Financing growth

(1st of a series)

This column will produce a new series on Financing Growth. The take-off point is the successful UP School of Economics program in development economics alumni association homecoming lecture last Saturday titled “A Conversation with finance and budget secretaries on financing sustained economic growth.”

Finance Secretary Benjamin E. Diokno and Budget Secretary Amenah F. Pangandaman discussed the recent and medium-term economic performance and targets of the economic team and Marcos administration.

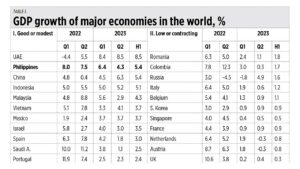

GDP GROWTH IN Q2 2023Of the top 50 largest economies in the world in GDP size in 2022, 32 have reported their second-quarter 2023 GDP data. The top three fastest-growing in the first half or average for Q1 and Q2 2023 were the United Arab Emirates (UAE), Philippines and China. But UAE and China have fast growth in 2023 on low base or low growth in Q1 and Q2 of 2022, whereas the Philippines has fast growth in 2023 on high base or high growth in 2022. So it would appear that of these 32 major economies in the world, the Philippines has the most dynamic and resilient growth.

And of these 32 economies, 11 have low H1 growth of below 2%, while seven have contractions of 0.1% to 1% including Germany — the largest economy in Europe — Sweden, Poland and Taiwan. I added four countries with modest or high growth in Q1 but no Q2 data yet (Table 1).

The global and regional economic environment in 2023 is worse than in 2022. A growth of 3% or higher now looks fast already. The Philippines growing at 5.4% in H1 was already an outstanding performance.

BIG INFRASTRUCTURESecretary Diokno and Secretary Pangandaman discussed an optimistic short- to medium-term economic and fiscal outlook. Below are four sets of data presented by the two secretaries, among the many data they discussed and for brevity, I compressed these sub-tables into one.

Sub-table I shows the growth target of the Development Budget Coordination Committee (DBCC), and projections by the ASEAN+3 Macroeconomic Research Office and the three multilaterals — ADB, IMF and WB. The four institutions’ projections for 2023 are within the DBCC target, but for 2024, the three multilaterals have lower projections than DBCC but still high — 5.5% or higher.

Sub-table II shows that all the five credit rating companies either upgraded or affirmed and sustained their previous ratings for the Philippines since President Ferdinand R. Marcos, Jr. assumed power in July 2022. The most recent were made by Fitch, from BBB- to BBB stable in May, and by R&I, from BBB+ stable to BBB+ positive early this month. The next goal is to move from BBB+ to A and I think that is highly possible.

Sub-table III shows the medium-term fiscal projections like reducing the public debt/GDP ratio, deficit/GDP ratio and keeping the infrastructure spending/GDP ratio between 5-6% yearly. I also think these are doable, although I wish that deficit/GDP ratio was below 3% by 2028.

Sub-table IV shows an ambitious infrastructure program of P1.3 trillion until 2028, led by more roads and bridges. Both secretaries highlighted two main sources of funding other than the budget and new borrowings from multilaterals — more public private partnerships (PPP) and the Maharlika Fund (Table 2).

BusinessWorld reporter Keisha B. Ta-asan was at the lecture and she wrote two stories, “Diokno: Tuition-free college education unsustainable” (Aug. 20), “DBM chief says Q2 GDP growth would have been higher if not for gov’t underspending” (Aug. 21). Good to see you there, Keisha.

PDE ALUMNI HOMECOMINGEven if it was a Saturday afternoon of a long weekend, the UPSE auditorium was full during the lecture by the two secretaries. The bulk of the audience came from PDE alumni batches of the 1970s and 2010s.

After the lectures and open forum with the two secretaries, dinner was served courtesy of the Philippine Center for Economic Development of UPSE. Then came the PDE homecoming program. Mai Valera-Co, president of batch 46th, and I were the co-MCs. There were lots of fun games, raffle prizes and giveaways to all alumni who came, plus food and beer. Our batch also gave an entertainment number — economic carols composed and sang in December 1997.

For that very successful event, the two secretaries’ lecture and PDE homecoming, I want to thank the following.

Our corporate sponsors who gave donations in kind, in alphabetical order: Alas Oplas & Co. CPAs., Astoria Hotels and Resorts, Gallerie Joaquin, iOptions Ventures Corp., Japan Tobacco, Inc., Manila Electric Co., Nestlé Philippines, Philip Morris Fortune Tobacco Corp., Robinsons Retail and San Miguel Corp.

Friends who represent the companies above: Marycris (also my sister), Jeffrey, Jack, Pidro, Robert, Joe, Arlene, Noel, Robina and Ferdie. Thank you guys, more blessings to your companies.

Of those 10 corporations, only iOptions Ventures is province-based, in Palawan. Pidro was my dormmate at the UP Narra dormitory in the 1980s, a very kind man and he formed the Palawenyo Savers, the CSR arm of iOptions that provide scholarships and nurture rural-based entrepreneurship like developing small organic farm systems, biochar production including carbonized rice hull and liquid smoke.

For the organizing team, special thanks to UPSE Dean Joy Abrenica (also our teacher in PDE in 1997-1998), Rose San Pascual, Chelle Magboo, many other staff of UPSE, my co-MC Mai Valera-Co, PDE Alumni Association convenor Monching Bacani and most importantly, former UPSE faculty and PDE Director Ruping Alonzo (RIP) who is well-loved and remembered by so many PDE graduates from various batches.

Thank you all. Fantastic lectures and homecoming. We will do it again next year.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers.