Moody’s Analytics lowers 2022 PHL growth outlook

Shoppers are seen in Divisoria, Manila. — PHILIPPINE STAR/ MICHAEL VARCAS

By Luz Wendy T. Noble, Reporter

MOODY’S ANALYTICS trimmed its Philippine growth forecast for this year, citing the impact of slower global demand and faster inflation on the economy.

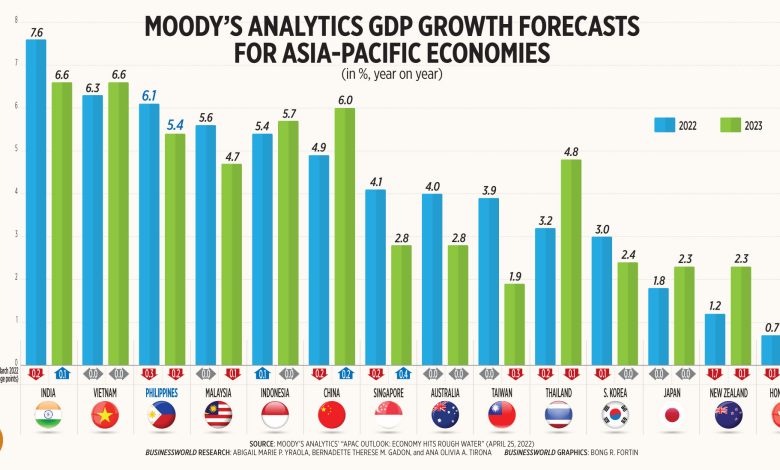

In a note titled “APAC Outlook: Economy Hits Rough Water,” Moody’s Analytics said Philippine gross domestic product (GDP) is likely to expand by 6.1% this year. This is lower than the 6.4% forecast it gave in March and well below the 7-9% government target.

The think tank also retained its 5.4% growth forecast for the Philippines in 2023.

Moody’s Analytics Chief Asia-Pacific Economist Steven Cochrane said the slight easing of the 2022 GDP forecast for the Philippines is due to the anticipated global economic slowdown.

“The global economy generally will be hindered by rising inflation and higher interest rates as central banks, particularly the US Federal Reserve, accelerate their policy normalization. Thus, global demand for goods and services from the Philippines will continue to rise, but at a slower pace,” he said in an e-mail.

Mr. Cochrane also cited the slowdown in China’s economy due to weak domestic demand, policy changes affecting the property and technology sectors, as well as the recent coronavirus disease 2019 (COVID-19) lockdowns. This may also reduce demand for Philippine exports, he added.

The faster increase in commodity prices may also impact consumption in the Philippines, Mr. Cochrane said. Household spending accounts for 70% of the country’s economy.

“Inflation is accelerating in the Philippines, as it is throughout the region, more quickly than we expected a month ago. This will reduce consumer spending slightly,” he said.

The consumer price index rose by 4% in March from 3% in February, as the war in Ukraine caused oil and commodity prices to spike. The March inflation print matched the upper end of the 2-4% central bank target band, but still below the Bangko Sentral ng Pilipinas’ (BSP) 4.3% forecast for the full year.

“The greatest uncertainty remains how long inflation will remain elevated, and when the BSP will choose to begin its own normalization policies to shift the policy interest rate to a more neutral level,” Mr. Cochrane said.

The central bank has kept policy rates unchanged at record lows to support the economy’s recovery from the pandemic, even as major central banks like the Fed started raising rates last month.

BSP Governor Benjamin E. Diokno on Tuesday said they may now consider a rate hike in their June 23 policy review.

Mr. Cochrane said the country may see stronger growth prospects, depending on measures that will be put in place by the next administration. The national election will be held on May 9, and the country’s next president will assume office in July.

“The economy continues to recover, with some upside potential for stronger growth depending upon what stimulus measures may be put in place by the next president and Congress,” Mr. Cochrane said.

In Moody’s Analytics’ commentary, Mr. Cochrane said the Asia-Pacific region’s growth outlook has been dampened by the renewed supply chain disruptions, accelerating inflation and China’s slower growth, as well as the war in Ukraine.

“COVID-19-related production shutdowns and transport delays contribute to renewed stress in regional and global supply chains that had already started to rise in February due to shipping disruptions caused by the Russia/Ukraine military conflict,” he said.

Inflation in Asia-Pacific is “largely milder,” compared with those in North America and Europe, Mr. Cochrane said.

“The rise of food, transport and utility costs will dampen the ongoing recovery in consumer spending throughout the region,” he said.

“The second half of the year and into next year may be calmer if central banks can clearly signal their intentions for policy normalization and with that begin to tame inflation expectations.”