Secondary market debt yields go up after RTB plan

By Abigail Marie P. Yraola, Researcher

YIELDS on government securities traded on the secondary market increased last week after the state said it would issue five-year retail Treasury bonds (RTBs), as well as news of easing inflation in January.

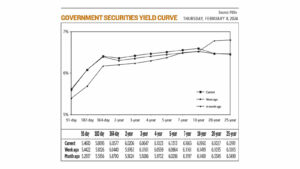

Bond yields, which move opposite prices, rose by 2.8 basis points (bps) week on week, based on PHP Bloomberg Valuation Service Reference Rates data posted on the Philippine Dealing System’s website.

Financial markets were closed on Feb.9 for the Chinese New Year.

Last week, rates were mixed across all tenors, with yields on the 91- and 364- day Treasury bills (T-bills) rising by 1.88 bps and 1.37 bps to 5.4610% and 6.0577%, respectively. Meanwhile, 182-day T-bills fell by 0.31 bp to 5.8095%.

Debt volume traded fell to P11.34 billion on Thursday from P20.91 billion a week earlier.

“Despite a lower-than-expected inflation figure year on year, trading volume in the local bond market remained subdued, reflecting minimal demand from investors given upcoming bond supply risks,” Lodevico M. Ulpo, Jr., vice-president and head of Fixed Income Strategies at ATRAM Trust Corp., said in an e-mail.

A local bond trader said the week might have started with some volatility after surprisingly positive nonfarm payroll figures from the US.

The market appears to have settled down amid easing inflation and after the Bureau of the Treasury (BTr) rejected all bids for its bond auction and announced a plan to sell a five-year retail Treasury bonds, the trader said.

“Additionally, the BTr’s cancellation of the seven-year auction has ensured that bonds in that part of the curve would have some support, with supply in that tenor effectively halted for at least a month,” the trader said in a Viber message.

January inflation eased to 2.8%, slower than 3.9% in December and 8.7% a year earlier, the slowest since October 2020. It was the second straight month that it settled within the Bangko Sentral ng Pilipinas’ (BSP) 2-4% target.

Core inflation, which excludes the volatile prices of food and fuel, eased to 3.8% from 4.4% in December, the first time it settled within the target after 17 months.

Last week, despite total demand reaching P53.426 billion, the Treasury rejected tenders for its offer of P30 billion in reissued five-year bonds.

The bonds, which have a remaining term of four years and 11 months, would have been sold at an average of 6.219%, with tendered yields ranging from 6.09% to 6.27%.

The Treasury is planning to sell P30 billion of five-year RTBs due in 2029, which will allow existing holders to exchange their debt due this year for the new debt.

The public offer will be from Feb.13 to 23, with the issue and settlement date set for Feb. 28.

“The BTr’s rejection of the five-year auction was a bit unexpected although this probably only counterbalanced the surprisingly good job data from the US,” the bond trader said.

Mr. Ulpo said market players had taken a defensive approach in response to the recent global rate instability and the announcement of material bond supply during the week.

“Bid-offer spreads in the local bond space widened by 5 to 10 basis points across the curve, signaling cautiousness among investors as they await further developments and guidance due [this] week,” he said.

Mr. Ulpo expects yields to rise as the market adjusts to the retail Treasury bond rate. Trading activity would depend on initial bids and final yield pricing, he added.

“After the auction, we expect a curve repricing, with a flattening yield curve due to anticipated long-term bond issuance cancellations for the RTB period,” he said.

He said investors are likely to remain cautious and wait for further policy direction from central banks.

The unnamed bond trader expects the market to focus on the pricing of the RTBs to determine the shape of the yield curve.

“The demand for the issue will also be of importance although we do expect healthy demand considering the P700 billion of liquidity coming in from the maturities of two RTBs in March,” the trader said.