Financing growth: Maharlika Fund and SWFs from abroad

(Part 3 of a series)

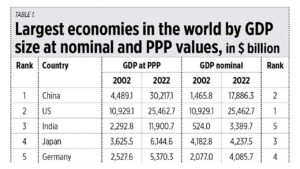

The International Monetary Fund (IMF) released the World Economic Outlook (WEO) October 2023 two weeks ago. In Table 1 I show the largest economies in the world, with a focus on Asians. Two valuations of GDP here: nominal (GDP at national currency divided by US$ average exchange rate for the year) and purchasing power parity (PPP, which converts the currency of one country with another to buy the same amount of goods and services in each country).

When it came to GDP at nominal values in 2022, the US was the largest in the world and three Asians were in the top 10. When it came to GDP at PPP values, China was the largest and three other Asians were in the top 10 — India, Japan, and Indonesia.

The Philippines was the 30th largest economy in the world at PPP values, but in nominal values, it was the 39th largest (Table 1). Since we have the 12th largest population in the world, this does not appear impressive, but if we look at the expansion over the past 20 years, from 2002 to 2022, the Philippines’ economy has expanded four to five times while the population has expanded only 1.4 times, from 80 million in 2002 to 112 million in 2022.

So there has been a significant increase in productivity and income in the Philippines and many other developing countries through the years and it is something to ponder, that all those crisis narratives and the alarmism in the world — the food/hunger crisis, the oil/energy crisis, the NCDs/virus crisis, the climate/garbage crisis, etc. — are not realistic enough to deter continued improvement in the people’s lives and standard of living.

MAHARLIKA FUND AND SWFs ABROADThe Philippines economic team, composed of Finance Secretary Benjamin Diokno, Budget Secretary Amenah Pangandaman, Economics Secretary Arsenio Balisacan, and Bangko Sentral officials went to Doha, Qatar and Dubai, United Arab Emirates (UAE) on Sept. 10 to 12, for a business dialogue and Philippine Economic Briefing (PEB). The team met with the representatives of the sovereign wealth funds (SWFs) of both countries — the Qatar Investment Authority and the Investment Corp. of Dubai — plus other big investment entities. Several big investment pledges were made on those two economic diplomacy meetings in the Middle East.

Then President Ferdinand Marcos, Jr. went to Riyadh, Saudi Arabia for business dialogue last week, on Oct. 19. The head of the economic team, Mr. Diokno, joined him and again pitched the Maharlika Investment Fund. He said that “Maharlika seeks to work with other sovereign wealth funds, both as an investment partner and peer in the global sovereign wealth fund community. We look forward to exchanging views and learning from the best practices of top-of-class funds, such as those here in Saudi Arabia.”

Here are recent stories in BusinessWorld about the Maharlika Fund: “Philippines’ Marcos suspends implementation of sovereign wealth fund” (Oct. 18), “Philippines committed to start operating sovereign wealth fund this year — Marcos” (Oct. 19), “Safeguards sought for Maharlika fund” (Oct. 19), “Diokno tells Saudi investors Maharlika fund prioritizes safety, transparency” (Oct. 20), “Philippines says over $4.26-B investment deals agreed with Saudi business leaders” (Oct. 20), “MIF’s governance structure needs improvement — analysts” (Oct. 23).

For me, the establishment of the Maharlika Investment Fund is good and important mainly because there are many big infrastructure projects that must be done here, like the Cavite-Corregidor-Bataan bridge, and the Iloilo-Guimaras-Negros bridge, both 32 kms long each. And there are many super-rich and wealthy SWFs abroad that can be tapped to invest here and having our own SWF or sovereign investment fund will help attract them. In Table 2 are listed the largest and richest SWFs abroad.

I doubt the government-owned banks like LANDBANK and DBP, even the big conglomerates here like San Miguel Corp. and Metro Pacific, can attract those big SWFs abroad to bring in big money. They lack the political plus financial muscles in the vetting process by those huge SWFs. The Maharlika Fund capitalization of P500 billion is only $8.9 billion (at P56/$), of which only P125 billion is the initial capitalization. An investment of $2-3 billion in Maharlika is “small amount” for the SWFs of UAE, Qatar and Saudi Arabia. Not to mention the SWFs of Norway, China, Kuwait, Singapore and Hong Kong.

This administration’s economic team is doing the right thing when it comes to business and investment diplomacy. Go out there and meet those big SWFs, tell them of the reforms that have been done, the reforms that are under way, the big infrastructure projects that can be utilized by our big population and rising business communities. We need to sustain fast growth, 5% to 8% yearly, for many years to come.

See also my previous columns in this “Financing growth” series: Part 1, “Financing growth: a rice tariff cut, an MUP pension cut, and reforms in excise tax in mining, oil, and coal” (Sept. 26), and Part 2, “Financing growth: Reducing interest payments and spending control” (Oct. 5).

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers.