Yields inch higher on borrowing plan

YIELDS on government securities (GS) inched up last week amid a shortened trading week and after the Bureau of the Treasury (BTr) announced its second-quarter borrowing program.

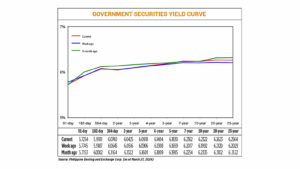

Debt yields, which move opposite to prices, rose by 1.36 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates data as of March 27 published on the Philippine Dealing System’s website.

Rates at the short end of the curve were mixed, with the 91- and 182-day Treasury bills (T-bills) going down by 4.91 bps and 0.06 bp week on week to 5.7254% and 5.9181%, respectively. Meanwhile, the 364-day T-bill rose by 0.95 bp to 6.0740%.

At the belly, the yield on the two-year Treasury bonds (T-bonds) fell by 0.91 bps to 6.0425%. Meanwhile, rates of the three-, four-, five-, and seven-year bonds went up by 0.12 bp (6.0918%), 0.96 bp (6.1404%), 1.71 bps (6.1830%), and 3.45 bps (6.2362%), respectively.

The long end of the curve also rose, with the 10-, 20- and 25-year debt papers going up by 3.30 bps (to 6.2322%), 5.03 bps (6.2623%), and 5.35 bps (6.2564%), respectively.

GS volume traded climbed to P17.29 billion on Wednesday from P10.12 billion on March 22.

The rise in the yield curve was primarily attributed to the release of the BTr’s borrowing plan for this quarter, ATRAM Trust Corp. Vice-President and Head of Fixed Income Strategies Lodevico M. Ulpo said in an e-mail.

“Local bond yields have trended higher week-to-date on the back of better selling interest seen over the last trading sessions, with market participants de-risking on the long end of the curve,” Mr. Ulpo said.

“Given the shortened trading week, market reaction to the duration-heavy borrowing schedule of the BTr was relatively muted, only increasing by 1 to 3 bps week-on-week,” he added.

The government is looking to borrow P585 billion from the domestic market in this quarter, the Treasury bureau said last week.

In a notice on its website, the BTr said it seeks to raise P195 billion from the issuance of T-bills and P390 billion from T-bonds in the April-to-June period. Based on its notice, the Treasury will offer more T-bonds with longer tenors in the second quarter.

The BTr announcement offset the initial decline in yields due to Bangko Sentral ng Pilipinas (BSP) policy signals, a trader said in a Viber message.

These signals led to “relatively weaker interest in the bond auction last Tuesday,” the trader said.

The trader added that the BSP will likely look at the March inflation figure to be released this week when they revisit their policy settings this month.

The government raised P30 billion as planned via the reissued seven-year bonds it offered on Tuesday as total bids reached P46.501 billion, above the amount on the auction block.

The bonds, which have a remaining life of six years and nine months, were awarded at an average rate of 6.237%, with accepted yields ranging from 6.15% to 6.274%.

BSP Governor and Monetary Board (MB) Chairman Eli M. Remolona, Jr. earlier said that while the MB closely monitors the Fed, its own policy decisions are not dependent on the US central bank.

He said the BSP will likely begin cutting “in the next few policy meetings.”

Meanwhile, MB member and Finance Secretary Ralph G. Recto said he expects the BSP to cut rates twice this year or by 50 bps, although policy easing is unlikely to begin at the April 8 meeting.

The BSP in February kept the policy rate steady at a near 17-year high of 6.5% for a third straight review. The Monetary Board raised borrowing costs by 450 bps from May 2022 to October 2023 to tame inflation.

The March inflation figure and the BSP’s policy meeting will be the primary catalysts for this week’s GS trading, analysts said.

“Rates are seen to move sideways to up as inflation for March is seen to rise close to 4% in line with the BSP’s risk-adjusted forecast of 3.9%,” Jonathan L. Ravelas, senior adviser at Reyes Tacandong & Co., said in a Viber message.

“For the month of April, the March inflation data release and the BSP Monetary Board meeting will be the primary catalysts to watch out for. Similar to the previous month, any upside surprise in inflation may be a non-event locally as elevated inflation going into the second quarter is largely expected by the market,” Mr. Ulpo said. — A.C. Abestano