Energy realism: Oil-coal consumption and NGCP’s delayed projects

(Part 3)

Last week two beautiful statements from two agencies came out.

One was from the Department of Energy (DoE) on July 6: “DoE, MENRE Sign Circular on the Joint Award of Petroleum Service Contracts and Coal Operating Contracts in the BARMM.” The other was from the Department of Budget and Management (DBM) on July 7: “Pangandaman lauds DoE-BARMM deal on energy exploration.”

The DoE and the Ministry of Environment, Natural Resources, and Energy (MENRE) of the Bangsamoro Autonomous Region in Muslim Mindanao (BARMM) signed the Intergovernmental Energy Board (IEB) Circular on the Joint Award of Petroleum Service Contracts (PSCs) and Coal Operating Contracts (COCs) in the BARMM at Malacañang Palace, witnessed by President Ferdinand E. Marcos, Jr. and DBM Secretary Amenah F. Pangandaman, among others.

Energy Secretary Raphael P.M. Lotilla said, “It will not only contribute to the energy security of the country but also unlock vast opportunities for economic growth in the Bangsamoro Autonomous Region.”

Budget and Management Secretary Pangandaman, the only Muslim Secretary in the Marcos Jr. Administration, said, “The Joint Circular agreement between DoE and MENRE exemplifies a significant step towards sustainability and prosperity for BARMM.”

Bravo, Mr. Lotilla and Ms. Pangandaman. Bravo, MENRE-BARMM, and President Marcos Jr. We need more oil, gas, and coal. We need more investments and businesses, more job creation.

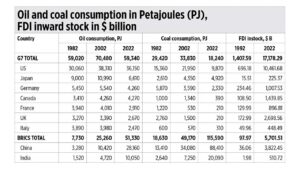

The Philippines remains a laggard in oil and coal consumption compared to many countries in the world and yet aspires to industrialize. In the table, I trace the numbers over four decades — the years 1982, 2002, 2022 — in oil and coal consumption then foreign direct investment (FDI) inward stock. Data sources are the Energy Institute Statistical Review of World Energy (EI-SRWE) 2023 which was released last month, and the UN Conference on Trade and Development (UNCTAD) World Investment Report (WIR) 2023, which was released last week.

I grouped the countries into three — the G7 industrialized countries, the BRICS (Brazil, Russia, India, China, South Africa), and the rest of East Asia. The results after four decades are really interesting.

One, G7 oil consumption in 2022 is back to 1982’s level of 59,000 petajoules (1PJ = 163,400 barrels of oil equivalent, or 1 PJ = 277.78 gigawatt-hours), while their coal consumption has declined from 29,400 to PJ to 18,200 PJ — Wow! Their FDI inward stock has expanded 12.2 times from the 1982 level.

Two, BRICS’ oil consumption expanded by 6.6x, coal consumption expanded 6.2x, and their FDI inward stock expanded 58.2x. Great achievement.

Three, the oil use, coal use, and FDI inward stock of the other East Asian economies including South Korea, Taiwan, and the ASEAN-6, have expanded 4.2x, 13.5x, 38.2x, respectively. Good achievement too.

Four, the Philippines’ oil consumption in 2022 was only 86% of Vietnam’s, 51% of Malaysia’s, 37% of Thailand’s, 33% of Singapore’s, and 16% of South Korea’s. And the Philippines remains to have the smallest FDI inward stock (see the table).

NGCP’S PROJECTSAlso last week, these developments were reported in BusinessWorld: “NGCP ordered to explain 37 delayed projects” (July 6), “Delayed approvals blamed for transmission project delays” (July 10), “Yellow alert declared over Luzon grid after Batangas power plant suffers outage” (July 11), and, “Meralco implements lower rates this month” (July 11).

The Energy Regulatory Commission (ERC) — in the Show Cause Order (SCO) dated June 14, issued on July 4 — ordered the only remaining private monopoly nationwide, the National Grid Corp. of the Philippines (NGCP), “to explain why it should not face administrative penalties for the delays, non-completion, and failure to commence ERC-approved transmission projects.”

Bravo, ERC.

Delayed completion of 37 projects, three of which are yet to commence, with delays ranging from 21 to 2,561 days — horrible job, NGCP.

The biggest private monopoly’s Transmission Development Plans submitted to DoE show that since 2009 the transmission grid increased only by 8% in terms of line expansion (from 19,425 circuit-kilometers in 2009 to 21,027 circuit-kilometers in 2022). From 2011-2018, NGCP’s line expansion was only 1.05% progress rate per year.

During the “Pandesal Forum” on July 5, DoE Secretary Lotilla said: “The NGCP is the biggest monopoly in the Philippines … the one that can hinder or facilitate the progress or the entry of new generation capacity …. major projects still delayed … Congress has given them a 3% franchise tax in lieu of all other taxes.”

Secretary Lotilla is 100% correct in his assessment there. Congress and the previous Arroyo administration had given NGCP a tax privilege, and NGCP is even passing this franchise tax on to customers. It earns huge revenues, has a huge tax shield, and has huge project delays that lead to frequent yellow-red alerts in the country, which can terrify potential investors from coming into the country. I really hope that when the Maharlika Investment Fund becomes a law, among its big investments is to acquire majority control of the NGCP.

Finally, some good news announced by Meralco — a reduction of P0.72/kWh in the electricity rate this July. The overall rate for a typical household declined from P11.91/kWh last June to P11.19/kWh this July.

The generation charge has declined from P7.25/kWh in June to P6.61/kWh this July. There are three reasons why this is so.

One, Meralco has increased its power purchase from the Wholesale Electricity Spot Market (WESM) where prices have gone down by P2.66/kWh as demand has decreased. Two, low coal prices that led to low prices from non-fixed power supply agreements. And three, Peso/Dollar appreciation.

And back to energy realism. Stable, reliable, predictable, dispatchable energy on demand by consumers can come only from conventional sources like coal, oil, gas, and nuclear power. Coal and oil prices can go up but they can protect customers from blackouts and inconvenience, damaged appliances, and damaged production. When coal prices decline, then we have blackout-free and cheap electricity at the same time.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers