Businesses now required to start using new BIR notice for receipts, invoices

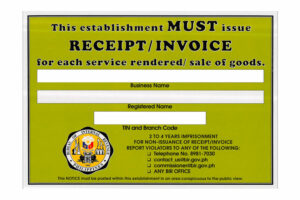

THE Bureau of Internal Revenue (BIR) said businesses are now required to use the new format for the Notice to Issue Receipt/Invoice (NIRI).

“Starting on July 1, 2023, all sellers, including online sellers, engaged in the sale of goods or provision of services, are required by the Bureau to display prominently in their respective establishments/websites/social media accounts the NIRI, which (began to be) issued on a staggered basis by the revenue district offices and large taxpayers divisions, to their registered business taxpayers since October 2022,” the BIR said on Monday.

The NIRI will replace the previous “Ask for Receipt” Notice (ARN), which expired on June 30.

“With the display of the NIRI in business establishments, all sellers are reminded of their obligation to automatically issue receipt/invoice for each service rendered/sale of goods without waiting for the buyer to ask for it,” Commissioner Romeo D. Lumagui, Jr. said.

“Failure to comply… will result in the imposition of penalties or other legal consequences provided under the Tax Code, as amended,” he added.

The notice must be “prominently displayed” within the shop or place of businesses, including branches and mobile stores.

Businesses applying for the NIRI are required to update their registration information.

The shift to the new format of notice was ordered by former Finance Secretary Carlos G. Dominguez in 2019. The government said it aims to improve revenue collection through the mandatory issuance of receipts and invoices. — Luisa Maria Jacinta C. Jocson