Gov’t debt yields drop on US inflation report

YIELDS on government securities (GS) dropped last week as slower US consumer inflation bolstered bets that the US Federal Reserve might be done hiking rates this year.

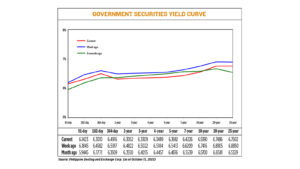

GS yields, which move opposite to prices, fell by an average of 15.15 basis points (bps) week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of Nov. 17 published on the Philippine Dealing System’s website.

Yields fell across the board last week. The 91-, 182-, and 364-day Treasury bills saw their rates decrease by 4.22 bps (to 6.1423%), 15.72 bps (6.301%), and 10.01 bps (6.4916%), respectively.

At the belly, the two-, three-, four-, five- and seven-year T-bonds declined by 17.70 bps, 17.13 bps, 16.95 bps, 17.21 bps and 19.83 bps to 6.3052%, 6.3309%, 6.3489%, 6.3692% and 6.4226%, respectively.

Lastly, at the long end, the yield on the 10-year bond dropped by 20.26 bps to 6.539% and rates of the 20- and 25-year papers went down by 14.19 bps (to 6.7486%) and 13.48 bps (6.7502%), respectively.

Total GS volume reached P32.24 billion on Friday, surging from the P11.43 billion seen on Nov. 10.

GS yields declined following slower US consumer inflation last month, a bond trader said, which fanned expectations that the Fed may pause its tightening cycle anew.

“This put less pressure on the BSP (Bangko Sentral ng Pilipinas) to hike [last week] in spite of an out-of-cycle move late last month and the pause was pretty much expected already,” the trader said in a Viber message.

US consumer prices were unchanged in October as Americans paid less for gasoline, and the annual rise in underlying inflation was the smallest in two years, bolstering the view that the Federal Reserve was probably done raising interest rates, Reuters reported.

Though rents continued to rise last month, the pace of the increase slowed considerably from September. The softer-than-expected inflation readings reported by the Labor department’s Bureau of Labor Statistics on Tuesday pushed US Treasury yields lower and sparked a stock market rally.

The unchanged reading in the consumer price index (CPI), the first in more than a year, followed a 0.4% rise in September.

In the 12 months through October, the CPI climbed 3.2% after rising 3.7% in September.

Economists polled by Reuters had forecast the CPI would gain 0.1% on the month and increase 3.3% on a year-on-year basis.

The lower US CPI led to the extended rally in GS yields, a second bond trader said in a Viber message.

The result of the 10-year T-bond auction last week “helped fuel momentum,” the first bond trader added.

The Bureau of the Treasury raised P30 billion as planned via the reissued 10-year bonds it auctioned off last week as total bids reached P65.928 billion or more than twice the offered volume.

The bonds, which have a remaining life of nine years and nine months, were awarded at an average rate of 6.781%, with accepted yields ranging from 6.748% to 6.8%.

Government securities are expected to continue trading with a downward bias this week, the second bond trader added.

“Although the Fed and the BSP have signified their willingness to remain hawkish, if need be, markets are pricing in the tightening is at an end,” the second trader said.

“Traders will likely monitor developments that could threaten the inflation outlook from here on out,” the first bond trader added. — B.T.M. Gadon with Reuters