Growing pains

(I am pleased to share with readers, excerpts from our June 7 Quarterly Economic Outlook Report, “Growing pains.” Christine Tang, Shanee Sia, and I wrote this for GlobalSource Partners (globalsourcepartners.com), a New York based network of independent analysts in emerging markets.)

ALMOST a year in office, President Ferdinand Marcos, Jr. has managed to solidify his hold on power not least by putting the business sector at ease and keeping a 78% approval rating. He is overseeing a growing economy thanks largely to post-pandemic revenge spending, facing a quieter opposition thanks in part to his foreign policy pivot back to the US, and is himself exuding more confidence after winning the support of local businessmen with his relatively more consultative style compared with his predecessor.

Going into Year 2 with consumer and business sentiments seemingly steady, the President will nevertheless have a tougher challenge growing the economy. Not only are slackening global demand and tighter financial conditions weighing down output, but pent-up domestic demand looks close to running its course while inflation is turning out stickier than anticipated. Monetary authorities have paused policy tightening but the set of nine interest rate hikes, totaling 425 bp, is still working its way through the economy and likely lowering firms’ risk-taking appetites. Fiscal authorities, although aided temporarily by the unexpected inflation tax, remain committed to bringing down the budget deficit and the debt, with little room to support economic growth.

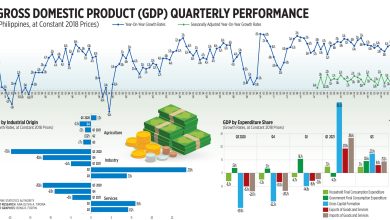

Coming from Q1’s 4.6% annualized growth clip, we still expect GDP to expand by 5.5% for the full year as inflation decelerates, interest rates stabilize, and the rebound in tourism strengthens, gaining from China’s reopening. Overall, GDP growth will still be consumption driven with rising remittances and local job opportunities, particularly in the BPO sector, supporting household spending. The recovery in investments is expected to be tentative given external uncertainties and higher hurdler rates, and uneven across sectors reflecting changing demand trends (e.g., travel up, telecommunications plateauing) and clarity of regulatory frameworks (e.g., renewable energy). Meanwhile, despite increased earnings from services exports and industry forecasts of semiconductor sales catching up following the sharp Q1 contraction, generally weaker external demand for goods exports alongside higher consumer goods imports will contribute to a still wide trade deficit. A higher 5.8% growth is still possible for 2024 based on more supportive monetary policy as inflation falls to target.

Upsides and downsides to our baseline scenario depend largely on the external environment and how an assortment of risks — economic, financial, and geopolitical — with varying transmission channels and impacts that either offset or reinforce each other, pan out. For example, higher odds of a recession in the US coupled with banking sector stress could lead to earlier interest rate cuts although spillover effects from credit contraction in the US would temper any fall in borrowing costs for emerging markets like the Philippines. Interest rate cuts may also be constrained by another bout of high inflation should there be an escalation of the war in Ukraine that pushes up energy and food prices anew. A weaker economic recovery in China due in part to an overextended property sector could delay tourism recovery and add to heightened tensions with the US particularly on trade and technology where a chip war is underway.

Ostensibly in response to the above, the Marcos administration rushed through congress a bill creating a P500-billion ($9 billion) Maharlika Investment Fund (MIF). Initially capitalized at P125 billion ($2.3 billion), it is still unclear at this point what direction the MIF will take and considering lead time to get the initiative off the ground, we are not expecting any significant contribution to economic growth over our forecast horizon.

Romeo L. Bernardo is principal Philippine adviser to GlobalSource Partners (globalsourcepartners.com). He serves as a board director in leading companies in banking and financial services, telecommunication, energy, food and beverage, education, real estate, and others. He had a 20-year run in the public sector including stints in the Department of Finance (Undersecretary), the IMF, World Bank, and the ADB.