Previously, condominium flipping — buying units early and reselling upon completion — was profitable. However, the introduction of the Bureau of Internal Revenue’s Memorandum Circular No. 57-2015 imposed stricter monitoring of unit inventory, recognizing and taxing two separate transfers during the flipping process. This policy dramatically reduced profitability for flippers. At present, the application of recently adjusted zonal valuations that are higher that market values compounds these challenges, underlining the urgency to align zonal values closer to market realities.

OPPORTUNITIES FOR REFORM CAN UNLOCK CONDOMINIUM AFFORDABILITY AND MARKET LIQUIDITYAddressing transactional cost barriers presents key opportunities to improve housing affordability and reinvigorate the condominium market. Realigning zonal values to reflect true market conditions would significantly reduce transaction taxes, directly enhancing market liquidity and appeal. Removing VAT from the resale of previously rented condominiums would further improve profitability and stimulate activity in the secondary market.

There is also merit in providing targeted incentives for homebuyers. Countries like Australia have offered stamp duty concessions to reduce upfront transaction costs — similar in function to the Philippines’ documentary stamp tax — while Canada introduced tax-advantaged savings plans to help first-time buyers build up funds for downpayments. Introducing a similar tax break for first-time homebuyers in the Philippines would help lower entry barriers and encourage end-user participation, particularly among younger and working-class buyers.

Additionally, commercial banks should consider offering longer-term mortgages spanning 25 to 35 years. This financing flexibility would allow more working-class Filipinos to afford condominiums near major business districts, supporting both residential access and market demand.

TARGETED POLICY ADJUSTMENTS ARE ESSENTIAL FOR METRO MANILA’S CONDO RECOVERYIn summary, Metro Manila’s condominium market challenges primarily stem from localized oversupply, growing affordability gaps and excessive transaction costs, exacerbated by aggressively adjusted zonal values. Recognizing and addressing these nuanced realities through strategic policy adjustments — realigning zonal valuations, removing VAT on resales and introducing graduated tax incentives — can effectively mitigate the challenges. These targeted reforms promise a healthier and more vibrant condominium market, creating beneficial outcomes for buyers, sellers and investors alike.

Jet Yu is the founder and CEO at PRIME Philippines, the country’s fastest-growing and most disruptive commercial real estate advisory firm that has redefined the brokerage industry by replacing outdated practices with innovation, data intelligence and relentless execution. Jet is a multi-awarded young CEO and serial entrepreneur. He led PRIME to become the fastest-growing real estate consultancy firm in its founding year, and under his visionary leadership, it has consistently ranked among the top five local real estate consultancy firms by revenue since 2017. Beyond PRIME, Jet has founded several other ventures across real estate, coworking and importation. He also served as the youngest investor and judge on CNN Philippines’ The Final Pitch for two seasons.