BIR estimates P370-B revenue losses from ‘ghost receipts’

AS MUCH AS P370 billion in tax revenue may have been lost to “ghost receipts,” the Bureau of Internal Revenue (BIR) said.

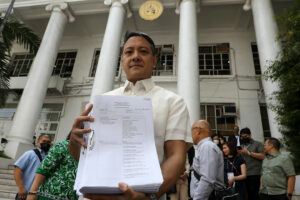

BIR Commissioner Romeo D. Lumagui, Jr. estimated the total value of ghost receipts issued has reached P1.3 trillion.

“We computed the total purchases (of those ghost receipts), we totaled the value-added tax (VAT) and income tax and that (P370 billion) is the revenue loss to date,” Mr. Lumagui told reporters in an interview late on Tuesday.

“There are still many other groups that sell ghost receipts. It’s a challenge to catch them,” he added.

In June, the BIR filed criminal cases against buyers of fake receipts that led to losses worth P17.9 billion.

The agency also filed cases against the sellers of ghost receipts in March. These included four “ghost” corporations that cost the government about P25.5 billion in losses.

“Because of our task force on fake transactions, we have seen that many individuals are coordinating with us and are willing to pay their taxes. We have also heard from business groups that they are complying,” Mr. Lumagui added.

Meanwhile, the BIR said there has been a 11-20% shortfall in excise tax collections in the first half of the year.

“We are hoping to recover that. What we will try to do is run after those that are not paying the excise tax on sugar-sweetened beverages and cigarettes. For vape products, we plan to release regulations on that,” he added.

The BIR collected P1.22 trillion in the first half of the year, up by 7.65% from P1.13 trillion a year ago, data from the Treasury showed.

However, this was 2.57% lower than the agency’s P1.25-trillion program for the period.

The BIR expects to collect P2.64 trillion in revenues this year, 13% higher than the agency’s actual collection of P2.34 trillion in 2022.

Broken down, it is targeting to collect P1.32 trillion from taxes on net income and profits are expected to reach P1.32 trillion. It also aims to collect P538.13 billion from VAT, P336.1 billion from excise taxes, P124.65 billion from percentage taxes and P224.15 billion from other taxes.

The agency collects about 70% of government revenues. — Luisa Maria Jacinta C. Jocson