Gov’t debt yields go up on CPI, auction result

YIELDS on government securities at the secondary market rose last week following the release of data showing the consumer price index (CPI) hit a new peak in September and the result of the seven-year bond auction.

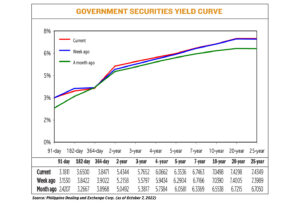

GS yields, which move opposite to prices, rose by an average of 4.33 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of Oct. 7 published on the Philippine Dealing System’s website.

The short end of the curve declined as the 182- and 364-days Treasury bills (T-bills) fell by 19.22 bps and 5.51 bps to yield 3.65% and 3.8471%, respectively.

Meanwhile, the 91-day T-bills increased by 2.81 bps to fetch 3.1811%.

The belly of the curve also climbed as the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) saw their rates go up by 21.86 bps (to 5.4344%), 18.55 bps (5.7652%), 12.28 bps (6.0662%), 6.32 bps (6.3536%), 2.97 bps (6.7463%).

Likewise, the long end of the curve rose, with the rates of the 10-, 20-, and 25-year papers climbing by 1.08 bps, 2.93 bps, and 3.6 bps to 7.0498%, 7.4298%, and 7.4349%, respectively.

GS volume reached P4.82 billion on Friday, lower than the P7.12 billion recorded on Sept. 30.

“Yields on government securities climbed for the week after inflation accelerated in September and is still seen to peak as we close the year. Market participants also took cues from the rise of US Treasury yields given that several Federal Reserve officials who spoke this week remained hawkish,” a bond trader said in a Viber message.

Philippine headline inflation surged to 6.9% year on year in September due to the rising food, utility and transport costs. This matched the 6.9% logged in September and October 2018 and was also the fastest in more than 13 years or since the 7.2% in February 2009.

The September pace also marked the sixth straight month that inflation breached the Bangko Sentral ng Pilipinas’ (BSP) 2-4% target for the year.

For the first nine months, the CPI averaged 5.1%, faster than the 4% seen in the same period last year but below the BSP’s 5.6% forecast for 2022.

Meanwhile, US central bank policy makers, in separate speaking engagements last week, expressed support for continued interest rate hikes as inflation in the world’s largest economy remains stubborn.

On the other hand, Security Bank Corp. Chief Economist Robert Dan J. Roces said in an e-mail interview that GS rates rose last week following the government’s partial award of its T-bond offer.

The Bureau of the Treasury (BTr) partially awarded the reissued seven-year bonds it offered last as investors asked for higher rates on expectations of faster inflation.

The BTr raised just P22.85 billion from its offer of seven-year papers on Tuesday, less than the programmed P35 billion, even as total bids reached P39.144 billion.

The reissued bonds, which have a remaining life of two years and six months, were awarded at an average rate of 5.746%, 134.4 bps lower than the 7.09% quoted for the issue when it was last offered on Dec. 11, 2018 and 0.4 bp below its 5.75% coupon.

For this week, the bond trader expects debt yields to continue rising on expectations of more rate hikes from the BSP and the Fed, with the BTr’s auction of fresh seven-year papers on Tuesday also expected to be a major trading driver.

“For the week ahead, outlook for yields is still skewed on the upside on expectations that both the US Fed and the BSP will continue to keep hiking to fight down inflation and as market players look to this week’s 7-year FXTN auction with its coupon rate expected to clear at the 6.75% to 7% range,” the bond trader said.

Mr. Roces said yields may remain range-bound with a slight upward bias this week ahead of the release of latest US consumer inflation data, which could provide clues on the Fed’s next move. — M.I.U. Catilogo