Value of Philippine metals output climbs to P121B on strong prices

By Revin Mikhael D. Ochave, Reporter

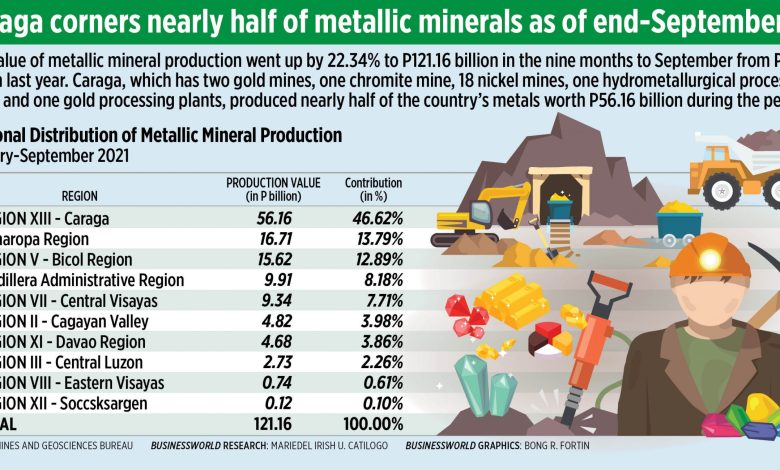

THE VALUE of the Philippines’ metallic mineral production jumped by 22.34% to P121.16 billion in the first nine months of 2021, thanks to strong metal prices and higher production of select metals, according to the Mines and Geosciences Bureau (MGB).

“The strong metal price coupled with the better mine production of nickel ore during the review period was the vital factor for this development,” the MGB said in a report on Wednesday.

MGB data showed nickel and its other by-products had the biggest share in terms of overall production value at 58.5% or P70.83 billion. Gold accounted for 31.2% or P37.75 billion, while copper made up 9.7% or P11.74 billion. The combination of silver, chromite, and iron ore accounted for less than 1% or P840.76 million.

Production volume of nickel direct shipping ore went up by 29% year on year to 325,848 metric tons (MT) and was valued at P46.05 billion.

The nine-month average price of nickel rose by 38% year on year to $18,035.15 per MT compared with $13,059.28 per MT last year.

“In terms of mine regional production, Caraga Region, the nickel capital hub of the Philippines, accounted for 76% with 248,001 MT, followed by Mimaropa with 17% or 54,936 MT, while Regions III and VIII accounted for 6% or 18,939 MT and 1% or 3,971 MT, respectively,” MGB said.

Gold production for the nine-month period inched up by 3% year on year to 13,356 kilograms from 12,973 kilograms last year.

MGB noted the average gold price during the nine-month period went up by 3.8% year on year to $1,801.97 per troy ounce versus $1,735.39 per troy ounce in 2020.

Among provinces, the Bicol Region accounted for 40.89% or 5,462 kilograms, followed by Cordillera Administrative Region (CAR) at 15.10% or 2,017 kilograms, and Caraga Region at 14.91% or 1,991 kilograms.

In contrast, copper output dropped by 18% year on year to 38,025 MT from 46,520 MT after the deficit recorded by Philex Mining Corp. and Carmen Copper Corp.

However, the decline in copper production was offset by the 57% year on year increase in its average price to $9,187.81/MT.

“Another optimistic development is the renewal of the Financial or Technical Assistance Agreement (FTAA) of OceanaGold (Phils), Inc. last July 2021. Its re-entry to the production stream will naturally boost not only copper but also gold and silver output,” MGB said.

Silver output also slipped by 5% year on year to 16,875 kilograms, but the average silver price rose by 34.2% to $25.77 per troy ounce.

Production of chromite declined by 59% to 10,816 dry metric tons (DMT) while iron ore output fell 33.5% to 28,474 DMT.

Meanwhile, MGB said the total area covered by mining tenements as of end-October is at 2.48% or 745,685.48 hectares out of the country’s total land area of 30 million hectares.

There are 313 approved mineral production sharing agreements (MPSA) to date, following the issuance of Executive Order No. 130 that lifted the moratorium on new mining projects, the MGB said. These MPSAs cover a land area of 576,482.65 hectares.

“MGB is working diligently on the formalization and declaration of the new Minahang Bayan (MB). At this time, 43 MBs have already been declared all over the country with 170 pending applications,” it said. Of the declared MBs, there are 13 in Luzon, three in Visayas, and 27 in Mindanao.

Sought for industry comment, Chamber of Mines of the Philippines Chairman Gerard H. Brimo said opportunities for the mining industry will continue to outweigh risks in 2022.

“We see opportunities will continue to outweigh risks in 2022 as governments invest in stimulus activities to revive economies battered by the pandemic and as the drive to transition to clean energy alternatives accelerates,” Mr. Brimo said in a mobile phone message.

“We look forward to further policy pronouncements, such as the lifting of the ban on open-pit mining, which will help maximize the Philippine mining industry’s growth potential and attract more foreign and domestic invest-ments. We also remain hopeful that business and investment policies going forward will be more stable,” he added.

Calixto V. Chikiamco, Foundation for Economic Freedom president, said the mining industry faces a brighter future following the acceleration of economic digitalization amid the pandemic.

“There is increasing demand for electronic products and the metals inside them. Moreover, with most governments pushing for an electronic vehicle (EV) future, there will be an increased demand for metals which are compo-nents of EV batteries. Copper, nickel, lithium, and cobalt are critical for battery production,” Mr. Chikiamco said in a mobile phone message.

“Also pushing up mineral prices are the low interest rates and easy money, which are causing investors to shelter their money from inflation by investing in metals,” he added.