BPI sees slower loan growth amid elevated rates

BANK of the Philippine Islands (BPI) sees slower loan growth this year as benchmark interest rates are expected to remain high.

The Ayala-led bank is expecting 8-10% loan growth this year, lower than its previous double-digit outlook, BPI President and Chief Executive Officer Jose Teodoro K. Limcaoco said to BusinessWorld on Tuesday.

“I think loan growth will be moderate this year. [We’re] looking at 8-10% this year. So far, that seems to be the call. That’s slower than what we thought at the start,” Mr. Limcaoco said.

BPI saw its loans increase by 10.5% to P1.72 trillion in the first half from end-December, driven by its corporate, credit card, and auto portfolios, the bank’s quarterly report showed

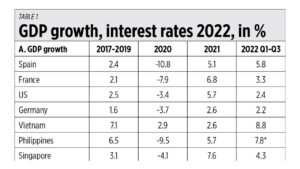

Loan growth may slow amid companies’ expectations that the Bangko Sentral ng Pilipinas’ (BSP) benchmark rates would stay elevated, Mr. Limcaoco said.

“I think that’s driven by the fact that a lot of companies postponed lending because they thought rates were coming off. Now that we’re higher for longer, I think people will have to make the adjustment,” he said.

The BSP kept its policy rate at 6.25% for a fourth straight meeting in September. It will hold its next review on Nov. 16.

Meanwhile, consumer lending could be steady as inflation is still expected to ease eventually, Mr. Limcaoco said.

“I think people are a little worried about inflation, but I think it should be under control towards the end of the year. Therefore, the businesses, I think, will begin to come back and make their investments and realize that they have to, in a way, bite the bullet,” he said.

For 2024, BPI expects its loans to grow by 10% as policy easing is unlikely to happen until the second half of the year, he added.

“I don’t think you’ll see a big jump from this year, but it should be better than this year,” Mr. Limcaoco said.

Still, elevated rated are unlikely to affect BPI’s nonperforming loans and profitability significantly, he added.

BPI saw its net income rise by 4.5% year on year to P13 billion in the second quarter amid higher revenues.

This brought its attributable net profit to P25.15 billion for the first semester, up by 23.02% year on year. — A.M.C. Sy