National Government debt hits record P12.09 trillion as of end-February

THE NATIONAL Government’s outstanding debt hit a record P12.09 trillion as of end-February, as domestic and offshore borrowings increased, the Bureau of the Treasury (BTr) said on Thursday.

Preliminary data from the BTr showed outstanding debt rose by 16.2% from P10.4 trillion a year ago.

The BTr said total debt inched up by 0.5% or P63.83 billion month on month “due to currency fluctuations, and net financing from both local and foreign sources.”

Of the total, 70% of the debt portfolio were from domestic lenders while the rest were from external sources.

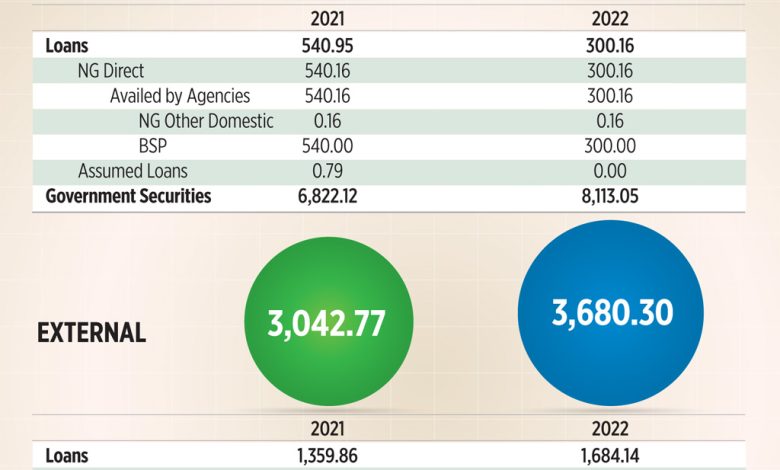

Domestic debt stock rose by 14.3% to P8.41 trillion year on year, and by 0.54% month on month. The Treasury attributed this to the net issuances of government securities totaling P44.89 billion.

Of the amount, P8.11 trillion were from government securities, which jumped by 18.9% year on year and 0.6% month on month.

On the other hand, external debt stood at P3.68 trillion as of end-February, increasing by 20.95% from P3.04 trillion a year earlier.

“For February, the increment in external debt was due to the impact of peso depreciation against the (US dollar) amounting to P17.91 billion and the net availment of external obligations amounting to P3.25 billion,” the Treasury said. “These more than offset the P2.74-billion reduction caused by adjustments in other foreign currencies.”

In February, the peso’s weakest closing against the dollar was P51.50 on Feb. 8.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the debt stock will likely go up after the US dollar-denominated bond issuances in March.

“Government debt could still increase in view of the P457.8-billion retail Treasury bond (RTB) issuance and the $2.25 billion, both for the month of March 2022 to finance the budget deficit amid increased infrastructure spending,” he said in a Viber message.

The Treasury raised $2.25 billion from its first triple tranche, US dollar-denominated bond offering last week, which included its first-ever green bonds.

The government said it raised $1 billion from the inaugural 25-year green bond offer, as well as $500 million from five-year bonds, and $750 million from 10.5-year bonds.

The next administration would inherit a fiscal handicap, “given the projected deficit and debt levels,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail.

“Hopefully, debt levels will not deteriorate further as the Philippines can ill afford a credit rating downgrade in the environment of rising global rates.”

Fitch Ratings last month said it maintained the Philippines’ “BBB” credit rating, but with a “negative” outlook.

A “negative” outlook means Fitch could downgrade the Philippines’ credit rating in the next 12 to 18 months. The outlook was revised to “negative” from “stable” in July 2021 due to the impact of the pandemic on the economy.

Mr. Ricafort said that the next administration should “sustain the country’s economic and fiscal efforts,” to improve tax collections and good governance measures, and to help ease the country’s debt-to-GDP (gross domestic product) ratio from the internationally accepted 60%.

In 2021, the Philippines’ debt-to-GDP ratio hit a 16-year high of 60.5%. This is higher than the 60% threshold considered manageable by multilateral lenders for developing economies. — Tobias Jared Tomas