Low inflation and better job data

HONG KONG — Last time I was here was in late 2017 when I attended two international free market events. Yesterday, when our plane from Manila landed at the Hong Kong International Airport (HKIA), I was surprised at the huge number of cranes, heavy construction machines, and high piles of soil both left and right of the runway.

After a quick search of the web, I learned that HKIA is constructing a third runway, 3.8 kilometers long, with the reclamation of 650 hectares of land. It will build 57 new gates, and expand capacity by another 30 million passengers by 2030. The project is huge, and such construction activities must have contributed to Hong Kong’s further lowering of its unemployment rate.

Also yesterday, the Philippine Statistics Authority (PSA) released the Philippines’ employment data for November 2023. It showed that our unemployment rate was down to only 3.6%, the lowest since 2005.

The latest unemployment figure translates to 1.83 million unemployed persons, significantly less than the reported 2.18 million in November 2022 and 2.09 million in October 2023.

The year-to-date (YTD) unemployment rate averaged 4.5%, way below the 5.3% to 6.4% target for 2023 as specified in the Philippine Development Plan (PDP) 2023-2028.

The underemployment rate in November 2023 was maintained at 11.7%, lower than in November 2022 which was at 14.4%, and the same as the previous month.

Budget Secretary Amenah Pangandaman has correctly observed that “Fiscal consolidation is bearing fruit, the high GDP growth of 5.6% average for Q1-Q3 of 2023 is creating more jobs, the January-October average unemployment rate of 4.6% is lower than the 5.3% to 6.4% target for 2023 in the Philippine Development Plan. Our public spending, especially in hard and soft infrastructure, is helping expand labor productivity of our people and business dynamism.”

INFLATIONAmong the other data the PSA released was the inflation rate of November 2023, which was a low 4.1%. This was down from 4.9% in October last year, and 8% in November 2022, or just half of the level a year ago.

This brings the year-to-date (YTD) headline inflation rate to 6%, the same as the Development Budget Coordination Committee (DBCC)’s assumption of 6% for full year 2023.

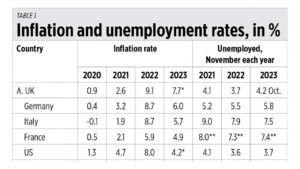

In one table I have consolidated and summarized the monthly inflation data plus comparable months of unemployment data for other countries. In Group A are the G7 industrial countries, in group B are the big South Asian economies, and in group C are the big East Asian economies. The Philippines had the highest inflation rate in 2023 among its neighbors in East Asia, and comparable to inflation in Italy and Germany (see Table 1).

To deal with inflation, investments in flood control infrastructure and post-harvest facilities will be prioritized to stabilize the supply of key agriculture commodities. Subsidies and financial assistance to farmer beneficiaries are also available for managing rising production costs and sustaining the sector’s productivity. Other measures include increasing the agriculture sector’s productivity, filling the domestic supply gap through timely and adequate importation based on ex-ante demand and supply analysis, and further strengthening the government’s commitment to address anti-competitive practices.

The Inter-Agency Committee on Inflation and Market Outlook (IAC-IMO) — co-chaired by the Secretaries of the Department of Finance and the National Economic and Development Authority (NEDA) — will continue to utilize its newly enhanced dashboard in the timely monitoring of on-the-ground developments, such as the demand, supply, and prices of essential food commodities (i.e., rice, garlic, onion, pork, fish, chicken, sugar, and corn) as well as non-food items (i.e., rent, water supply, electricity, transport, education, and wages) which may contribute to food and non-food inflation.

The DBCC expects the inflation rate to return to the target range of 2% to 4% in 2024 until 2028.

MAKING PAYING TAXES EASIERThe Ease of Paying Taxes (EOPT) Act, which was signed into law as Republic Act No. (RA) 11976 by President Ferdinand R. Marcos, Jr. on Jan. 5, is meant to modernize Philippine tax administration and strengthen taxpayer rights.

RA 11976 will encourage more taxpayers to enter into and comply with the tax system by streamlining processes and minimizing the burden on taxpayers, thereby increasing the country’s revenue collection.

President Marcos Jr. previously tagged the EOPT Act as a piece of priority legislation in his State of the Nation Address (SONA). The measure supports the administration’s 8-Point Socioeconomic Agenda through the collection of more taxes to enhance economic and social development.

“After the comprehensive amendments to tax policy introduced by the previous administration, we now focus our sights on tax administration with the passage of the Ease of Paying Taxes Act. Recognizing the importance of how the government collects taxes, this measure solidifies our commitment to our countrymen towards a dynamic and efficient tax administration which is responsive to the needs of our taxpayers, both individuals and those who are doing business, adapts to the changing times, and ultimately supports our recovery and growth objectives,” the President said in a statement.

The new law will classify taxpayers into micro, small, medium, and large according to their gross sales in order to form a tax system that is responsive and specific to each segment’s needs.

Filing of returns and payment of internal revenue taxes will also be made easier through electronic or manual means such as authorized agent banks or authorized software providers.

The option to pay internal revenue taxes to the city or municipal treasurer with jurisdiction over the taxpayer was removed in order to encourage the shift to electronic payment channels.

Furthermore, it ensures the availability of registration facilities to taxpayers not residing in the country.

The law also harmonizes the rules on the value-added tax (VAT) treatment of sales of goods and services, thereby requiring sales invoices for both.

The mandatory issuance of receipts for each sale and transfer of goods and services will be increased from P100 to P500.

The VAT refunds will be classified into low-, medium-, and high-risk claims which are based on the amount of VAT refund claim, tax compliance history, and frequency of filing of VAT refund claims, among others.

Moreover, an invoice system will be implemented to accelerate VAT refunds.

The Act now also provides a 180-day period for the Bureau of Internal Revenue (BIR) to process general refund claims on erroneous or illegally collected taxes.

On top of this, the Ease of Paying Taxes and Digitalization Roadmap will be developed by the BIR to promote and assist taxpayers by streamlining tax processes, reducing documentary requirements, and digitalizing its services.

In line with this effort, the number of income tax return (ITR) pages will be reduced from four to two pages only.

The President, however, vetoed Section 8 of the Act which exempts micro taxpayers from withholding creditable income tax, citing possible understatement of tax obligations that would impact the government’s cash flows.

Creditable withholding taxes serve as advance payment of tax obligations and an audit trail for compliance.

“We have to strike a balance between providing relief to taxpayers, on the one hand, and maintaining administrative efficiency through the integrity of our tax collection and monitoring mechanisms, on the other,” the President explained.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.