BIR files tax evasion cases vs buyers of fake receipts

THE BUREAU of Internal Revenue (BIR) on Wednesday filed criminal cases against buyers of fake receipts that led to tax losses worth P17.9 billion.

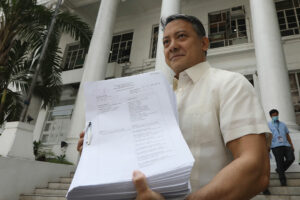

“The BIR has filed criminal cases against buyers of fake or ghost receipts, their corporate officers, the accounting firms they engaged and the certified public accountants who signed their documents,” Internal Revenue Commissioner Romeo B. Lumagui, Jr. said in a statement.

“A total tax liability of P17.9 billion has been computed for this first set of cases,” he said. “This is tax evasion of the highest order, and perhaps the most elaborate tax evasion scheme in the history of Philippine taxation. We will regularly file criminal cases against buyers of fake or ghost receipts.”

The complaints were filed before the Department of Justice in Manila.

The agency conducted a raid in December, from which it seized thousands of illegal receipts, invoices and other documents in a condominium in Quezon City.

In March, the BIR filed criminal cases against the sellers of fake receipts, including four “ghost” corporations and their accountants. The sellers’ activities cost the government about P25.5 billion in taxes, it said.

“This syndicate registers ghost companies whose sole business purpose is to sell original receipts so their buyers could illegally reduce their tax liabilities,” Mr. Lumagui said. — Luisa Maria Jacinta C. Jocson