Yields on government debt rise as inflation, rate bets drive sentiment

YIELDS on government securities (GS) rose last week as inflation continued to drive market sentiment amid a lack of fresh leads, and with the market looking forward to an offering of fresh 13-year bonds on Tuesday.

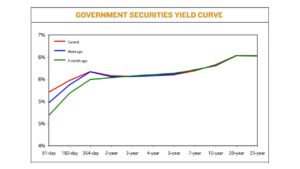

GS yields, which move opposite to prices, at the secondary market climbed by an average of 4.09 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of April 14 published on the Philippine Dealing System’s website.

The short end of the curve on the 91-, 182-, and 364-day Treasury bills (T-bills) increased by 28.95 bps (to 5.4374%), 11.94 bps (5.7605%), and 0.54 bp (5.998%), respectively.

Meanwhile, most of the tenors at the belly of the curve dropped, with rates of the four-, five-, and seven-year Treasury bonds (T-bonds) declining by 0.31 bp (to 5.8853%), 1.36 bps (5.9147%), 2.70 bps (6.0210%), respectively.

On the other hand, the two- and three-year bonds rose by 2.61 bps and 0.52 bp to fetch 5.8899% and 5.8723, respectively.

At the long end of the curve, the 10-, 20-, and 25-year papers saw their rates increase by 3 bps, 0.71 bp, and 1.08 bps to 6.185%, 6.4361%, and 6.4348%, respectively.

Total GS volume traded reached P7.44 billion on Friday, declining from the P12.40 billion on April 5.

A bond trader said long-term yields moved sideways last week as the curve remained flat.

“Price action before Holy Week already reflected expectations of disinflation, both locally and abroad,” the bond trader said in text message.

Philippine headline inflation eased for a second consecutive month in March to 7.6% from 8.6% in February.

For the first quarter, inflation averaged 8.3%, higher than the Bangko Sentral ng Pilipinas’ (BSP) 6% forecast and 2-4% target for the year.

Meanwhile, the US consumer price index (CPI) climbed 0.1% last month after advancing 0.4% in February, data released on Wednesday showed.

In the 12 months through March, the CPI increased 5%, the smallest year on year gain since May 2021. The CPI rose 6% on a year-on-year basis in February.

“The 10-year traded sideways beginning of the week, but news of a fresh issue for the 13-year auction [this] week pushed yields in this area a little higher as speculators bet that the fresh issue could possibly be awarded at 6.375% against a fair value of 6.25%,” the bond trader added.

On Tuesday, the Bureau of the Treasury will offer P25 billion in fresh 13-year T-bonds.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa likewise said that last week’s yield movements continued to be driven by inflation data.

“I think local bonds tracked global sentiment including the outlook on Fed rates. We also took some direction from BSP Governor Felipe M. Medalla who indicated that he would be open to pausing if inflation slows further,” Mr. Mapa said in a Viber message.

For this week, Mr. Mapa expects the local bond market to track overseas sentiment as investors await more hints on the US Federal Reserve and BSP’s next policy moves.

The bond trader also said that there could be “little change” in yields this week as the market looks ahead to the Fed’s next policy meeting.

The BSP last month hiked benchmark interest rates by 25 bps to help bring down elevated inflation.

This brought the yield on its overnight reverse repurchase facility or its key rate to 6.25%.

Since May 2022, the central bank raised borrowing costs by a total of 425 bps.

The Monetary Board’s next meeting is on May 18.

The central bank may consider pausing its monetary tightening next month if April inflation does not accelerate, BSP Governor Felipe M. Medalla said last week.

He said a pause in interest rate increases was possible “if the April CPI (consumer price index) is not higher than the March CPI” or if there is “zero or negative month-on-month inflation.”

Meanwhile, the Fed has raised rates by 475 bps since March 2022. It is scheduled to meet on May 2-3 to discuss policy. — M.I.U. Catilogo