Yields on gov’t debt mixed

YIELDS on government securities (GS) were mixed last week as the market consolidated after the Bangko Sentral ng Pilipinas’ (BSP) decision to pause its monetary easing cycle.

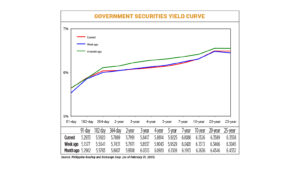

GS yields at the secondary market went up by 1.61 basis points (bps) on average week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of Feb. 21 published on the Philippine Dealing System’s website.

The short end of the curve rose, with yields on the 91-, 182-, and 364-day Treasury bills (T-bills) increasing by 13.56 bps (to 5.2933%), 2.79 bps (5.592%), and 4.58 bps (5.7889%) respectively.

At the belly, the two-year tenor inched up by 0.2 bp to yield 5.7991%. Meanwhile, rates of the three-, four-, five-, and seven-year Treasury bonds (T-bonds) inched down by 1.2 bps (to 5.8417%), 2.29 bps (to 5.8814%), 3.04 bps (to 5.9225%), and 3.4 bps (to 6.0088%), respectively.

At the long end, yields on the 10-, 20-, and 25-year T-bonds went up by 0.13 bp, 1.23 bp, and 5.13 bp, respectively, to 6.1326%, 6.3589%, and 6.3558%.

Total GS volume traded reached P39.83 billion on Friday, lower than the P40.92 billion seen on Feb. 14.

GS yields were mixed last week as the market continued to digest BSP Governor Eli M. Remolona, Jr.’s remarks following the Monetary Board’s Feb. 13 policy meeting, analysts said.

“The BSP’s decision to keep rates unchanged initially drove some selling in the secondary market, but yields eventually settled. Part of this may have been brought about by the shift in the governor’s rhetoric towards a cut in the reserves, which may have alleviated the effects of the surprise of the BSP’s decision,” a bond trader said in a Viber message.

“Shorter-dated bonds were more affected since there had been demand there leading up to an expected rate cut, driving average yields at T-bills auctions gradually lower over the last couple of weeks. It was pretty much priced in, so there was an adverse reaction there when the BSP did not cut.”

Meanwhile, yields at the belly moved mostly lower as the market expects the BSP’s pause to be temporary, the trader noted.

“The BSP’s rate-cutting cycle is very much intact. It is just on hold for now due to global trade policy uncertainties coming from the US. Thus, the short end of the curve to the belly is on anticipatory mode and is awaiting domestic and US economic data that affirms inflation will continue to ease here and in the US,” First Metro Investment Corp. Head of Research Cristina S. Ulang said in a Viber message.

The BSP’s policy-setting Monetary Board on Feb. 13 unexpectedly held benchmark interest rates steady in a “prudent” move as global uncertainties cloud the outlook for growth and inflation.

At its first meeting for 2025, the BSP left the target reverse repurchase rate unchanged at 5.75%. Rates on the overnight deposit and lending facilities were also kept at 5.25% and 6.25%, respectively.

This was the central bank’s first pause following three consecutive 25-bp cuts since it began its easing cycle in August 2024.

The decision took the market by surprise as 19 out of 20 analysts polled by BusinessWorld had anticipated a fourth straight 25-bp cut at the meeting, while one analyst expected the BSP to keep rates steady.

Mr. Remolona said uncertainty over the trade policy of US President Donald J. Trump and its potential impact on the Philippines led to the decision to keep rates unchanged for now. However, he said the BSP continues to be in an easing cycle, with the pause letting the central bank hedge itself against the risk of policy reversal.

He added that the central bank will likely continue reducing interest rates by 25 bps at a time, with 50 bps in cut for this year still likely.

The Monetary Board’s next policy meeting is on April 3.

On Friday, the BSP announced that it will reduce the reserve requirement ratios (RRR) of universal and commercial banks and nonbank financial institutions with quasi-banking functions by 200 bps to 5% from 7% effective March 28.

The RRR for digital banks will be cut by 150 bps to 2.5%, while the ratio for thrift banks will be brought down by 100 bps to 0%.

The central bank last cut banks’ reserve ratios in October 2024.

Moving forward, Ms. Ulang said the market will watch hints from both the BSP and the US Federal Reserve on their outlook for inflation amid the Trump administration’s policies.

“Any positive signal… will spur buying,” she said, adding that the long end of the curve could face downward pressures. — P.O.A. Montalvo