BSP to keep policy rates steady — poll

A vendor arranges vegetables at a public market in Manila, March 16. — PHILIPPINE STAR/ RUSSEL PALMA

By Luz Wendy T. Noble, Reporter

THE BANGKO Sentral ng Pilipinas (BSP) is widely expected to maintain policy rates at record lows on Thursday in line with its signals it will continue to support economic recovery.

However, analysts said they are seeking more forward guidance from the BSP on its imminent tightening as the space to retain its accommodative stance is getting smaller.

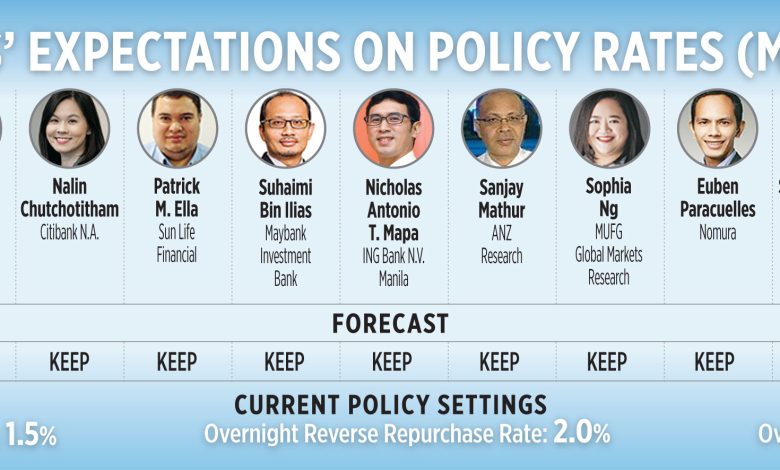

A BusinessWorld poll last week showed 15 out of 17 analysts still anticipate the Monetary Board keeping rates on hold on March 24, the second policy review this year.

Analysts believe the BSP will remain focused on providing support for a more sustainable economic recovery despite inflationary risks caused by the Russia-Ukraine war.

“I think the BSP will maintain rates, since the problem (i.e., the Russia-Ukraine conflict and its ripple effect on world oil and commodity markets) is essentially cost-push in nature, which requires appropriate supply-side interventions from the government,” said Ser Percival K. Peña-Reyes, associate director at the Ateneo de Manila University Center for Economic Research and Development.

Global oil prices have been volatile in the recent weeks due to supply concerns arising from Russia’s invasion of Ukraine. Russia is the world’s second-biggest exporter of crude oil.

Latest data from the Department of Energy showed prices of gasoline, diesel, and kerosene increased by P20.35, P30.65, and P24.90 per liter since the start of the year.

Fuel retailers are expected to announce on Monday a hefty cut in pump prices, as global crude oil prices posted a weekly loss last Friday.

The Philippine economy is still below its pre-pandemic level, which strengthens the case for the BSP to stay on hold, analysts said.

“The economy will likely only return to its pre-pandemic level by the third quarter of 2022. As such, we believe that the central bank would only be comfortable to start tightening the monetary environment by the middle of the year,” Philippine National Bank economist Alvin Joseph A. Arogo said.

He expects the BSP to announce a rate hike at its policy review meeting on June 23.

“I certainly think that economic growth should still be the BSP’s focus, largely because the economy is still operating well below potential. Indeed, this is one of the reasons why we expect the bank to remain on hold throughout this entire year, despite the wave of interest rate tightening sweeping the globe,” said Miguel Chanco, senior Asia Economist at Pantheon Macroeconomics.

The economy expanded by 5.6% in 2021 after shrinking by a record 9.6% in 2020. However, gross domestic product (GDP) remained below its pre-pandemic level and is only expected to regain this within this year.

BSP Governor Benjamin E. Diokno has earlier said they would first want to see at least four consecutive quarters of economic growth before assessing the need for a rate hike.

In the fourth quarter of 2021, GDP grew by 7.7% — a third straight quarter of growth.

Meanwhile, two economists believe that inflation risks caused by the surge in oil prices are enough reason for the BSP to start increasing interest rates by at least 25 basis points (bps) on Thursday.

“We anticipate an escalating rise in prices of practically all prices of commodities for this month and the month to come due to the uncertainties brought about by the Ukraine-Russia war. This will bring about economic uncertainties that will linger,” Colegio de San Juan de Letran Graduate School Dean Emmanuel J. Lopez said.

“I think this will call for a slow hike [in interest rates]. The effects of oil prices on inflation need to be tempered by an appropriate monetary policy,” Asian Institute of Management economist John Paolo R. Rivera said.

Inflation remained steady at 3% for the second straight month in February. However, the central bank said inflation could go beyond their 2-4% target in the second quarter if oil price increases are sustained.

Some analysts said that while the BSP will likely keep rates on hold this week, a more aggressive tightening may come in the next few months given the inflation risks caused by the war in Ukraine.

“We think the BSP will remain on hold this March 24, but should give stronger guidance on policy and the likelihood of an earlier-than-second half of 2022 policy action given that the window for monetary policy action may be narrowing with the current circumstances,” Security Bank Corp. Chief Economist Robert Dan J. Roces said.

He said the BSP’s current policy directive is similar to its stance of staying “behind the curve” when faster inflation was mostly caused by low supply.

“Clearly the key risk is the possibility that world commodity prices stay elevated for a prolonged period as a function of the Russia-Ukraine conflict, pressuring inflationary tendencies, and thus a preemptive hike may prove to be more and more prudent,” Mr. Roces said.

The US Federal Reserve’s policy tightening and its impact will also be another reason for an earlier rate hike, Makoto Tsuchiya, an economist at Oxford Economics said. For the first time since 2018, the Fed last week raised interest rates by 25 bps to quell a four-decade high inflation.

“High commodity prices are not only pushing up inflation but will also contribute to a larger current account deficit. With the US Fed set to raise rates by another 150-bp hike this year leading to a narrowing interest rate differential, we could see investors turn negative on Philippine assets, weakening the peso and putting pressure on the BSP to raise rates earlier,” he said.

Last week, Mr. Diokno said they do not necessarily need to move in tandem with the Fed, noting the BSP adjusts its policy setting only to the extent that external developments affect the outlook for growth and inflation.

The BSP chief also said they will wait until the second half of the year to start raising interest rates.

After Thursday, the Monetary Board’s next policy review is set on May 19. First-quarter GDP data will be released on May 12.