Yields on gov’t debt climb on Fed move, hawkish BSP

YIELDS on government securities (GS) rose last week after the US Federal Reserve fired off another jumbo rate hike, hawkish statements from the Bangko Sentral ng Pilipinas (BSP) chief, and as Philippine inflation surged in October.

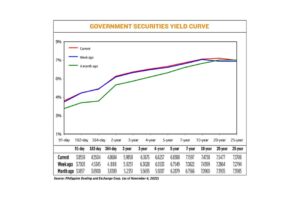

GS yields in the secondary market went up by 7.70 basis points (bps) on average week on week, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates as of Nov. 4 published on the Philippine Dealing System’s website.

The 91- and 182-day Treasury bills (T-bills) saw their rates climb by 10.56 bps and 1.59 bps to close at 3.8559% and 4.5504%, respectively.

However, the yield on the 364-day T-bill dropped by 1.96 bps to 4.8684%.

At the belly of the curve, yields on the two- and three-year Treasury bonds (T-bonds) went up by 6.07 bps and 6.47 bps to 5.9858% and 6.3675%, respectively.

Likewise, the rates of the four-, five-, and seven-year papers climbed by 7.24 bps (to 6.6257%), 8.39 bps (6.8388%), and 7.75 bps (7.1597%), respectively.

At the long end of the curve, yields on the 10-, 20-, and 25-year T-bonds increased by 3.39 bps (7.4738%), 26.13 bps (7.5477%), and 9.12 bps (7.3706%).

Total GS volume traded reached P7.33 billion on Friday, 71.7% higher than the P4.26 billion recorded on Oct. 28.

“The Fed concluding and confirming still higher rates will influence BSP policy rates par for par. This has been communicated by the BSP even as early as last week and affirmed even stronger after today’s inflation print,” Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group Noel S. Reyes said on Friday.

“This will keep the curve flatter and still keep investors favoring long-dated bonds in order to lock in at the high yields that we rarely encounter,” Mr. Reyes said.

A bond trader likewise said in a Viber message that yields climbed week on week after the Fed’s decision, the BSP chief’s hawkish statements, and faster Philippine inflation in October.

The US central bank last week fired off a fourth straight 75-bp hike as it seeks to rein in inflation, bringing the fed funds rate to a level within 3.75-4%. The Fed has increased borrowing costs by 375 bps since March.

Following the Fed’s decision, BSP Governor Felipe M. Medalla said the Monetary Board will also raise benchmark interest rates by 75 bps at its Nov. 17 meeting to maintain price stability.

The central bank has hiked rates by 225 bps since May to rein in rising inflation.

Headline inflation surged to a near 14-year high of 7.7% in October from 6.9% in September and 4% in the same month in 2021.

For the first 10 months, inflation averaged 5.4% versus 4% a year ago, well above the BSP’s 2-4% target but still below its 5.6% full-year forecast.

For this week, the bond trader said yields remain “skewed on the upside” as the market continues to price in the Fed’s decision and faster Philippine inflation in October.

“Moreover, the market will continue to track global yield movements and also look to this week’s five-year FXTN (fixed-rate Treasury note) issuance by the government for justified directional cues,” the bond trader added.

The Treasury will offer P35 billion in reissued 20-year T-bonds on Tuesday, which have a remaining life of four years and 10 months. — A.O.A. Tirona