Gov’t debt yields mixed on monetary policy bets

YIELDS on government securities (GS) traded in the secondary market moved sideways last week as sentiment was mixed amid monetary policy bets here and in the United States and following the release of Philippine gross domestic product (GDP) data.

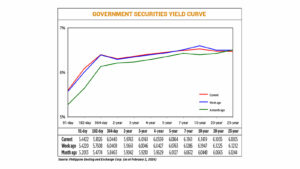

GS yields, which move opposite to prices, inched up by an average of 0.23 basis point (bp) week on week, based on PHP Bloomberg Valuation Service Reference Rates as of Feb. 2 published on the Philippine Dealing System’s website.

Yields on the 91-, 182-, and 364-day Treasury bills (T-bills) went up by 2.02 bps, 6.18 bps, and 0.32 bp to 5.4422%, 5.8126%, and 6.044%, respectively.

Rates at the belly likewise rose, with the two-, three-, four-, and five-year Treasury bonds (T-bond) climbing by 1.02 bps (to 5.9763%), 1.15 bps (6.0161%), 1.32 bps (6.0559%), and 1.01 bps (6.0864%).

Meanwhile, the seven-year T-bond saw its rate drop by 1.25 bps to 6.1161%.

All tenors at the long end saw their yields fall week on week. Rates of the 10-, 20-, 25-year papers dropped by 5.28 bps, 1.9 bps, and 2.07 bps to end at 6.1419%, 6.1035%, and 6.1005%, respectively.

Total GS volume traded reached P20.91 billion on Friday, higher than the P19.39 billion seen on Jan. 26.

“Yields moved sideways during the week due to mixed signals from prospects of delayed policy rate cuts from the US Federal Reserve and the Bangko Sentral ng Pilipinas (BSP), and the robust Philippine gross domestic product (GDP) report for the fourth quarter,” a bond trader said in an e-mail.

“Market participants remained largely cautious during the week as the economic data releases and the Fed policy meeting were widely seen to influence the future monetary policy actions by central banks this year,” the trader added.

The BSP is likely to remain cautious and wait for the Fed to cut rates before starting to loosen policy, analysts said.

The Federal Open Market Committee (FOMC) kept the target fed funds rate steady at the 5.25-5.5% range for the fourth straight meeting on last week. The Fed hiked by 525 bps from March 2022 to July 2023.

Fed Chair Jerome H. Powell said after their two-day review that they are unlikely to ease their policy stance in their March 19-20 meeting amid lingering inflation risks, dashing market expectations of rate cuts in the first quarter.

“The pause adds to the data we are looking at,” BSP Governor Eli M. Remolona, Jr. said. “The statement was slightly more hawkish than before.”

The Monetary Board raised benchmark interest rates by 450 bps from May 2022 to October 2023, bringing the policy rate to a 16-year high of 6.5%.

The BSP will hold its first meeting for the year on Feb. 15.

Meanwhile, Philippine economy grew by 5.6% in 2023, slightly faster than the 5.5% median estimate of 20 economists in a BusinessWorld poll. Still, this fell short of the government’s 6-7% target for the year and was slower than the 7.6% expansion in 2022.

In the fourth quarter alone, GDP also grew by 5.6%, slightly below the 5.7% median forecast in the same poll. This was slower than the revised 6% in the third quarter and the 7.1% growth in the same period in 2022.

“The bond market ended sideways last week, but better buying was seen from Tuesday after the auction as we saw good demand from investors. The lower yield was also supported by the downtrend in the US Treasury yields given the FOMC decision,” a second bond trader said in a Viber message.

The Bureau of the Treasury (BTr) last week raised P30 billion as planned via the reissued three-year bonds as total bids reached P62.434 billion, or more than twice the amount on the auction block.

The bonds, which have a remaining life of two years and 11 months, were awarded at an average rate of 6.007%, with accepted yields ranging from 5.95% to 6.05%.

For this week, the first bond trader said GS yields may decline amid potentially softer Philippine inflation in January.

A BusinessWorld poll of 16 analysts yielded a median estimate of 3.1% for January headline inflation, within the BSP’s 2.8-3.6% forecast. If realized, this would be the second consecutive month that inflation was within the BSP’s 2-4% target band. It will also be slower than the 3.9% in December.

The Philippine Statistics Authority will release January consumer price index data on Tuesday.

“We continue to see sideways movement, but maybe a little higher given the five-year auction and as the market prepares for a possible retail Treasury bond announcement this month,” the second bond trader added.

The BTr will auction off P30 billion in reissued five-year T-bonds with a remaining life of four years and 11 months on Tuesday.

“The market will also wait for the inflation report. The BSP is expecting a lower print compared to the previous month. The market will likely focus more on the month-on-month trend rather than year-on-year given base effects,” the trader said. — L.O. Pilar