What’s next for digital banking in the country

By Abigail Marie P. Yraola, Researcher

DIGITAL BANKING in the Philippines is set to revolutionize the country’s financial sector as consumer demand rises, financial institutions adopt new technologies, and the government supports these advancements.

The Philippines is one of fastest-growing economies in Southeast Asia, but its banking penetration rate is one of the lowest in the region, McKinsey & Co. said in a report titled “On the verge of a digital banking revolution in the Philippines.”

Amidst the introduction of digital technologies, which has driven gains in financial access in emerging markets and developing economies, existing banks in the Philippines have underinvested in digital offerings.

The report also added that banks in the country devote less than 10% of their revenues to information and technology (IT), while about 5-15% of these revenues go to digital channels.

In addition, financial technologies focus solely on payments, while infrastructure constraints limit their capacity.

Given the situation, this results in a gap between the underbanked and unbanked Filipino consumers and the increasing adoption of financial technologies.

But bridging the gap is pretty much close.

On the positive side, the report highlighted that the country is a productive ground for digital banking, providing opportunities for interested players in the banking landscape.

The McKinsey report also said there is a need to promote fintech innovation, which is deemed necessary to achieve financial inclusion goals.

In response to this, local regulators are stepping up their game by “creating conditions to address the underbanked customers while fostering competition.”

With digital startups rapidly increasing, traditional banks investing in digital offerings, foreign banks, and fintech service providers expanding their presence in the country, the central bank welcomes these developments.

The Bangko Sentral ng Pilipinas (BSP) said that digital banks and banks offering digital financial services are well-positioned to be crucial enablers for greater digital transformation and financial inclusion.

“These banks are at the forefront of digitalization as they leverage emerging and innovative technologies to operate efficiently and do business effectively,” the BSP said in an e-mail.

The BSP has lowered requirements for opening bank accounts, issued digital banking licenses, established a real-time payment system, and standardized a Quick Response (QR) network.

The six digital banks granted licenses by the BSP and began their operations in 2022 were UNObank, UnionDigital Bank, GoTyme, Overseas Filipino Bank, Tonik Bank, and Maya Bank.

The current roster of digital banks provides unique products while prioritizing customer satisfaction, following ethical market practices, and ensuring consumer safety, the BSP said.

The central bank highlighted that digital banks in the country have maintained their capitalization above the required regulatory level and enabled the opening of more digital deposit accounts.

BSP data show that the total assets of digital banks as of end-June stood at P77.13 billion, about 0.3% of the banking system’s total assets.

Meanwhile, total deposits amounted to P62.01 billion (0.3% of the total), while its total loan portfolio reached P22.4 billion (0.2%) as of end-June.

ABUNDANT OPPORTUNITIESThe digital banking space has much room for growth, said Japhet Louis O. Tantiangco, senior research analyst at Philstocks Financial, Inc., in an e-mail.

“The digital space is expected to play a vital role in the local economy with more commercial transactions to be done in which the government is supportive of the said development to boost the competitiveness of the local economy,” he said.

The McKinsey report also emphasized that the sustained economic growth brought more underprivileged Filipinos to the middle class and increased their purchasing power, resulting in higher demand for digital space.

They also added that due to the emergence of a young, tech-savvy consumer base, this has led to an increasing demand for innovative financial services.

This resulted in a significant increase in the use of mobile payment platforms, including e-wallets and digital apps offered by established banks.

Digital banking is an avenue to pursue greater financial inclusion given that a significant majority of the population is at ease with digital technology, said John Paolo R. Rivera, president and chief economist at Oikonomia Advisory & Research, Inc., in a separate e-mail interview.

He also said that digital offerings pose security threats, thus traditional banks take slow and calibrated moves to ensure regulatory compliance and consumer protection before going into full swing into digital offerings.

Traditional banks will only invest in digital offerings for financial inclusion when proper regulations and protections are done accordingly, Mr. Rivera said.

For Munmun Nath, chief marketing officer at UnionDigital Bank, digital banking enhances the banking experience by providing faster, easier, and more affordable access to financial services from anywhere at any time.

“As a result, it improves the accessibility of banking to consumers whom traditional banks previously underserved,” she said in a separate e-mail.

She also added that digital banking’s support to the banking sector includes enhanced product innovation, wider market reach, increased transactions, and reduced costs.

Additionally, the central bank noted that digital banks are in the early stages of exploring emerging technologies driving the significant digital transformation in the banking sector.

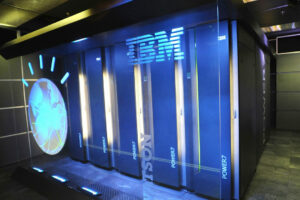

These include the use of application programming interfaces, cloud computing, artificial intelligence (AI), machine learning, and big data, wherein these tools are adopted and can change how banking operations may be performed.

In addition, BSP said the development and growth of open finance in the country will drive the emergence of fintech start-ups that utilize technology to provide innovative products and services.

ESCALATING DEMANDThe use of digital payments in the country has been growing, signaling a shift of preference from traditional cash-based payments into digital modes of payments due to their safety, speed, and convenience for Filipino consumers.

This rise in online payments suggests that more consumers are embracing digital payment methods due to their convenience and accessibility, the central bank noted.

In response, the government has been supportive of ongoing initiatives or efforts to further promote digitalization.

“The BSP has been making significant strides in promoting digital payments as evidenced by the increasing share of online payments in the total volume of retail transactions,” BSP said.

The central bank said that they are continuously working towards digitalizing 50% of retail payments by end-2023.

It also added that their continuous efforts to educate the public on the benefits of digital payments and to address any concerns could lead to a higher adoption rate as more individuals become acquainted with the convenience, security, and efficiency of digital transactions.

For Mr. Tantiangco, if digital finance expands further, we may see some changes in consumer behavior, as this may help them to make commercial transactions easier.

“The expansion of digital finance could possibly expose consumers to more financial investment products, which could entice them to invest, too,” he said.

Similarly, Mr. Rivera sees the same results but cautions against its repercussions.

Consumer demand will step up if the bandwagon effect is accompanied by legislation protecting consumer’s interests against fraud, hacking, unauthorized transactions, and other threats to digital use, Mr. Rivera said.

Likewise, he said that digital banking is a good investment, noting that regulation should also go with this trend so that investments in digital technology or digital banking will be worth it and sustainable.

GEARING UP FOR DIGITALIZATIONThe central bank is aware that a considerable portion of the population remains unbanked or underbanked.

To address this issue, several regulatory measures have been implemented, including the issuance of a regulatory framework that permits the establishment of digital banks.

“Digital banks act as partners of traditional banks in advancing financial inclusion in the country by leveraging on digital technology to offer customer-centric digital financial products and services.”

BSP’s goal is to provide access to communities in remote areas and fill the gaps in the market for those who are unserved and underserved.

This includes efforts to encourage the widespread use of digital payments and educational campaigns to promote financial literacy in public markets and barangays using these new platforms.

Financial institutions are encouraged to build a culture of innovation and adaptability to technological changes with these initiatives in place.

Banks can enhance their infrastructure to provide new digital services that coexist with their traditional offerings.

The BSP also recommends that traditional banks should improve the skills of their current workforce, allocate resources to establish partnerships with technology companies and tap individuals with the necessary skills.

This will enable traditional banks to compete with fintech players and technology-driven banks and keep up with the rapidly advancing industry developments.

HURDLES AND SETBACKSThe central bank, despite making progress in digitalizing financial services and increasing financial accessibility, has identified key areas that require improvement.

By addressing these issues, such as the inadequate access to digital financial infrastructure, the necessity of identification documents, and the lack of awareness and perceived risks associated with digital payments, the BSP can maximize its impact.

As much as the country is ripe for digital banking, threats to security, the persistence of fraud and a lack of regulatory mechanisms to protect banks and their consumers impede these, Mr. Rivera said.

Likewise, Mr. Tantiangco said that with digital banking growth, these will present more opportunities for cybercrimes.

In response to these, it is best and safe to strengthen the country’s cybersecurity framework.

Mr. Tantiangco also underlined that digital banking growth may widen the socioeconomic division between the poor and the rest of the economy.

“Financial services, especially the core of banking, which is lending and borrowing, if done strategically, [can help improve one’s] socioeconomic status. However, for the [underprivileged], there are a lot of barriers to availing financial services,” he said.

Also, he said that such challenge the underprivileged face when accessing financial services is the lack of knowledge on how to use them effectively; specifically, the lack of technological knowledge and even access to devices needed to navigate into the digital banking space due to their limited income levels.

He said the underprivileged often have limited savings and are perceived as high-risk borrowers or lenders to take part in the loanable funds market.

“As the financial industry grows, the poor usually get left behind, and this is just traditional banking. If we talk about digital banking, we will tackle additional challenges,” he explained further.

For the central bank, digital banking does not only raise concerns on cybersecurity risks but also in data privacy issues.

The government is aware of these and is taking steps to address these concerns.

Some measures initiated by the BSP are the digital literacy program, cybersecurity policies and measures, consumer protection policy and policy on data governance and ethical use of data.

Similarly, Mr. Rivera said that digital banking is accompanied by issues of fraud.

These must be addressed by legislation so consumers may have confidence aside from comfort in using digital banking that will usher in an age of greater financial inclusion for all segments of society.

For Mr. Tantiangco, intensifying efforts are needed to bridge the gap between low-income individuals and consumers who fully embrace digital technologies in promoting financial literacy.

“Expanding the digital banking space while helping the poor get past financial and technological barriers would [greatly help] the financial inclusion mission,” he said.

POSITIONED FOR GROWTH“Digital banks will significantly contribute to the growth and development of the digital financial ecosystem,” BSP said.

The central bank has observed greater market acceptance and consumer adoption of products in the digital banking sector.

They added that digital banks are well-situated to achieve growth trajectory while continuing to implement their various strategies and offerings.

Digital banks will revolutionize the banking industry standards by improving operational efficiency and utilizing technology to navigate the digital space.

Consumers can also access financial products and services easily and conveniently through digital banking.

“Digital banking can enhance financial inclusion that will prompt the population to save money, and use financial instruments correctly assisted by financial institutions — all of which would create capital accumulation necessary for sustained economic growth and development,” Mr. Rivera said.