NCR Feb. retail price growth accelerates to 2.2%

THE growth in Metro Manila retail goods prices was 2.2% in February, the highest in three months as countries recover from the coronavirus disease 2019 (COVID-19) pandemic and economies reopen.

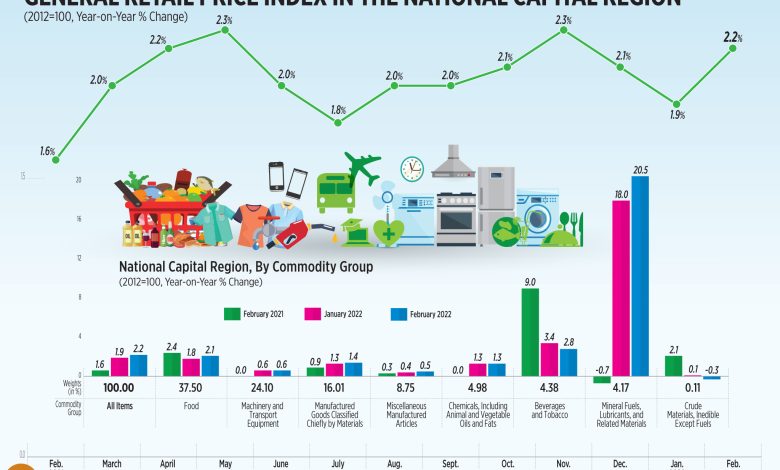

According to preliminary data from the PSA, growth in the general retail price index (GRPI) accelerated from 1.9% in January and from 1.6% a year earlier.

In November, the GRPI grew 2.3%.

In the year to date, retail price growth in the National Capital Region (NCR) averaged 2%, up from 1.5% a year earlier.

China Banking Corp. Chief Economist Domini S. Velasquez said that the elevated price growth was due to the “optimistic global outlook” from the reopening of economies and the decline in Philippine COVID-19 infections.

“In the Philippines, although there was a surge in the Omicron variant in January to around mid-February, mobility was almost reaching pre-pandemic levels and already up from 2021,” she said in a Viber message.

Ms. Velasquez said Russia’s invasion of Ukraine on Feb. 24 has not yet been reflected in the February reading, but she expects the GRPI to trend upwards in the coming months because of the war’s impact on oil and food prices.

The statistics agency attributed February’s uptick to food, the largest component of the basket of goods used to compute the index. Food price growth was 2.1% in February from 1.8% in January.

Other commodities that recorded increases in price growth were mineral fuels, lubricants and related materials (20.5% in February from 18% in January); manufactured goods classified chiefly by materials (1.4% from 1.3%); and miscellaneous manufactured articles (0.5% from 0.4%).

Meanwhile, price growth in beverages and tobacco eased to 2.8% in February from 3.4% the previous month. Price growth in crude materials, inedible, except fuels came in at minus 0.3%, from 0.1% growth in January.

Ms. Velasquez said the disruption of domestic food production could have accounted for the increase in Metro Manila’s GRPI reading in February.

“Hog raisers shied away from repopulating their herds due to the continued presence of ASF (African Swine Fever). February is also part of the closed fishing season (usually from mid-November to mid-March) which could have also pushed up prices for the month,” Ms. Velasquez said.

Second-round effects of high oil prices will lead to higher GRPI in Metro Manila for the rest of the year, she said. In addition, supply chain disruptions due to China’s zero-COVID policy will push up prices of manufactured goods.

“Recent actions of countries banning exports of key commodity items risk driving up the cost of food,” she added. — Bernadette Therese M. Gadon