Debt yields decline on dovish Fed

YIELDS on government securities (GS) went down last week due to dovish signals from the US Federal Reserve and following the release of the Treasury bureau’s borrowing plan in December.

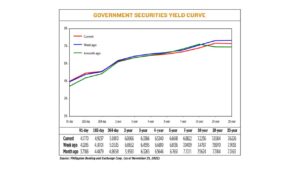

GS yields, which move opposite to prices, dropped by an average of 11.15 basis points (bps) at the secondary market week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of Nov. 25 published on the Philippine Dealing System’s website.

Treasury bills (T-bills) rose while Treasury bonds (T-bonds) retreated at the end of the trading week.

Yields on the 91-, 182-, and 364-day T-bills climbed by 5.65 bps, 11.36 bps and 2.75 bps to 4.1770%, 4.9237 and 5.0810%, respectively, to close the week.

Meanwhile, at the belly, rates of the two-, three-, four-, five-, and seven-year T-bonds fell by 5.86 bps (6.0066%), 12.29 bps (6.3366%), 14.7 bps (6.534%), 15.18 bps (6.6618%) and 15.87 bps (6.8822%), respectively.

The long end of the curve also declined as yields on the 10-, 20-, and 25-year debt dropped by 25.51 bps (7.2236%), 23.86 bps (7.6584%), and 29.12 bps (7.6226%), respectively.

Total GS volume reached P12.984 billion on Friday, lower than the P10.714 billion recorded on Nov. 18.

“Global bond yields continue to drop on dovish pivot bets. Locally, BTr’s (Bureau of the Treasury) December borrowing schedule is less than previous month, helping support bond prices,” the bond trader said in a Viber message.

Minutes of the Fed’s policy Nov. 1-2 meeting where they fired off a fourth straight 75-bp hike showed a “substantial majority” of policy makers agreed it would soon be appropriate to deliver smaller increases.

The Fed has raised rates by 375 bps since March to rein in elevated inflation. Its next meeting is on Dec. 13-14.

Meanwhile, the BTr plans to borrow P135 billion from domestic debt market in December, 37.2% lower than the P215 billion programmed for November. Broken down, it plans to raise P30 billion from T-bills and P105 billion from T-bonds next month.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail that local rates took their cue from global bond yields moving lower.

“The move was sparked by expectations that US Fed policy rate hikes would continue but at a more measured pace,” Mr. Mapa said.

“The downshift in global yields was enough to push local yields lower,” he said.

Reuters reported last week that US Treasury yields went down following the release of the Fed meeting minutes.

The 10-year US Treasury yield fell to 3.65%, the lowest since Oct. 5.

“GS yields followed global bonds, while lack of supply next month helped market players ignore possible higher CPI (consumer price index) print for November,” the bond trader added.

For this week, the bond trader expects yields to continue seeing a downside bias, but this could be tempered by profit taking ahead of the release of Philippine November CPI data on Dec. 6.

Headline inflation stood at 7.7% in October. For the first 10 months, inflation averaged 5.4%, higher than the central bank’s 2-4% target but below its 5.8% forecast for the year.

The Bangko Sentral ng Pilipinas (BSP) has hiked borrowing costs by 300 bps since May to keep in step with the Fed’s tightening and temper rising inflation.

BSP Governor Felipe M. Medalla last week ruled out further outsized or off-cycle increases, but said they will need to keep on raising borrowing costs as the Fed’s tightening cycle continues. The Monetary Board’s next review will be held on Dec. 15. — Lourdes O. Pilar with Reuters