Yields on government debt end mixed on dovish BSP bets, tariff uncertainty

YIELDS on government securities (GS) traded in the secondary market were mixed last week amid dovish comments from the Bangko Sentral ng Pilipinas (BSP) chief, positioning after the reserve requirement ratio (RRR) cut, and uncertainty over the Trump administration’s tariff plans.

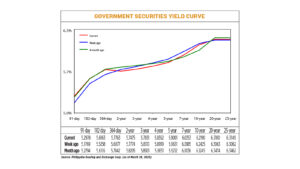

GS yields, which move opposite to prices, rose by an average of 0.32 basis point (bp) week on week, according to the PHP Bloomberg Valuation Service (BVAL) Reference Rates as of March 28 published on the Philippine Dealing System’s website.

Yield movements were mixed. At the short end, rates went up week on week across the board, with the 91-, 182-, 364-day Treasury bills (T-bills) rising by 12.09 bps (to 5.2978%), 9.05 bps (5.6163%), and 8.86 bps (5.7763%), respectively.

Meanwhile, at the belly, yields fell across all tenors. The two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) saw their rates decline by 2.99 bps (to 5.7475%), 4.82 bps (5.7831%), 5.77 bps (5.8362%), 6.3 bps (5.9001%), and 6.32 bps (6.0353%), respectively.

Tenors at the long end closed mixed. The 20- and 25-year bonds rose by 1.17 bps and 0.87 bp to fetch 6.3180% and 6.3149%, respectively. Meanwhile, the yield on the 10-year debt fell by 2.35 bps to 6.2190%.

GS volume traded amounted to P40.72 billion on Friday, higher than the P27.98 billion recorded a week earlier.

“Anticipation of likely policy move from the BSP continues to influence the short-term yields, while the effectivity of the lower reserve requirement for Philippine banks have driven the significant movement in the belly of the curve owing to increased liquidity in the domestic bond market,” a bond trader said.

“BSP Governor Remolona’s positive forward guidance on a potential 25-bp policy rate cut in April influenced the local bond market, leading to declining yields throughout the week… Offshore flows pushed the yield curve lower, with the belly of the curve outperforming,” ATRAM Trust Corp. Chief Investment Officer Alessandra P. Araullo likewise said in a Viber message.

She added that the latest round of RRR cuts that took effect on Friday compressed yields on the front end as banks redeployed their excess liquidity into short-term papers.

BSP Governor Eli M. Remolona, Jr. last week said that there is a “good chance” that the Monetary Board will cut rates by 25 bps at their April 10 meeting, Bloomberg reported.

Mr. Remolona said the BSP remains on an easing cycle and could bring down borrowing costs by as much as 75 bps this year depending on data.

The central bank has reduced benchmark interest rates by a cumulative 75 bps since it began its rate-cut cycle in August last year, with its policy rate currently at 5.75%.

The Monetary Board in February unexpectedly kept rates unchanged amid uncertainties stemming from the Trump administration’s policies.

Meanwhile, the RRR of universal and commercial banks and nonbank financial institutions with quasi-banking functions was brought down by 200 bps to 5% from 7% effective Friday.

The reserve ratio for digital banks was cut by 150 bps to 2.5%, while the ratio for thrift lenders was lowered by 100 bps to 0%, now at par with rural and cooperative banks’ RRR.

On the other hand, yields on long tenors mostly rose due to inflation concerns, the trader added. “While domestic inflation has been moving favorably so far for the year, the threat of a stronger dollar could amplify domestic inflationary risks in the coming summer months. Potential sources are likely to come from higher energy prices and higher price of imported food items.”

Still, yield movements last week were mostly subdued as the market stayed cautious before the release of key US economic data on Friday, the trader said.

“The local currency fell against the dollar due to uncertainty over US President Donald J. Trump’s tariff plans and a US Federal Reserve official’s statement that these plans will boost inflation. This uncertainty led to global investors reallocating their cash, causing movements in the local bond market,” Ms. Araullo added.

Mr. Trump on Friday said that he was open to carving out deals with countries seeking to avoid US tariffs but those agreements would have to be negotiated after his administration announces reciprocal levies on April 2, Reuters reported.

For this week, the market will continue to monitor developments in the Trump administration’s trade policies, both analysts said.

“Local yields might continue to be somehow muted for the first half of the week as market participants await the fuller disclosure of US tariff policies on April 3,” the trader said. “However, yields might start to move higher towards the end of the week in anticipation of a likely rebound in domestic inflation for March from the February lows.”

“Renewed uncertainty from the US and global markets may drive offshore flows into local bonds, influencing yield movements. Given these factors, yields are expected to remain on a downward trajectory in the short term, particularly on the front end and belly of the curve. However, investors should remain cautious of external risks, such as unexpected inflation surprises or global market volatility, which could trigger a reassessment of current market positioning,” Ms. Araullo said.

She added that a lower-than-expected March inflation print could support “a bullish bias” for bonds and expectations of a rate cut at the BSP’s policy meeting next month.

The Philippine Statistics Authority will release March consumer price index (CPI) data on April 4 (Friday).

Headline inflation may have eased slightly in March amid lower prices, analysts said. A BusinessWorld poll of 18 analysts conducted last week yielded a median estimate of 2% for the March CPI.

If realized, this would be a tad slower than the 2.1% in February and the 3.7% clip in the same month a year ago. This would also be the lowest monthly inflation in six months or since the 1.9% print in September. — Abigail Marie P. Yraola