BSP seen to deliver more rate hikes

By Keisha B. Ta-asan

THE PHILIPPINE central bank could deliver more aggressive rate hikes in order to support the peso and tame inflation without derailing economic growth, analysts said.

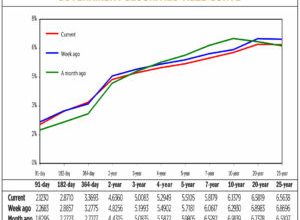

The Bangko Sentral ng Pilipinas (BSP) unexpectedly tightened its monetary policy by 75 basis points (bps) on July 14, bringing the benchmark rate to 3.25%.

Interest rates on the overnight deposit and lending facilities were also hiked by 75 bps to 2.75% and 3.75%, respectively.

Deutsche Bank Chief Executive Officer for Asia Pacific Alexander von zur Muehlen said the BSP would likely raise interest rates by another 50 bps in August to support the peso, which recently touched the all-time low.

“We think the central bank needs to stabilize the currency and it will take more than (the July 14) move to do that. We still expect a 50-bp rate hike in August and for now will keep the September rate hike at 50 bps too,” Mr. Muehlen said in an exclusive interview with BusinessWorld.

Despite policy tightening, the peso remains under pressure. It closed at P56.36 against the US dollar on Friday, weakening by 21 centavos from its Thursday finish.

Year to date, the peso depreciated by 10.5% or by P5.36 from its close of P51 versus the dollar on Dec. 31, 2021

“What we’re experiencing right now, is that obviously, a lot of currencies here in our region are looking weaker against the dollar. This is less to do with any individual currency’s weakness, and more to do with a number of macroeconomic drivers pushing up the dollar’s strength,” Mr. Muehlen said.

Investors are flocking to the dollar, which is seen as a safe-haven asset, as the US Federal Reserve considers larger rate hikes amid red-hot inflation.

BSP Governor Felipe M. Medalla said he would not rule out another interest rate increase in its next policy meeting on Aug. 18.

“We still have room to raise depending on the inflation picture,” Mr. Medalla said in an interview with Bloomberg TV on Friday, also citing spillover effects from other countries for last Thursday’s off-cycle decision.

Inflation rose by 6.1% year on year in June, the fastest in nearly four years and exceeded the central bank’s 2-4% target band for a third straight month. The inflation rate averaged 4.4% in the first six months, still below the BSP’s full-year forecast of 5%.

The Philippine Statistics Authority (PSA) is scheduled to release July inflation data on Aug. 5, and second-quarter gross domestic product (GDP) data on Aug. 9.

GROWTH OUTLOOKSanjay Mathur, chief economist for Southeast Asia and India of ANZ research, said the BSP has room to hike rates without hurting economic recovery amid global uncertainties.

“The 75-bp rate hike, though unexpected and unexpectedly large, is unlikely to impact growth. Nonetheless, further tightening is also on the cards to reduce inflation,” Mr. Mathur said in an e-mail.

“Now the critical point to bear in mind is that the way a monetary tightening cycle works is that it reduces aggregate demand and that in turn, stabilizes or reduces inflation. The same transmission will evolve in the Philippines — aggregate demand ease and that is a prerequisite for lower inflation.”

The economy expanded by a faster-than-expected 8.3% in the first quarter. The Development Budget Coordination Committee (DBCC) is targeting 6.5-7.5% GDP growth this year.

“On the external developments, we should bear in mind that the Philippines is not a major exporting economy. Nonetheless, even a marginal impact on exports when domestic demand is easing (as discussed above), the overall impact on growth would be apparent,” Mr. Mathur said.

The global economic outlook for this year and 2023 is expected to be further downgraded when the International Monetary Fund (IMF) releases its World Economic Outlook Update later this month.

“The war in Ukraine has intensified, exerting added pressures on commodity and food prices. Global financial conditions are tightening more than previously anticipated. And continuing pandemic-related disruptions and renewed bottlenecks in global supply chains are weighing on economic activity,” IMF Managing Director Kristalina Georgieva said in a statement.

“Moreover, downside risks will remain and could deepen — especially if inflation is more persistent — requiring even stronger policy interventions which could potentially impact growth and exacerbate spillovers particularly to emerging and developing countries,” she added.

Meanwhile, Mr. Muehlen expects that countries in the Southeast Asian region would continue their recovery in contrast with the global outlook.

“This part of the world is set for growth, we anticipate that ASEAN (Association of Southeast Asian Nations) and large parts of Asia will see its GDP grow by two times versus the rest of the world, in the foreseeable future, and for quite a number of years,” Mr. Muehlen said.

“The growth opportunities here are over proportional. And as a consequence, we continue to look very constructively at the future here for us,” he added.