Gov’t debt yields rise on BSP move

YIELDS on government securities (GS) rose across the board last week as the Philippine central bank hiked key interest rates by 50 basis points (bps) to help stem elevated inflation.

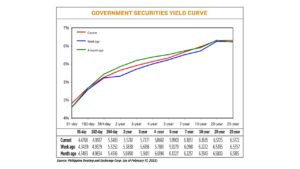

GS yields, which move opposite to prices, went up by an average of 8.83 bps week on week, based on PHP Bloomberg Valuation Service Reference Rates as of Feb. 17, published on the Philippine Dealing System’s website.

Rates at the short end of the curve climbed, with the 91-, 182-, and 364-day Treasury bills (T-bills) going up by 13.29 bps, 5.58 bps, and 2.31 bps to 4.4768%, 4.9937%, and 5.3483%, respectively.

Likewise, the belly of the curve saw the biggest increases, with the rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) rising by 19.43 bps (to 5.5781%), 12.35 bps (5.7371%), 8.11 bps (5.8692%), 6.24 bps (5.9903%), and 8.70 bps (6.1851%), respectively.

At the long end of the curve, yields on the 10-, 20-, and 25-year debt papers gained 13.63 bps, 3.30 bps, and 4.15 bps to 6.3635%, 6.5725%, and 6.5772%, respectively.

Total GS volume traded reached P15.809 billion on Friday, higher than the P14.118 billion seen on Feb. 10.

ING Bank N.V. Manila Branch Senior Economist Nicholas Antonio T. Mapa said via e-mail that the increase in global bond yields helped drive local rates higher.

“Expectations that the Federal Reserve may need to hike their terminal rate after a string of better-than-expected US data was the main factor for this shift in sentiment. Onshore, the 50-bp increase and high inflation all played a part in pushing yields higher,” Mr. Mapa said.

He said the Bangko Sentral ng Pilipinas’ (BSP) rate hike last week was mostly anticipated by the market and showed its “resolve to bring inflation back within target.”

“This was viewed to be a positive for longer-dated bonds as inflation can be expected to head lower eventually with the help of this hike. We can expect more tightening from the Fed and the BSP should inflation remain elevated in the US and domestically. Bond markets may react initially, but if inflation eventually moderates, this could be viewed as a positive for the markets,” he added.

A bond trader also said in a Viber message that the market was mostly split prior to the BSP’s policy decision.

“Medium term, the key consideration will be how the January CPI (consumer price index) pushes the succeeding figures higher, especially in the near term. I think the BSP recognizes this as it revised its inflation forecast for 2023 significantly higher from 4.5% to 6.1%,” the bond trader said.

“This is bad news for the local GS market, with the prospect of a prolonged tightening cycle and a period of elevated yields,” the trader added.

The BSP’s policy-setting Monetary Board on Thursday raised benchmark interest rates by 50 bps for a second straight meeting after headline inflation surprised to the upside last month, indicating widening price pressures.

The latest increase brought the policy rate to 6%. The BSP has now hiked borrowing costs by 400 bps since May 2022.

Inflation climbed 8.7% year on year in January, faster than 8.1% in December 2022. It was the 10th consecutive month that it exceeded the central bank’s 2-4% target range for the year.

BSP Governor Felipe M. Medalla said after the meeting that it was difficult to rule out a third or a fourth increase this year, with a 25-bp or 50-bp hike likely to be delivered at their next review on March 23.

Meanwhile, mixed US consumer inflation data released last week supported worries over further rate increases by the Fed.

US consumer prices accelerated in January amid higher costs for rental housing and food. The US consumer price index increased 0.5% last month after gaining 0.1% in December.

In the 12 months through January, the CPI increased 6.4%. That was the smallest gain since October 2021 and followed a 6.5% rise in December.

The US central bank has raised its fed funds rate by 450 bps since March 2022 from near zero to a 4.5%-4.75% range, with the latest move being a 25-bp increase earlier this month.

Looking ahead, Mr. Mapa said yields may continue to rise as central banks here and abroad continue to tighten amid high, supply-driven inflation.

“The market will continue to take its cue from global developments, in particular on expectations of how hawkish the Fed would need to be in the coming months,” he added.

The bond trader expects the market to be defensive this week due to the continued rise in US Treasury yields and as the Bureau of the Treasury (BTr) resumes its weekly bond auctions.

The BTr canceled two T-bond auctions scheduled on Feb. 7 and 14 to make way for its retail Treasury bond offer that ended last week. — B.T.M. Gadon