Remolona sees no need for rate hike if there are no new supply shocks

By Keisha B. Ta-asan, Reporter

THE BANGKO SENTRAL ng Pilipinas (BSP) does not see the need to resume monetary tightening if there are no more supply shocks such as those that fueled the uptick in August inflation.

BSP Governor Eli M. Remolona, Jr. told reporters on Thursday that the acceleration in August inflation was caused by supply shocks in food and fuel, which dissipate “fairly quickly.”

“If that’s all there is, if there are no further supply shocks beyond that uptick in August, then it won’t be necessary to hike the policy rate,” he said in a press briefing during the Alliance for Financial Inclusion (AFI) Global Policy Forum. “It won’t justify an easing, (but) it won’t be necessary to raise the policy rate.”

The BSP has kept its key policy rate at a near 16-year high of 6.25% for the last three meetings. It has hiked borrowing costs by 425 basis points (bps) from May 2022 to March 2023.

Headline inflation quickened for the first time in seven months in August, hitting an annual 5.3%. It marked the 17th consecutive month that inflation surpassed the BSP’s 2-4% target range. Inflation averaged 6.6% in the eight-month period.

“I think we should hit the (2-4%) target range by October if there are no further supply shocks. But hitting the target range is not enough. We want to be comfortably within the target range for the year,” Mr. Remolona said.

The BSP projects inflation to hit 5.6% in 2023, before easing within the target to 3.3% in 2024 and 3.5% in 2025.

Makoto Tsuchiya, assistant economist from Oxford Economics Japan, said the Philippine central bank is expected to maintain its pause despite the quicker inflation in August.

“The central bank is likely to see through the transitory rise in prices. Inflation is still too high to pivot to easing, but the weakening growth picture means a hike is also undesirable,” he said.

Mr. Tsuchiya said inflation could settle within the 2-4% target range by the end of the year, bringing the full-year average to 5.8%. This will allow the Monetary Board to start cutting rates in the first quarter of 2024, he added.

Security Bank Corp. Chief Economist Robert Dan J. Roces in a note said the central bank will consider inflation, economic growth, and other external factors at next week’s policy-setting meeting.

“The recent uptick in the August inflation alone is unlikely to prompt the BSP to resume tightening, recognizing the supply-side nature of the uptick and the fact that there would only be so much that monetary policy can do in such a situation, which requires fiscal complement,” he said.

Mr. Roces said the BSP will likely keep interest rates unchanged on Sept. 21.

Nicholas Antonio T. Mapa, senior economist at ING Bank N.V. Manila, also expects the BSP to keep rates untouched at its next meeting.

“We believe the hurdle for additional rate hikes will be quite high given the glaring slowdown in growth momentum. BSP admits that tightening efforts have yet to be fully felt with the lagged impact still feeding through to bank lending,” Mr. Mapa said.

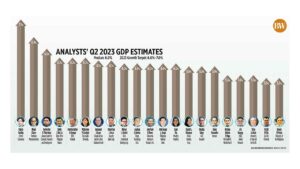

The Philippine economy expanded by 4.3% in the second quarter, the slowest in two years. This was slower than the 6.4% growth in the first quarter and 7.5% in the same period last year. For the first half, economic growth averaged 5.3%, lower than the government’s 6-7% target.

Mr. Mapa noted recent price shocks to inflation are supply side in nature and is best dealt with non-monetary measures.

“BSP will only hike should inflation expectations become disanchored or to steady the currency,” he said, adding that the Philippine central bank will likely consider the policy decision of the US Federal Reserve.

The Federal Open Market Committee is scheduled to meet on Sept. 19 and 20.

The Monetary Board will be having its sixth policy review of the year on Sept. 21.

Mr. Remolona told reporters that the new Monetary Board members will be participating in next week’s meeting.

National Treasurer Rosalia V. de Leon and former Finance undersecretary Romeo L. Bernardo were recently appointed as the new members of the policy-making body of the BSP.