Yields on government debt edge lower on CPI data

YIELDS on government securities (GS) ended lower last week after a slower-than-expected March inflation print.

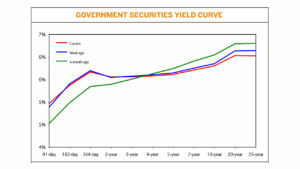

GS yields dropped by an average of 3.76 basis points (bps) week on week, based on PHP Bloomberg Valuation Service Reference Rates as of April 5 published on the Philippine Dealing System’s website.

Local financial markets were closed on April 8 and 9 in observance of Maundy Thursday and Good Friday.

At the secondary market on Wednesday, yields went down almost across the board except for the 91-day Treasury bill (T-bill), which increased by 9.78 bps to 5.1479%, and the two-year Treasury bond (T-bond), which rose by 1.49 bps to yield 5.8638%.

Meanwhile, the 182- and 364-day T-bills saw their rates decline by 3.60 bps and 3.43 bps to 5.6411% and 5.9944%, respectively,

Yields on the three-, four-, five-, and seven-year Treasury bonds also dropped by 1.41 bps (5.8671%), 3.02 bps (5.8884%), 3.97 bps (5.9283%), and 4.60 bps (6.048%), respectively.

At the long end, the 10-, 20- and 25-year debt papers dropped 6.05 bps, 12.66 bps, and 13.91 bps to fetch 6.155%, 6.429%, and 6.424%, respectively.

Total GS volume reached P12.40 billion on Wednesday, lower than the P20.14 billion recorded on March 31.

Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group Noel S. Reyes attributed last week’s yield movements to slower March headline inflation.

“Buying picked up on this expectation and eventual confirmation, but volume was not aggressive as core CPI (consumer price index) was higher,” Mr. Reyes said in a Viber message.

“Nonetheless, the headline number provided added confidence that peak inflation could likely be behind us,” he added.

Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion in an e-mail that yield movements last week mostly already “reflected disinflation expectations.”

Philippine headline inflation in March eased to its slowest in six months amid lower prices of food and transport, the statistics agency said last week.

However, core inflation, which excludes volatile food and fuel prices, accelerated to the fastest since December 2000.

Preliminary data from the Philippine Statistics Authority (PSA) showed annual headline inflation eased to 7.6% from 8.6% in February. However, this was faster than the 4% print a year ago.

March inflation was the slowest since the 6.9% print in September 2022.

For the first quarter, the CPI averaged 8.3%, higher than the Bangko Sentral ng Pilipinas’ full-year forecast of 6% and the 2-4% target for the year.

Core inflation, on the other hand, quickened to 8% in March, from 7.8% in February and 2.2% a year ago. This is its highest clip since the 8.2% seen in December 2000.

For this week, Mr. Asuncion said the market will await the release of March US CPI data on Wednesday “as this could influence the US Federal Reserve’s next policy decision.”

This week’s T-bond auction could also be a trading driver, he added.

The Bureau of the Treasury will offer P25 billion in reissued 10-year bonds with a remaining life of nine years and five months on Wednesday.

The government borrows from local and foreign sources to help plug a budget deficit capped at 6.1% of gross domestic product this year. — Lourdes O. Pilar