Fitch Solutions maintains 5.9% PHL growth forecast

FITCH SOLUTIONS said on Wednesday that it maintained its 5.9% growth forecast in 2023 for the Philippines with inflation cooling though interest rates remain elevated.

“We are forecasting GDP (gross domestic product) growth to slow from 7.6% in 2022, to 5.9% in 2023, slightly more downbeat than the official government forecast range of 6-7%,” Fitch Solutions Country Risk Analyst Low Shi Cheng said in a Webinar.

Despite cooling inflation, pressures remain high which could result in the central bank raising borrowing costs further and weigh on consumption and investment growth, he added.

Mr. Low forecasts inflation to remain on a downward track for the rest of the year, eventually hitting the government’s 2-4% forecast range in the second half of the year.

Headline inflation in March cooled to a six-month low of 7.6% from 8.6% in the previous month amid lower prices of food and transport, according to preliminary data from the Philippine Statistics Authority.

March inflation was the weakest reading since the 6.9% posted in September. It remained much higher than the year-earlier 4%.

“Signs of the economy’s weakness will also become increasingly evident in the data, which will set the stage for the policy rate to be kept on pause beyond the next meeting,” he added.

Fitch Solutions expects the central bank to raise benchmark interest rates by another 25 basis points (bps) at its May 18 meeting, before keeping the policy rate on pause at 6.5% thereafter.

The Bangko Sentral ng Pilipinas (BSP) last month hiked benchmark interest rates by 25 bps to help bring down inflation, raising its key rate to 6.25%.

Since May 2022, the central bank has raised borrowing costs by a total of 425 bps.

However, Mr. Low said that the BSP could hike rates beyond 6.5% if inflation remains elevated and if the peso remains vulnerable.

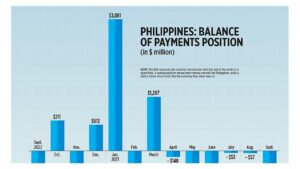

Fitch Solutions forecasts the current account deficit to narrow to 4.1% of GDP by the end of this year from 4.7% in 2022, on the back of lower commodity prices and resilient remittances.

“High imports of capital goods on the back of infrastructure projects will prevent a sharper narrowing. Moreover, timelier data showed that export growth has started to contract. It seems that this downward trend will likely continue amid faltering global demand,” Mr. Low said. — Aaron Michael C. Sy