BSP extends ‘hawkish’ rate pause

By Keisha B. Ta-asan, Reporter

THE BANGKO SENTRAL ng Pilipinas (BSP) kept benchmark interest rates steady for a third straight meeting on Thursday, but signaled it is prepared to resume tightening if needed amid risks to inflation.

At the same time, the BSP raised its inflation forecast for this year and next, reflecting the spike in global oil prices.

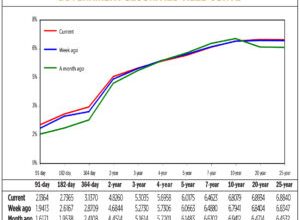

The Monetary Board left its overnight reverse repurchase rate unchanged at a near 16-year high of 6.25%, as expected by 13 economists in a BusinessWorld poll last week. Interest rates on the overnight deposit and lending facilities were maintained at 5.75% and 6.75%, respectively.

The BSP has raised borrowing costs by 425 basis points (bps) from May 2022 to March 2023 to tame inflation.

“The Monetary Board deemed it appropriate to maintain monetary policy settings to allow a moderation of inflation even as authorities continue to assess the emerging risks to the inflation outlook,” BSP Governor Eli M. Remolona, Jr. said after chairing his first policy meeting as governor.

The balance of risks to the inflation outlook remains skewed to the upside, he added.

“Potential price pressures are linked to the impact of possible higher transport charges, higher minimum wage adjustments, persistent supply constraints on key food items, and the effects of El Niño weather conditions on food prices and power rates,” he said.

Mr. Remolona said the Monetary Board also recognized the “challenging outlook” for the economy, as the slower second-quarter gross domestic product (GDP) expansion reflected a “broad-based slowdown in domestic demand.”

“Authorities noted that the strength of economic activity going forward is likely to moderate as pent-up demand wanes and the full impact of prior monetary policy tightening continues to manifest,” he said.

The Philippine economy expanded by 4.3% in the second quarter, the slowest in two years. For the first half, GDP growth averaged 5.3%, below the government’s 6-7% target.

INFLATION OUTLOOKThe BSP slightly raised its average inflation forecast for 2023 to 5.6% (from 5.4% previously) and 3.3% (from 2.9%) for 2024, respectively, citing wage hikes and the recent rally in global oil prices. It also hiked its 2025 inflation forecast to 3.4% from 3.2% previously.

Despite the higher forecast for this year, the BSP still expects inflation to return to the 2-4% target band by the fourth quarter of 2023.

In July, headline inflation eased for the sixth consecutive month to 4.7%, bringing the seven-month average to 6.8%.

“The upward revision in these (inflation) forecasts is due to the sharp increase in Dubai crude oil prices in recent weeks. We’ve also incorporated the effect of the higher-than-expected minimum wage adjustment and the recent movements in the peso,” BSP Monetary Policy Sub-Sector Officer-in-Charge Dennis D. Lapid said during the same briefing.

BSP Deputy Governor Francisco G. Dakila, Jr. said the BSP expects the price of Dubai crude to average about $82.3 per barrel in 2024 and to around $77-$78 per barrel in 2025.

“If oil prices went up again following the onset of the war in Russia-Ukraine to $100 per barrel, that would be a scenario where inflation could breach the (2-4%) target. But those scenarios are unlikely. We are much more comfortable that we will be on the target path,” Mr. Dakila said.

Mr. Lapid said the BSP is looking at the potential inflationary impact of an increase in fares, more wage hikes, and higher power rates.

A P40 minimum wage hike in the National Capital Region took effect on July 16. Several regional wage boards are expected to decide on wage hike petitions by September.

READY TO TIGHTENMr. Remolona said the BSP is “ready to tighten” if necessary, as it keeps a close eye on developments that may impact inflation.

“For now, we don’t see any easing, at least not in the next meeting. The [policy] rates are not that elevated, it is still low enough to not be a factor in growth,” Mr. Remolona said.

He added that monetary tightening was not a major contributor to the slower GDP growth in the second quarter.

Mr. Dakila said the Philippine economy may still achieve its 6-7% growth target, particularly if government agencies ramp up their spending. He noted the 7.1% contraction in government spending was a significant factor in the weaker-than-expected growth in the April-to-June period.

“If government spending had just been flat, it would have already added more than a percentage point to economic growth. If government spending had just been moderately positive, then the outturn would have actually been significantly higher for the second-quarter growth,” he said. “That illustrates the cruciality of government spending in achieving government target.”

Mr. Dakila said a further deceleration in inflation in the second half will help support household spending.

Private consumption increased by 5.5% in the second quarter, but this was the slowest pace since the 4.8% contraction in the first quarter of 2021.

“Sustained non-monetary measures remain crucial in addressing lingering supply-side pressures on prices. The BSP remains prepared to respond as necessary to safeguard the inflation target, in keeping with its primary mandate to ensure price stability,” Mr. Remolona said.

Nicholas Antonio T. Mapa, senior economist at ING Bank N.V. Manila, noted Mr. Remolona made sure to retain his “hawkish bias, vowing to quickly resort to potential rate hikes in order to help anchor inflation expectations.”

Shivaan Tandon, emerging Asia economist at Capital Economics, said it is unlikely for the BSP to embark on rate cuts soon since core inflation remains “uncomfortably high.”

“Policy makers would also want to see signs of sustained falls in core inflation in the coming months. Given this backdrop, we are sticking with our view that interest rates will remain unchanged for the next few months and rate cuts are unlikely before the first quarter of 2024,” he said.

Core inflation, which discounts volatile prices of food and fuel items, slowed to 6.7% in July from 7.4% in June. This brought the year-to-date average to 7.6%.

Mr. Tandon also said the BSP likely considers it “premature” to cut rates before the impact of El Niño to food prices becomes more evident, as the Philippines is among “the most exposed” to risks from the weather event.

The state weather agency expects the El Niño weather pattern to persist in the Philippines until the first quarter of 2024.

Makoto Tsuchiya, assistant economist at Oxford Economics, said that while the pause was in line with consensus expectations, the outlook for monetary policy is becoming “increasingly uncertain.”

“Although soft second-quarter GDP calls for a more dovish stance, recent rapid rise in daily food prices and the peso depreciation provide a reason for the central bank to stay cautious,” he said in a note.

Mr. Mapa said the BSP may continue to keep policy rates for the rest of the year to balance the risks to growth and inflation.

“However, we could see BSP considering a rate hike down the line should the US Federal Reserve opt to increase policy rates before the end of the year, in order to maintain interest rate differentials,” he said.

The US central bank raised its target interest rate by 25 bps last month to a range between 5.25% and 5.5%, the highest level in 22 years.

The BSP is next scheduled to discuss policy on Sept. 21, Nov. 16, and Dec. 14.