Higher rates won’t kill growth — BSP

THE BANGKO Sentral ng Pilipinas (BSP) has room to further hike interest rates without “killing” economic recovery, according to its governor.

“Our policy rates are still accommodative. The policy rate as it goes up is not even keeping up with the inflation rate. As the inflation rate goes down, the real policy rate becomes less negative,” BSP Governor Felipe M. Medalla said during a Financial Executives Institute of the Philippines membership meeting on Tuesday.

“The policy rate is still negative in real terms. So, we can afford to step on the brakes without killing our nascent economic growth,” he added.

The economy expanded by a stronger-than-expected 8.3% in the first quarter. Economic managers are targeting 6.5-7.5% gross domestic product (GDP) growth this year.

Mr. Medalla said the central bank can continue to support the economy even with the planned policy rate hike of 25 or 50 basis points (bps) at its next meeting on Aug. 18.

“We’re still providing support for the recovery even with the increase in August and maybe with the rest of the year,” he said.

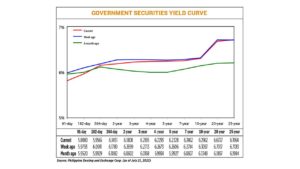

The Monetary Board last month raised the benchmark interest rates by 75 bps in an off-cycle move, as it sought to contain broadening inflationary pressures. It has raised rates by 125 bps since May.

The reverse repurchase facility rate is currently at 3.25%, while the rates on the BSP’s overnight deposit and lending facilities are at 2.75% and 3.75%, respectively.

In an ambush interview with reporters, Mr. Medalla said it’s too early to tell if the central bank will consider a pause in rate hikes.

“With regards to anything beyond August, it’s very data dependent. Don’t rule out anything. It will be rate hikes after August or it will be no rate hikes after August. It’s too early to tell,” he said.

Mr. Medalla said the central bank “stands ready to employ all necessary policy actions to bring inflation towards the target consistent path over the medium term.”

“In other words, we’ll try very hard to hit (the target) by next year,” he said.

Inflation accelerated to 6.1% in June, as prices of oil, food and other commodities continued to rise. June was the third straight month that inflation exceeded the BSP’s 2-4% target band.

The Monetary Board in June raised its average inflation forecast for 2022 to 5%, from 4.6% previously. It also hiked the 2023 average inflation forecast to 4.2%, from 3.9% previously. For 2024, BSP expects inflation to average 3.3%.

Meanwhile, Mr. Medalla said the central bank will continue to provide an enabling environment for its supervised financial institutions.

“We are very keen on reducing the reserve requirements because those that we do not regulate don’t have reserve requirements. The last thing we want to do is handicap those that we regulate,” Mr. Medalla added.

The BSP is planning to lower the banks’ reserve requirement ratio (RRR) before the end of the year.

The RRR for big banks is currently at 12%, one of the highest in the region. Reserve requirements for thrift and rural lenders are at 3% and 2%, respectively.

The BSP earlier committed to bringing down the RRR of big banks to single digits by 2023. — Keisha B. Ta-asan